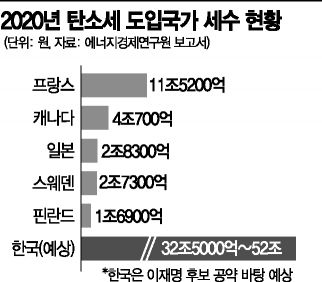

Plan to impose 50,000~80,000 KRW per ton... Annual tax revenue claimed up to 64 trillion KRW, nearly 6 times France's (11.5 trillion KRW)

"OECD also analyzes significant carbon costs in Korea... Concerns over competitiveness damage in our manufacturing-heavy industry"

[Asia Economy Sejong=Reporter Kwon Haeyoung] Carbon-intensive industries, including the steel sector, are highly anxious about the possibility of realizing a carbon tax pledge nearly six times higher than France’s ahead of the March presidential election. If the carbon tax proposed by Lee Jae-myung, the Democratic Party presidential candidate, is introduced, the annual tax burden on domestic companies is expected to be at least three times, and up to five to six times, higher than that of France, which currently collects the highest carbon tax worldwide. Given the high proportion of manufacturing industries such as steel, petrochemicals, and cement in Korea’s economic structure, excessive carbon tax imposition raises concerns about damaging industrial competitiveness and prompting the relocation of production bases overseas.

According to the report titled “Trends in Overseas Carbon Tax Operations and Implications for Carbon Pricing (Professor Lee Dong-gyu, Department of Economics, University of Seoul)” released by the Korea Energy Economics Institute on the 31st, France collected $9.632 billion (approximately 11.52 trillion KRW) in carbon tax in 2020, the highest revenue among the 28 countries that have introduced carbon taxes. It was followed by Canada ($3.407 billion), Japan ($2.365 billion), Sweden ($2.284 billion), and Finland ($1.42 billion).

The actual carbon tax revenues collected by these countries are significantly lower than the expected revenue from the carbon tax that candidate Lee plans to introduce. Lee proposes imposing a carbon tax of 50,000 to 80,000 KRW per ton, using the revenue to fund a basic income, claiming that it could generate between 30 trillion and 64 trillion KRW annually. Based on the 2020 carbon emissions (650 million tons), this translates to a potential revenue of 32.5 trillion to 52 trillion KRW. This amount is five to six times the maximum carbon tax revenue collected by France, the country with the highest carbon tax revenue worldwide.

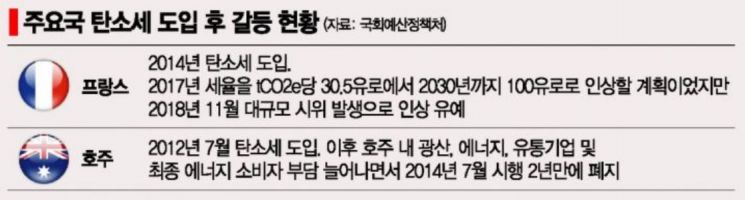

Moreover, most countries that have introduced carbon taxes, including France, exclude participants in the Emissions Trading System (ETS) from taxation or provide reduced rates. For example, the UK operates a carbon tax as a means to guarantee a minimum carbon cost because emission allowance prices can fluctuate. Finland is reportedly the only country that imposes overlapping taxation from both carbon tax and ETS costs.

In particular, the carbon tax rate envisioned by candidate Lee could severely impact Korea’s economy, which heavily depends on manufacturing. According to the OECD, manufacturing accounted for 27.5% of Korea’s GDP in 2019. This is higher than the US (10.9%), the UK (8.7%), Italy (14.9%), and even manufacturing powerhouses like Germany (19.1%) and Japan (20.7%). The UK, whose manufacturing sector is only one-third the size of Korea’s, imposed a carbon tax of $25 per ton as of January last year, whereas candidate Lee is considering a minimum of 50,000 KRW per ton. This rate exceeds those of other countries such as Spain ($18 per ton), the Netherlands ($35), Canada ($32), Japan ($3), Singapore ($4), and Indonesia ($2.1).

The industry is concerned that adding a carbon tax on top of the existing domestic emissions trading market, which is worth about 1 trillion KRW, could excessively increase burdens, leading to reduced investment, job losses, and inflation, thereby negatively affecting the overall economy. According to an OECD survey, 49% of domestic carbon emissions in 2018 were subject to prices of 60 euros or more per ton, ranking Korea 10th among 44 countries. Notably, the increase from 2015 to 2018 was the largest among these countries. The OECD also estimates that the domestic transport sector, which was not subject to the ETS at the time, had 93% of its total carbon emissions priced at 120 euros or more per ton due to other energy taxes such as environmental costs.

There are cases overseas where carbon taxes were introduced but later abolished due to increased environmental cost burdens on companies and the transfer of costs to consumers. For example, Australia introduced a carbon tax in July 2012, but due to increased burdens on mining, energy, distribution companies, and final energy consumers, the carbon tax system was abolished in July 2014, just two years after implementation.

Professor Lee Dong-gyu stated, “According to OECD research, countries with high carbon intensity apply low effective tax rates to reduce the burden on industries. Korea’s carbon-intensive industries contribute significantly to the national economy and already pay high carbon prices relative to GDP through the ETS, so the carbon tax rate should be determined restrictively.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)