Krafton and Wemade Achieve Record-Breaking Results

But Game Division Remains Weak

US and Europe Consider 'Post-Pandemic' Shift

Concerns Over Overseas Sales Impact

Game Demand Expected to Decline This Year... Rebound Through New Businesses

[Asia Economy Reporter Seungjin Lee] The outlook for the domestic gaming industry is bleak. Although some game companies achieved record-breaking results last year, many experienced stagnation or decline in their core gaming business. This is especially due to expectations of reduced demand for games as countries like the United States and Europe consider transitioning to a 'post-pandemic' lifestyle.

Record-Breaking Performance, Market Remains 'Cold'

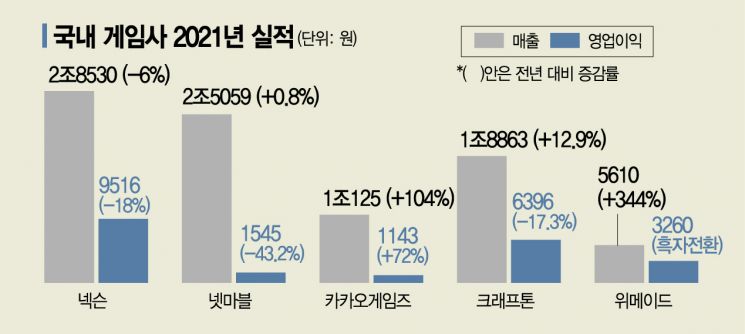

According to the gaming industry on the 11th, Krafton, Kakao Games, and Wemade all achieved record-high sales last year, but their stock prices plummeted, reflecting a lukewarm market response. Krafton's sales last year increased by 12.9% compared to the previous year, reaching 1.8863 trillion KRW, the highest ever. Operating profit decreased by 17.3% to 639.6 billion KRW, but excluding the cost of free stock grants, it achieved operating profits in the 700 billion KRW range for two consecutive years.

Wemade also recorded its best-ever performance. Last year, annual sales were 561 billion KRW and operating profit was 326 billion KRW, with sales increasing by 344% compared to the previous year and operating profit turning positive for the first time in four years. Kakao Games entered the '1 trillion club' last year. Kakao Games' sales last year were 1.0125 trillion KRW, and operating profit was 114.3 billion KRW, increasing by 104% and 72% respectively compared to the previous year.

Although the numbers are record-breaking, the content is not favorable. From the fourth quarter of last year, the core gaming division's performance has been sluggish. Krafton's operating profit in Q4 last year decreased by a staggering 53.6% compared to the same period the previous year. The new release, 'New State,' did not meet expectations. Kakao Games saw a 51% decrease in sales quarter-on-quarter in Q4 last year as the launch effect of the game Odin disappeared.

In Wemade's case, despite the 'surprise performance,' profits from the sale of its own cryptocurrency WEMIX accounted for 90% of total operating profit. Sales from cryptocurrencies and other non-core gaming sources made up 64% of total sales, leading to criticism that the results lacked substance, which caused the stock price to plunge. Additionally, leading domestic game companies Nexon and Netmarble both saw operating profits decline last year, falling significantly short of market expectations.

US and Europe 'Post-Pandemic'

There are forecasts that the gaming industry will face even greater difficulties this year. As countries like the US and Europe consider transitioning to a 'post-pandemic' phase, expectations are rising that travel restrictions will be lifted worldwide. The proportion of overseas sales for domestic game companies continues to grow year by year.

For Netmarble, overseas sales accounted for 78% in Q4 last year, an 8 percentage point increase from the previous quarter. By region, North America accounted for 43% of the total. Wemade, focusing on 'P2E (play-to-earn)' games which are restricted domestically, saw overseas market sales make up 93% of total sales in Q4 last year. Krafton generates 94% of its total sales overseas. As overseas revenue grows, the sales impact from the transition to a 'post-pandemic' phase appears inevitable.

The gaming industry plans to rebound through new businesses such as non-fungible tokens (NFTs). Netmarble plans to launch new businesses themed around blockchain and the metaverse (expanded virtual worlds) this year. It will first release six new blockchain games. Krafton intends to introduce a new production program called 'The Potential Program' and pursue new businesses including △deep learning △Web 3.0 △NFT △virtual reality (VR).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.