Household Loan Regulations Combined with Interest Rate Hikes

Lower Incomes Face Greater Disadvantages

Concerns Over Exacerbating Asset Polarization Side Effects

[Asia Economy Reporters Sim Nayoung, Song Seungseop] It has been found that low-income earners suffer more disadvantages from household loan regulations and interest rate hikes than high-income earners. With the intention of controlling household loans under the principle of "borrow only what you can repay," financial authorities tightened the Debt Service Ratio (DSR) regulations starting in January. The combination of loan regulations and rising interest rates raises concerns about exacerbating polarization as a side effect.

Mr. A: 240 million KRW → 129 million KRW

Mr. B: 240 million KRW unchanged

Due to loan regulations... Low-income earners face longer road to homeownership

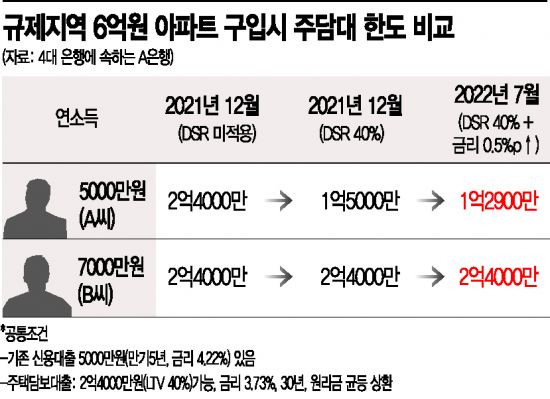

On the 12th, Asia Economy, together with a commercial bank, analyzed the mortgage loan amounts available over time for two office workers: Mr. A, earning an annual salary of 50 million KRW, and Mr. B, earning 70 million KRW, assuming they are trying to buy a 600 million KRW apartment (see table). The results showed that Mr. A’s loan limit dropped by half from December last year to July this year, while Mr. B’s loan amount remained unchanged. Until the end of last year, their limits were the same, but only Mr. A, with the lower salary, moved further away from the dream of homeownership within six months.

In the simulation, reflecting current borrowing behaviors of office workers, both individuals were assumed to have already taken out 50 million KRW in unsecured loans. The mortgage loan conditions were applied equally. Based on this premise, the mortgage loan limits were compared across three periods: December last year (no borrower-level DSR regulation) → January this year (DSR 40% for total loans exceeding 200 million KRW) → July this year (DSR 40% for loans exceeding 100 million KRW, with a 0.5 percentage point interest rate increase).

Mr. A’s loan limit fell from 240 million KRW → 150 million KRW → 129 million KRW. Meanwhile, Mr. B could borrow up to 240 million KRW throughout this period. Only Mr. A’s borrowing capacity significantly decreased. A representative from the commercial bank explained, "Mr. A can only borrow within a 20 million KRW annual principal and interest repayment limit, and as interest rates rise, the loan limit decreases. Mr. B’s annual repayment amount is 28 million KRW, so he can absorb the regulatory and interest shocks, making it much easier for him to buy a house."

When the housing price rise cycle returns, the asset gap between Mr. B, who could buy a house with a loan, and Mr. A, who could not, will inevitably widen. Professor Sung Tae-yoon of Yonsei University’s Department of Economics said, "If there is income and repayment ability, the DSR regulation should be reformed to allow increased borrowing."

Due to commercial banks’ total loan volume regulation... 'Loan refugees' expected to surge by year-end

Although the Financial Services Commission, which has positioned itself as a 'household debt fighter,' breathed a sigh of relief as the household loan balance of the five major commercial banks decreased for the first time in eight months in January, concerns about 'loan refugees' are emerging behind the scenes. The immediate challenge is the DSR regulation applied since last month, but the financial industry expects a bigger hurdle toward the end of the year.

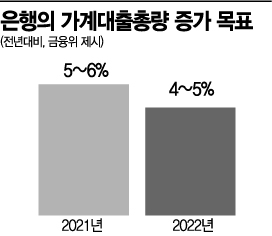

This is because the Financial Services Commission raised the household loan total volume growth target for banks this year (4-5%) compared to last year (5-6%). Last year, the household loan amount by banks is estimated to have increased by 11 trillion KRW compared to the previous year, but this year it can only increase by up to 9.7 trillion KRW. This also means that the amount banks can lend to households will decrease by about 1.3 trillion KRW compared to the previous year.

A commercial bank official said, "To meet the target set by the authorities, banks will start actively managing total household loan volumes from the fourth quarter. For example, Bank A might have lent without difficulty until the third quarter, but to meet the 4% growth rate by year-end, the only option is to reduce lending to customers," he explained.

In this case, borrowers who were only allowed to repay up to 40% of their annual income under the DSR regulation might face situations where they cannot even borrow up to that limit by year-end. Last year, banks hurriedly tightened lending to meet total volume targets, even resorting to raising loan interest rates.

The government plans to increase real estate supply this year, but financial authorities tightening loans is seen as contradictory policy. A senior government official said, "It has become harder to borrow money from banks, so how can real demand buyers purchase homes without new loans?" and added, "There are voices within the government saying that total loan volume regulation needs to be supplemented."

The loan thresholds for secondary financial institutions and private lenders, mainly used by low-credit borrowers, are also rising. This is due to the reduction of the legal maximum interest rate and total household loan volume regulations. Last year, the legal maximum interest rate was lowered from 24% per annum to 20%, and the total volume regulation target for savings banks was strengthened from 21.1% to 10.8-14.8%.

Financial Services Commission Chairman Ko Seung-beom announced plans to consider excluding mid-interest rate loans from total volume regulations to ease borrowing for low-credit borrowers, but there has been no news for two months. A savings bank official said, "We have requested mid-interest rate loans be excluded from regulations, but there has been no directive from financial authorities yet." As of February this year, more than 60% of the 79 savings banks do not lend to low-credit borrowers (below 600 points). More than 10 savings banks had a low-credit loan ratio of less than 1%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)