[Asia Economy Sejong=Reporters Kim Hyewon and Park Byunghui] As the Ukraine crisis escalates to a critical point, the raw materials market is shaking daily. Not only international oil prices but also industrial raw materials such as aluminum and nickel, as well as grain prices, are soaring simultaneously, plunging South Korea and the rest of the world into inflation fears. There are warnings that the global economy could face its worst crisis since the oil shock of the 1970s.

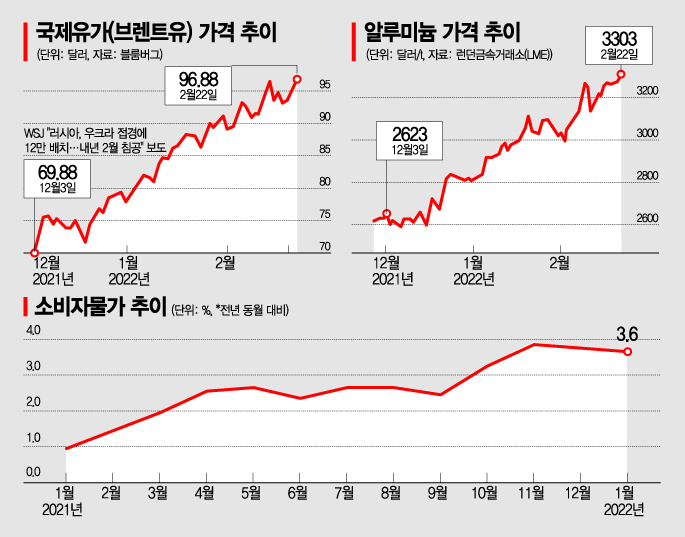

◆International oil price nearing $100= On the 22nd (local time), Brent crude oil from the North Sea recorded $96.88 per barrel, up $1.45 (1.52%) from the previous day at the London ICE Futures Exchange. During the session, it rose to a high of $99.50, threatening the $100 mark. The last time international oil prices reached $100 per barrel was in 2014.

At the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) crude oil prices also rose $1.28 (1.41%) to $92.35 per barrel, reaching an intraday high of $96. Prices rose due to concerns that the Ukraine crisis could cause a shortage in oil supply. Russia is the world's third-largest oil exporter. In Europe, the price of natural gas per megawatt-hour (MWh) surged by 10%. This was a result of Germany announcing the suspension of the approval process for the Nord Stream 2 gas pipeline project connecting Russia and Germany in relation to the Ukraine crisis. Although Nord Stream 2 is not yet operational, this announcement raised concerns that Gazprom, the Russian state-owned gas company, might halt natural gas exports.

Prices of industrial raw materials also rose across the board. At the London Metal Exchange (LME), aluminum prices increased by $23.5 (0.72%) to $3,303 per ton, approaching the all-time high recorded in 2008. LME nickel prices soared to their highest level in 10 years. Nickel closed at $24,721 but surged more than 3% intraday, breaking the $25,000 mark. Russia supplies 6% of the world's aluminum consumption and 7% of nickel consumption. Hwang Byungjin, a researcher at NH Investment & Securities, predicted, "The escalation of geopolitical tensions and the West's strong sanctions warnings could increase indiscriminate upward pressure on raw material prices in the short term."

The grain market, including corn and wheat, is also volatile. Ukraine is the largest grain-producing region in Eastern Europe, and according to the U.S. Department of Agriculture, Ukraine and Russia account for 29% of global wheat exports. At the Chicago Board of Trade (CBOT), wheat prices surged $48.50 (6.03%) to $852.5 per bushel. Corn prices also rose $19.75 (3.03%) to $672.5 per bushel compared to the previous day.

The UK National Institute of Economic and Social Research (NIESR) analyzed that the current situation, where demand explodes following the lifting of COVID-19 restrictions while supply of major raw materials such as oil and natural gas decreases, is reminiscent of the 1970s. NIESR predicted that if the West imposes sanctions on Russia's energy exports or if Russia retaliates by halting gas exports to the West, the global economic growth rate this year could fall by nearly 1 percentage point to 3.3%.

However, there are also forecasts that the rise in oil prices could be limited as reports emerge that an Iran nuclear deal is imminent. A Russian diplomat stated, "Discussions to restore the Iran nuclear agreement and ease economic sanctions on Iran are in the final stages." There are also talks that Iran is preparing for a prisoner exchange with the U.S. as the nuclear negotiations near completion.

◆South Korea’s inflation emergency, entry into the 4% range imminent= The simultaneous surge in energy and raw material prices triggered by the Ukraine crisis has put domestic inflation on high alert. The consumer price inflation rate for February is on the verge of entering the 4% range. This is because international oil prices, which are reflected in domestic prices with a 2-3 week lag, have remained above $90 per barrel throughout this month, and service prices are also rising rapidly.

An official from the Ministry of Economy and Finance said, "Until January, the main factors driving price increases were external supply-side issues such as rising international energy prices, but from February, demand-side factors are also rapidly transmitting inflationary pressures." Domestic consumer price inflation had remained in the 3% range for four consecutive months until January. Sustained inflation in the 3% range is the first in 10 years. The consumer price inflation rate recorded above 3% for 18 consecutive months from September 2010 to February 2012, then moved below 2%, before rising back to 3.2% in October last year for the first time in 9 years and 8 months. Whether the February figure will reach the 4% range is the key point to watch.

The government is making every effort to control inflation, but all domestic and international indicators are exerting additional upward pressure, making it a challenging situation. To monitor the real economy impact of the Ukraine situation on a daily basis, the government has decided to hold daily meetings of the inter-ministerial Ukraine Emergency Response Task Force (TF). Additionally, as part of inflation stabilization measures, the government conducted and publicly disclosed for the first time a survey of prices for signature menu items at major dining franchises. According to the survey results from the third week of this month, 16 out of 62 franchise companies raised product prices compared to the previous month. By item, price increases varied: porridge (4.0%), hamburgers (1.1?10.0%), chicken (5.9?6.7%), tteokbokki (5.4?28.7%), and pizza (3.2?20.2%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)