Accelerated by MyData Launch

Online Fund Sales Also Surge

[Asia Economy Reporter Minwoo Lee] The biggest buzzword in this year's digital asset management market was identified as 'hyper-personalization.' It is analyzed that this trend will accelerate further with the launch of MyData (personal credit information management) services.

Hana Bank announced on the 9th that it had published the '2022 Korea Digital Asset Management' report containing this information. The report named 'hyper-personalization' as the top priority topic in the digital personal market this year. This is based on the judgment that the level of customized information will rise further as a foundation for freer use of personal data is established.

It predicted that this hyper-personalization phenomenon will develop differently depending on the generation. The MZ generation (Millennials + Generation Z), for whom the use of digital channels is natural, actively participates in acquiring financial knowledge to increase assets and in new forms of investment. On the other hand, the older generation with a certain level of assets has mainly conducted financial transactions through face-to-face channels such as private banking (PB) and branches, but recently the proportion of those experiencing and utilizing digital channels is increasing.

Accordingly, the report selected ▲participatory platforms ▲convenience premium (convenience + premium) ▲digital investment journey management ▲data-driven asset management as representative trends.

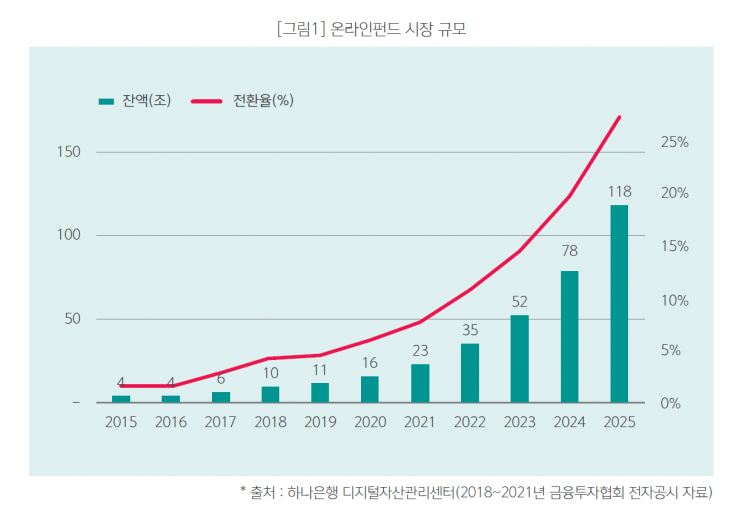

The report also analyzed the online fund market. According to the report, the online fund balance reached a record high of approximately 23.7 trillion KRW as of the end of last year. It is analyzed that the proportion of non-face-to-face sales rapidly increased due to COVID-19, causing the online fund balance to more than double over the past two years. It is expected that by 2025, the balance of online-only funds will exceed 100 trillion KRW, with the ratio of online-only funds to the total public offering fund size approaching 30%.

The fund sales of the four major banks?Hana, Kookmin, Shinhan, and Woori?are also rapidly shifting online. More than 80% of recently opened funds were conducted online. While online channels used to focus on small installment funds, recently the online proportion has rapidly increased in terms of sales amount and accumulated balance as well.

In line with this trend, Hana Bank launched the digital investment platform 'Funshop (Fun#)' last year. A Hana Bank Digital Asset Management Center official said, "In the future, through the combination of Funshop and the MyData service 'Hap,' we will introduce a richer and more convenient digital asset management service."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)