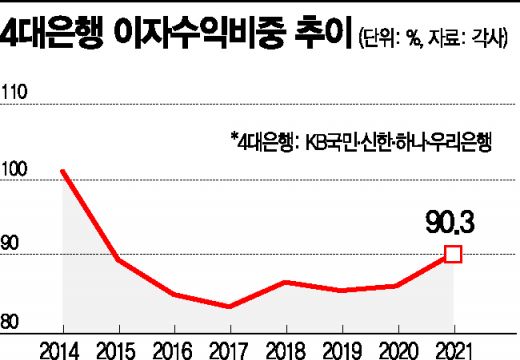

Average Interest Income Ratio of 4 Major Banks at 90.3%

First Time Exceeding 90% Since 2014

Last year, the interest income ratio of major commercial banks reached its highest level in seven years. Although bank CEOs emphasized the creation of 'non-interest income,' it appears they ultimately secured record-breaking profits through interest-based business.

According to the management performance data released by each financial group on the 14th, the average interest income ratio of the four major banks?KB Kookmin, Shinhan, Hana, and Woori Bank?was recorded at 90.3%. Out of the total operating profit of 29.2442 trillion KRW generated by these four banks, interest income accounted for 26.4129 trillion KRW.

The interest income ratio has been increasing for two consecutive years since 2019. The previous year's interest income ratio was 86.2%, marking a 4.1 percentage point increase in one year. Considering that the interest income ratio was 85.6% in 2019, the rate of increase has also accelerated.

This is the first time in seven years that the interest income ratio has exceeded 90%, since it reached 101.1% in 2014. Afterward, it gradually declined to 89.6% in 2015 and 85.1% in 2016, hitting a low of 83.5% in 2017, but it turned upward again in 2018 with a ratio of 86.7%.

The bank with the highest interest income ratio was Hana Bank. Out of its total operating profit of 6.6393 trillion KRW, 92.6%, or 6.1506 trillion KRW, came from interest income. Notably, the interest income ratio increased by 10.3 percentage points from 82.3% in 2020, marking the fastest growth.

The rise in the interest income ratio is attributed to the increase in interest rates and the government's household loan restriction policies, which expanded the interest margin. However, there are criticisms that banks have not properly innovated to improve their interest-centered revenue structure in the long term. In advanced countries such as the United States, Europe, and Japan, the proportion of non-interest income is around 40-50%.

Professor Kim Dae-jong of the Department of Business Administration at Sejong University pointed out, "In these still difficult economic times, banks have become like sitting and gathering money. Banks should not remain confined to the domestic market but actively expand into foreign countries and strive to diversify their profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)