Nationwide Apartment Jeonse Prices Surge Nearly 35% in 2 Years

Public-Supported Private Rentals 0.92:1 in 2019 → 9.47:1 in 2021

Jeonse Prices Rise After Lease 3 Act Implementation, Rental Demand Expected to Gradually Increase

With nationwide apartment jeonse prices soaring nearly 35% in two years, interest in publicly supported private rental apartments is skyrocketing. This is due to relatively flexible subscription conditions and the advantage of stable residency. There are also criticisms that this is a balloon effect caused by the Lease 3 Act.

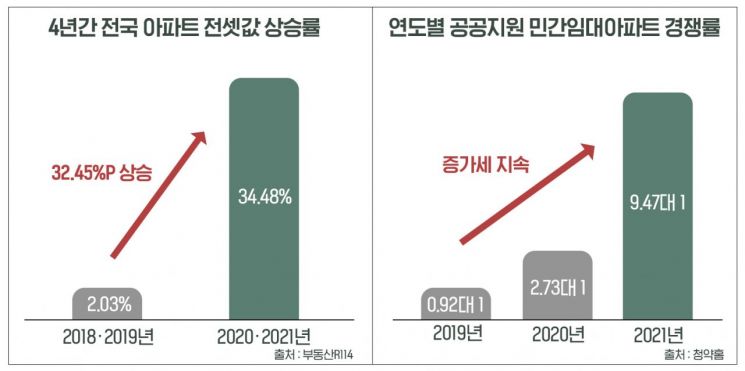

According to an analysis of Real Estate R114 data by Real Estate Info on the 19th, nationwide apartment jeonse prices increased by 34.48% from January 1, 2020, to December 31, 2021. This is a rise of 32.45 percentage points compared to the 2.03% increase from January 1, 2018, to December 31, 2019.

The market points out that the decrease in jeonse listings following the introduction of the Lease Act in July 2020, which includes the jeonse rent ceiling system and the right to request contract renewal to protect tenants, has led to the side effect of jeonse prices rising more than expected.

In particular, as jeonse prices surged, demand shifted toward rental housing. Private rental apartments do not require a subscription savings account, and anyone aged 19 or older who is a member of a household without home ownership can apply regardless of winning history.

In fact, the competition rate for private rental apartments has been steadily increasing. An analysis of 26 publicly supported private rental apartment complexes registered on the subscription home site from 2019 to 2021 by Real Estate Info showed that last year, 65,575 applications were submitted for 6,924 units across 12 complexes, resulting in an average competition rate of 9.47 to 1.

This is higher than the 2.73 to 1 competition rate recorded in 2020, when 26,697 applications were submitted for 9,777 units across 10 complexes. In 2019, 2,050 applications were submitted for 2,218 units across 4 complexes, showing an average competition rate of 0.92 to 1.

By specific complexes, ‘Seoul Yangwon Eoullim Forest’ supplied in Mangwoo-dong, Jungnang-gu, Seoul last year recorded an average competition rate of 47.87 to 1 with 15,845 applications for 331 units. ‘Siheung Janghyeon B-2BL Seohee Starhills’ supplied in Janggok-dong, Siheung-si, Gyeonggi also showed a competition rate of 16.29 to 1 with 14,446 applications for 887 units.

This year, Daewoo E&C is expected to continue recruiting tenants in the first quarter, including supplying 285 publicly supported private rental apartments in the Godeung district near Suwon Station at the end of February, as well as in Seoul, Gangwon, and Jeonnam.

Kwon Il, head of the research team at Real Estate Info, said, “The implementation of the Lease 3 Act has caused nationwide apartment jeonse prices to rise significantly, and demand seems to have concentrated on rental apartments that can be leased at relatively reasonable prices.” He added, “As the Lease 3 Act reaches its two-year mark on July 31 this year, a surge in jeonse prices is expected, and demand for rental apartments will increase further.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.