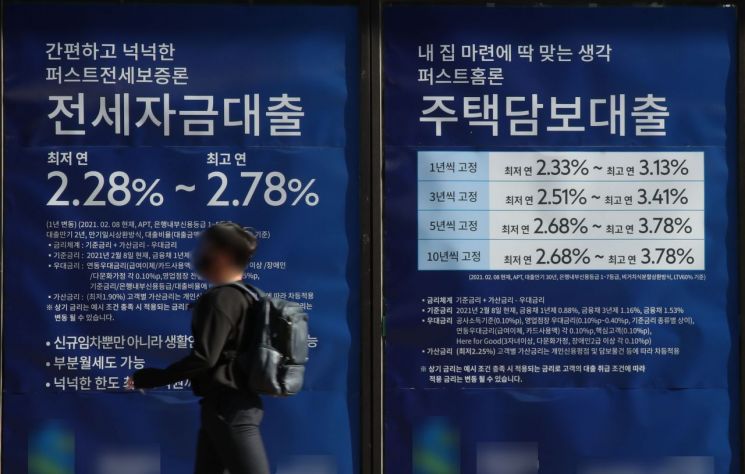

Last December, the average interest rate on mortgage loans rose to the highest level in 7 years and 7 months.

According to the 'Weighted Average Interest Rates of Financial Institutions' statistics released by the Bank of Korea on the 28th, the interest rate on new household loans at deposit banks in December last year was 3.66% per annum, up 0.05 percentage points from the previous month, marking the seventh consecutive month of increase. This is the highest level since August 2018.

The interest rate on mortgage loans among household loans was 3.63% per annum, rising 0.12 percentage points in one month. This is the highest figure in 7 years and 7 months since May 2014 (3.63%). On the other hand, the interest rate on general unsecured loans fell by 0.04 percentage points to 5.12%.

Song Jae-chang, head of the Financial Statistics Team at the Bank of Korea's Economic Statistics Bureau, explained, "The rise in benchmark interest rates such as COFIX and bank bonds caused the interest rates on mortgage loans and guaranteed loans to increase." He added, "In the case of unsecured loans and group loans, interest rates decreased due to the resumption of sales of products targeting some high-credit borrowers and an increase in the handling of pre-approved low-interest loans."

The interest rate on corporate loans continued its upward trend. Last month, the interest rate on new corporate loans at deposit banks was 3.14% per annum, up 0.02 percentage points from the previous month. This marks the fifth consecutive month of increase and is the highest since February 2020.

The interest rate on loans to large corporations fell by 0.04 percentage points (from 2.90% to 2.86%), but the interest rate on loans to small and medium-sized enterprises rose by 0.07 percentage points (from 3.30% to 3.37%).

The average interest rate on all loans at deposit banks, reflecting both corporate and household loan rates, was 3.25% last year, 0.02 percentage points higher than in November (3.23%).

The statistics based on new loan amounts mean that the interest rates applied to new deposits and loans handled by banks during the month are weighted by the amount of new transactions. Since it accurately reflects recent interest rate trends, it can be usefully utilized by financial consumers who want to save at banks or take out general loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)