Lithium Price Hits $55,000... Up 511% YoY

Supply in 2030 at 1.78 Million Tons... 220,000 Tons Short of Demand

[Asia Economy Reporter Minji Lee] There are forecasts that the supply-demand imbalance of lithium, an essential raw material for electric vehicle battery production, will continue. Consequently, there is also a possibility that the pace of electric vehicle adoption may slow down.

On the 14th, global energy information analysis company S&P Global Platts (hereafter Platts) reported that lithium prices are soaring due to increased battery demand and material supply shortages. It is projected that the lithium shortage will reach 220,000 tons by 2030.

According to Platts, the price of lithium carbonate surged 511%, from $9,000 per ton (approximately 10.8 million KRW) in early February 2021 to $55,000 per ton (approximately 66 million KRW) on February 9, 2022, continuously hitting record highs. During the same period, the price of lithium hydroxide also increased by 380%. This rise is notably steeper compared to other battery materials, with cobalt hydroxide and nickel sulfate prices increasing by approximately 59.5% and 15.8%, respectively.

Platts identified the main reason for the sharp rise in lithium prices as the expansion of electric vehicle production and sales in countries such as Europe and China. They concluded that lithium supply is unable to keep up with the growing battery demand.

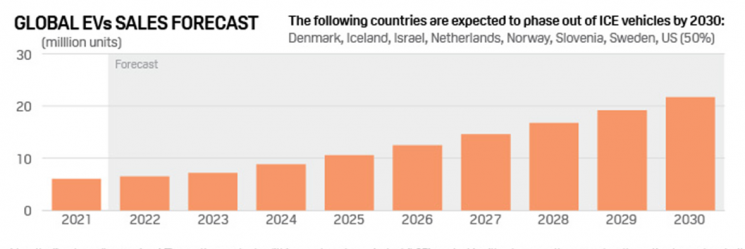

Electric vehicle sales are predicted to increase by more than 40% year-on-year to 9 million units in 2022 and expand to nearly 27 million units by 2030. Accordingly, the demand for lithium, a key material, is expected to grow from 500,000 tons last year to 2 million tons by 2030. Among this, the amount of lithium required by the three domestic battery companies?LG Energy Solution, SK On, and Samsung SDI?is estimated to reach 749,000 tons.

On the other hand, lithium supply has yet to fully enter the market due to insufficient investment, labor shortages and transportation issues caused by COVID-19, and regulations related to mining permits. Expansion and new projects are facing setbacks, failing to keep pace with the rapidly increasing battery usage. For example, the lithium mine development project by Australian mining company Rio Tinto in the Jadar region of Serbia has faced severe protests due to environmental pollution concerns during lithium extraction, resulting in project suspension and the recent cancellation of mining permits by the government.

As a result, lithium supply in 2030 is estimated at 1.78 million tons, which is 220,000 tons less than demand. This estimate assumes that 66 lithium producers, including Albemarle, Pilbara Minerals, Livent, and SQM, meet their target production volumes in existing and new projects in Australia, Argentina, Chile, and other locations. Considering the possibility of project suspensions or delays and other challenges, the supply-demand imbalance is expected to worsen.

Scott Yalham, Head of Battery Metals Benchmark Pricing at Platts, stated, “As countries and companies worldwide pursue carbon neutrality and accelerate energy transition, lithium, which is essential for electric vehicles and energy storage systems, is expected to see continuously increasing demand. Lithium supply shortages will pose obstacles for automotive and battery companies in achieving production targets and may delay the adoption of electric vehicles alongside rising battery pack prices.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)