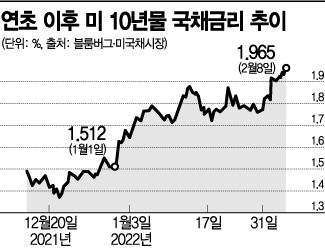

[Asia Economy Reporter Lee Seon-ae] As the schedule for the U.S. Federal Reserve's (Fed) benchmark interest rate hikes is expected to accelerate beyond initial forecasts and the magnitude of the hikes is also being revised upward, it appears necessary to generate returns through investment strategies that can respond to this trend until the first half of next year.

On the 12th, the securities industry expects the U.S. benchmark interest rate hike cycle to begin in March. Gong Dong-rak, a researcher at Daishin Securities, stated, "This year, the U.S. benchmark interest rate is expected to rise from the current 0.25% (upper limit) to 1.50% or 1.75% by the end of the year, and in 2023, it is forecasted to increase up to 2.00% or 2.25% by the first half, with a maximum of eight hikes." He added, "Accordingly, the Korean benchmark interest rate is expected to be raised two more times this year, with the year-end Korean benchmark rate projected at 1.7%."

Consequently, the domestic stock market is expected to be constrained, making adjustments and sideways movements inevitable.

Park Hee-chan, a researcher at Mirae Asset Securities, explained, "When signals of interest rate hikes emerge, there is an immediate valuation burden and concerns about growth slowdown, which could lead to sharp declines in stocks of companies facing these issues, maintaining an overall adjustment trend in the stock market."

The domestic stock market already experienced a sharp decline in January due to excessive concerns about this. The KOSPI and KOSDAQ indices fell by 10.55% and 15.58%, respectively, in January. This sharp adjustment occurred as investors' risk-asset avoidance sentiment was excessively amplified in response to the Fed tightening monetary policy to curb inflation that surged after the COVID-19 pandemic.

However, during periods of interest rate hikes, the stock market is influenced more by the economy and corporate earnings than by interest rate variables. This means that rather than worrying about confirmed tightening, attention should be paid to how stable the upcoming economic indicators and corporate earnings will be.

Therefore, until growth signals such as corporate earnings are confirmed, the most effective investment strategy is considered to be sectors with low price-to-earnings ratios (PER). This is based on the judgment that portfolios with short duration, which have a high correlation with value stocks, are advantageous amid rising market interest rates. Sectors with short equity duration include raw materials, finance, and automobiles. Duration is a concept from bonds, referring to the period until all returns, including final repayment, are received. This concept can be applied to stocks as well: companies expected to generate large future profits (growth stocks) have a higher equity duration, while the opposite (value stocks) have a lower equity duration. Along with this, low PER and earnings per share (EPS) growth rate can be considered as factors.

Researcher Noh Dong-sil of Shinhan Financial Investment said, "It is a time to focus on stocks and sectors with short earnings duration," adding, "Considering this strategy, large-cap stocks with relatively lower valuation burdens are in a better position compared to small- and mid-caps. Given that the PER of sectors such as semiconductors, IT, automobiles, and finance, which dominate the market capitalization of the Korean stock market, is low, the possibility of improving the relative returns of domestic large-cap stocks compared to global peers remains open."

Researcher Park Woo-yeol of Shinhan Financial Investment stated, "During periods of interest rate hikes, the stock market tends to prefer stocks with low valuations rather than those with high valuations." He explained, "Analyzing three periods of benchmark rate hikes since 1990, a strategy of buying stocks with low interest rate sensitivity and selling those with high sensitivity was tested. During rate hike periods, stocks with low interest rate sensitivity rose by an average of 3.5% annually, while those with high sensitivity rose by only 0.6% annually, resulting in a return difference of 2.9 percentage points."

According to FnGuide, undervalued stocks with low PER and rising net profit growth rates this year, selected by three or more securities firms among listed companies with a market capitalization of over 300 billion KRW, include HMM, Kolon Global, Halla, Halla Holdings, Kumho Construction, BNK Financial Group, DGB Financial Group, JB Financial Group, SeAH Steel, GS, Dongkuk Steel, LX International, and Industrial Bank of Korea. Notably, HMM is expected to have a net profit growth rate of 20.2% this year but has a PER of only 1.7 times. Kolon Global is estimated to have a net profit growth rate of about 5%, with a PER of 2.7 times.

Researcher Lee Kyung-soo of Hana Financial Investment said, "Extremely undervalued stocks can expect trend returns regardless of the direction of interest rates," adding, "Even if predicting the variable of interest rates is difficult, extremely undervalued stocks can help prepare for volatile market conditions."

In fact, when Hana Financial Investment bought the 20 stocks with the lowest PER at the beginning of the year and sold them on the last trading day of the year over three years, the average return of these 20 stocks was higher than the KOSPI in all three years. The estimated and market capitalization-based low PER 20-stock group achieved a 93.4% return over three years, while the KOSPI rose 43.9% during the same period. The average return of the extremely undervalued 20 stocks outperformed the KOSPI by an annual average of 16.5 percentage points. The researcher emphasized, "Last year, the excess return of the extremely undervalued stock group compared to the KOSPI was 39.6 percentage points, the highest, demonstrating the power of extremely undervalued stocks even in an environment favoring growth stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)