From Inception to Last Year, Sale Policy Maintained... "Full Review" Amid Supply Chain Crisis

Mining Corporation 'Danggok' at Government's Stance... "Cannot Halt Four-Year Mine Sale Plan"

Concerns Over National Wealth Outflow Due to Ambatovy Sale... High Possibility of Japan's Sumitomo Purchase

On the Other Hand, African FTA Considered for Nickel Securing... Policy Faces Issues from the Start

[Asia Economy Sejong=Reporter Dongwoo Lee, Sejong=Reporter Junhyung Lee] The Korea Mine Reclamation Corporation's persistent push to sell the Ambatovy mine is largely driven by the judgment that the public corporation's debt, amounting to trillions of won due to the overseas resource development projects initiated by the MB administration, must be improved following President Moon Jae-in's inauguration. However, the Korea Mine Reclamation Corporation is reportedly perplexed as the government, which had been driving the mine sales since taking office, recently announced it would reexamine the appropriateness of overseas mines. The corporation maintains that the mine sale process, which has been underway for four years, cannot be halted abruptly.

Six Overseas Mines Sold During Moon Administration's Five Years

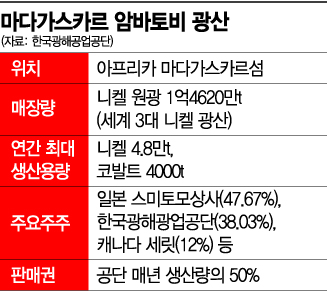

From its inception until last year, the Moon administration continued the policy of selling overseas assets. According to data obtained by Assemblyman Jo Jung-hoon of the Transition Korea party from the Korea Mine Reclamation Corporation, the corporation sold six overseas mines over five years from 2017 to last year. All six mines were sites where key minerals such as copper and lithium, which have nearly zero domestic self-sufficiency rates, could be mined. Previously, the Korea Resources Corporation sold a 30% stake in the Santo Domingo copper mine in Chile for $152 million (approximately 181.7 billion won) in March last year. The recovered amount was only about 60% of the principal investment ($240 million) made by the Korea Resources Corporation in 2011. The Ambatovy mine in Madagascar, currently being considered for sale, is one of the world's top three nickel mines with nickel ore reserves of 146.2 million tons, a core material for secondary batteries. Additionally, cobalt, another key secondary battery material, can be produced at around 4,000 tons annually. This signifies that the mine could be a key resource supporting the development of the 'K-Battery' industry, which has emerged as a national industry following semiconductors and displays.

Because of this, there has been significant concern in the industry about the outflow of national wealth due to the sale of major assets. The reason is that the government is handing over key mines, which should be strategically secured amid the growing importance of supply chains, to competing countries. The Ambatovy mine is also likely to be purchased by Sumitomo Corporation of Japan, the largest shareholder of the mine. In the case of mines, when shares are sold, other shareholders have the first right of refusal. Sumitomo has already increased its stake in the Ambatovy mine from 27.5% in 2006 to 47.67% last year. This is interpreted as a steady increase in shares based on a long-term view of the mine's profitability. Professor Kang Cheon-gu of Inha University's Department of Energy and Resources Engineering pointed out, "The current government has labeled resource development as a corrupt practice and sent a signal that it will sell overseas mines on the international market," adding, "This is equivalent to saying they will accept 10-20% less than the fair value for the mines being sold."

Despite industry controversy, the government, which had consistently pursued the sale policy for over four years, suddenly reversed course near the end of its term due to the growing importance of supply chain security. Earlier, on the 14th of this month, President Moon Jae-in chaired the '4th Foreign Economic Security Strategy Meeting' and announced a full reexamination of overseas mine sales. This move was influenced by the intensifying competition for resource acquisition amid geopolitical conflicts such as the US-China dispute and the Ukraine crisis, increasing the need for government-wide supply chain management. The government plans to increase stockpiles of key resources and enact the 'Economic Security Supply Chain Management Basic Act' to establish a management system covering the entire supply chain. It is also pushing for the enactment of the 'Resource Security Special Act' within the year, aiming to build a crisis response system capable of handling various scenarios in case of supply disruptions of critical minerals such as rare earths.

President Moon Jae-in Speaking

President Moon Jae-in Speaking(Seoul=Yonhap News) Photo by Ahn Jung-won = President Moon Jae-in is speaking at the Foreign Economic Security Strategy Meeting held at the Blue House on the afternoon of the 14th. The Foreign Economic Security Strategy Meeting is a newly established ministerial-level consultative body designed to thoroughly review current issues that require comprehensive consideration of the economy and security, such as global supply chain disruptions and the spread of inflation. 2022.2.14.

jeong@yna.co.kr

(End)

<Copyright (c) Yonhap News, Unauthorized reproduction and redistribution prohibited>

Meanwhile, Consideration of Korea-Africa FTA

The consideration of securing supply chains for raw materials such as crude oil, iron ore, and nickel through Africa is also based on the same background. At a closed-door expert meeting on the Africa FTA held by the Ministry of Trade, Industry and Energy on the 16th, prospects for progress in the 'AfCFTA' due to rising raw material prices were discussed in detail. Seosanghyun, a research fellow at POSCO's Management Research Institute Global Research Office, who presented at the meeting, emphasized that Africa is rich in deposits of key secondary battery materials such as cobalt, graphite, and nickel. He particularly pointed out that Africa accounts for about 10% of the world's nickel reserves and identified Madagascar as a key country. This introduced the Madagascar mine under consideration for sale as a major country for securing supply sources. Researcher Seo explained that the government should actively consider the Africa FTA, especially as competition to secure recent GVCs (Global Value Chains) such as secondary battery materials intensifies. Considering that China secures resources through government-led initiatives and the US, Japan, and the European Union are also actively developing resources mainly through the private sector, there is a judgment that Korea must hasten its entry into African resource development. However, government-level support for resource development remains minimal. African resource development has mainly involved domestic companies such as Samsung SDI and POSCO establishing joint ventures with mining companies to secure materials.

Given this situation, concerns are growing that Korea may fall behind in the resource war. There is worry that strategic mineral mines, which could be used as a kind of 'offshore stockpile base' in supply chain crises, have been consecutively sold overseas in recent years.

Professor Kang suggested, "Experts, not 'parachute appointments,' should be placed in public corporations responsible for overseas resource investments," adding, "Since the seed was sown in 2006 at the Ambatovy mine, the government should actively engage in overseas mine development even now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.