Korea Insurance Research Institute Hosts Seminar on 'Understanding MZ Generation's Financial Product Choices'

[Asia Economy Reporter Changhwan Lee] An analysis has emerged that the rising MZ generation (born from the early 1980s to the early 2000s), who generally have a higher understanding of financial technology compared to other generations, requires financial companies to actively develop financial products tailored to them.

The Korea Insurance Research Institute announced that it held an online seminar on the afternoon of the 28th under the theme "How to Understand the MZ Generation's Financial Product Choices?" to discuss the MZ generation's selection of financial products.

Professor Soohyun Joo of Ewha Womans University presented on "Characteristics and Financial Experiences of the MZ Generation," emphasizing the importance of generational analysis and sharing research results on the MZ generation's traits and financial experiences.

Professor Joo explained, "The MZ generation generally has a high level of education but is characterized by lower wages and higher debt compared to their parents' generation," adding, "They also show high interest in quality of life, practicality, fairness, diversity, and environmental friendliness."

He stated, "The MZ generation showed higher knowledge and ownership of cryptocurrencies, which are closely related to financial technology, compared to other generations. However, for other financial products, their product knowledge and ownership were lower than those of other generations."

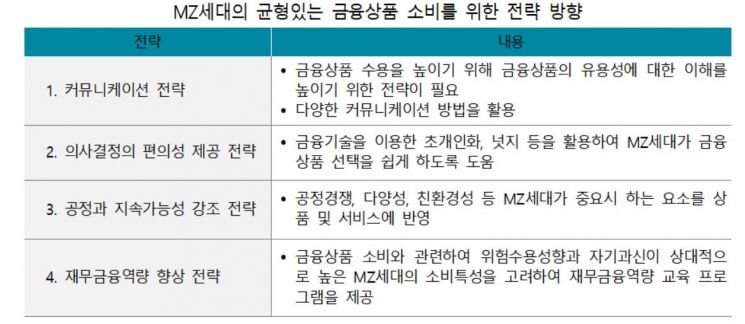

Based on these research findings and characteristics, Professor Joo proposed four financial product and service strategies for financial companies targeting the MZ generation.

First, he advised strengthening various communications aimed at the MZ generation to enhance understanding of the usefulness of financial products.

Next, he emphasized the need to help the MZ generation make financial consumption decisions easily on their own by utilizing technology-based hyper-personalization and nudges.

Third, he analyzed that it is necessary to reflect values important to the MZ generation, such as fairness, diversity, and environmental friendliness, in products and services. Lastly, he argued for the provision of educational programs targeting the MZ generation, who have a relatively higher risk tolerance.

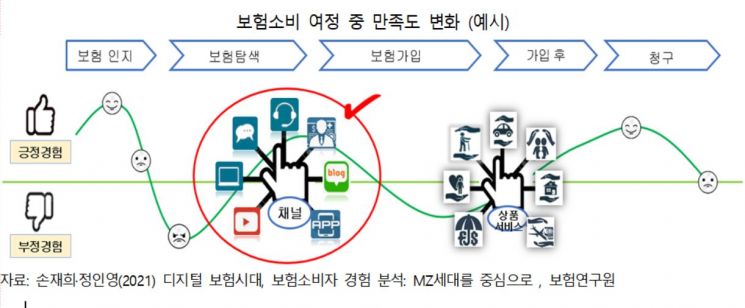

Researcher Jaehee Son of the Korea Insurance Research Institute, who participated as a discussant, also emphasized, "To target the experience-valuing MZ generation, it is essential to first analyze their experiences and emotions throughout the insurance consumption process, and to develop channel and product strategies that enable the MZ generation to have positive experiences during their insurance consumption journey."

Researcher Son said, "The MZ generation has a characteristic of not sparing time and money for diverse, new, and fresh experiences." He continued, "For the MZ generation, experience is the reason for consumption, so rather than caring about accessibility or convenience, they prefer products and services that provide them with differentiated experiences."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)