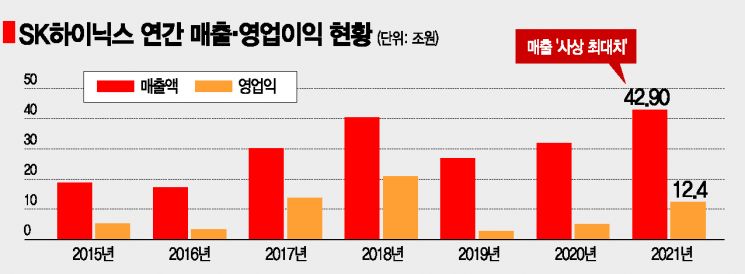

Annual sales surpassed 43 trillion won last year, the highest since establishment... Operating profit recorded 12.4 trillion

China Wuxi invested 2.4 trillion for supplementary investment... Dividend raised by more than 30%

Intel NAND acquisition and quality competitiveness improvement expected to exceed 50 trillion this year

[Asia Economy Reporters Sunmi Park and Hyeyoung Lee] SK Hynix achieved record-high sales last year due to the semiconductor market boom. The main reason for this record performance was securing quality competitiveness centered on high value-added products in the DRAM business, which accounts for about 70% of sales, and flexibly responding to demand. This means that actively supplying products amid uncertain semiconductor market conditions such as supply chain disruptions and increased non-face-to-face IT demand was key. The dividend per share was decided at 1,540 KRW, more than 30% higher than the previous year's 1,170 KRW.

On the 28th, SK Hynix announced that last year's sales reached 42.9978 trillion KRW, a 34.8% increase compared to the same period last year. This is the highest record ever, surpassing the 40.4451 trillion KRW sales recorded in 2018, the peak of the semiconductor market. Operating profit surged 147.6% to 12.4103 trillion KRW. In the fourth quarter of last year, sales were 12.3766 trillion KRW and operating profit was 4.2195 trillion KRW, with sales exceeding 12 trillion KRW quarterly for the first time ever, and operating profit staying above 4 trillion KRW for two consecutive quarters.

SK Hynix is expected to set another record this year with annual sales surpassing 50 trillion KRW and operating profit reaching an all-time high, as memory semiconductor demand remains solid and the acquisition effect of Intel's NAND business begins to take full effect.

What is the background of the record sales performance?

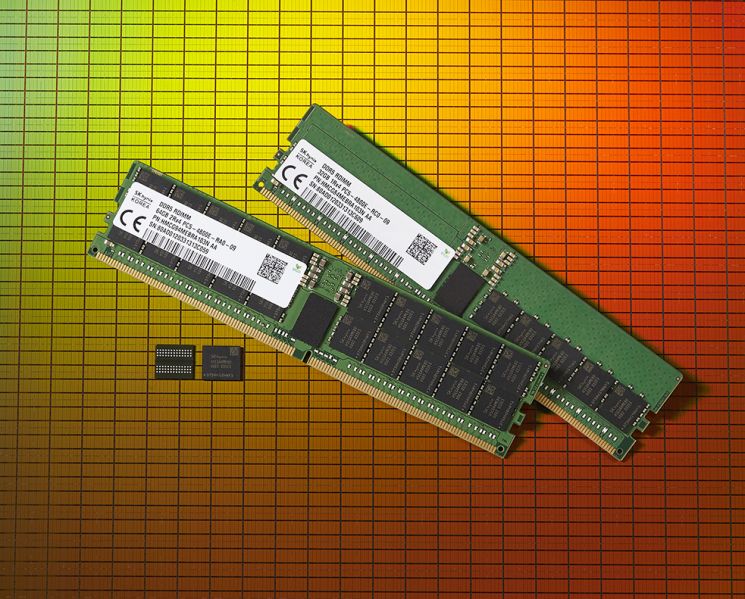

SK Hynix greatly benefited from the increased non-face-to-face IT demand due to the spread of COVID-19 last year. On the 28th, SK Hynix President Jongwon Noh explained during the earnings conference call, "In the DRAM business, we actively expanded sales to PCs, graphics, and Greater China mobile markets where non-face-to-face demand was solid last year, maintaining the top server customer market share based on quality competitiveness superiority. Additionally, we secured industry-leading quality competitiveness for next-generation strategic products such as DDR5 and HBM3, which saw increased demand."

HBM is a high value-added, high-performance product that dramatically improves data processing speed compared to existing DRAM. SK Hynix was the first in the industry to develop HBM3, securing a leading position. Furthermore, after launching the industry's first DDR5 DRAM in October 2020, SK Hynix solidified its technological leadership in the DDR5 field by introducing the largest capacity product just one year and two months later.

The NAND business, which turned profitable in the third quarter last year, also contributed to the record sales by achieving over 60% annual shipment growth based on the competitiveness of 128-layer products. By recording a sales growth rate significantly exceeding the market average, the NAND business posted an annual profit. President Noh explained, "The share of 128-layer sales reached 80%, achieving double-digit cost reduction rates."

What is the strategy according to this year's market outlook?

SK Hynix expects that supply chain issues, the most important variable in the demand environment, will continue through the first half of this year but will gradually ease in the second half, leading to increased market demand for memory products.

Accordingly, the DRAM business plans to continue a strategy focused on profitability while flexibly managing inventory to reduce market volatility. The limited decline in DRAM prices and the earlier-than-expected rebound are also positive signs. The spot price of PC DRAM, which can proactively reflect DRAM market conditions, turned upward in the second half of last year and has been trading around $3.7 this month, increasing expectations for market improvement.

For the NAND business, SK Hynix plans to continuously pursue scale growth. With the completion of the first phase of Intel's NAND business acquisition at the end of last year, the U.S. subsidiary Solidigm's SSD (storage device) business has been added, and SK Hynix expects sales volume to approximately double compared to last year. The demand growth rates for DRAM and NAND flash are expected to be in the high teens and around 30%, respectively.

Entry into the global top 2 in the NAND market has also become visible. President Noh said, "The biggest change from the Solidigm merger is expected to be an increase in combined market share. SK Hynix's NAND market share is expected to rank second."

He added, "In the SSD (enterprise solid-state drive) sector, being able to independently develop products based on Intel's technical understanding will be a great help. We will minimize losses during the Solidigm merger process and achieve a market share that exceeds a simple sum like '1+1=2.'"

Investment and dividend plans?… 2.4 trillion KRW invested in Wuxi, China for supplementary investment

SK Hynix plans to actively expand investments. Considering costs for purchasing land in Yongin and building R&D facilities in the U.S. this year, SK Hynix announced it will increase infrastructure investment. The company also announced a capital injection of 2.394 trillion KRW into its local subsidiary operating the DRAM production line in Wuxi, Jiangsu Province, China. This capital will be used as supplementary investment funds for the SK Hynix Wuxi DRAM semiconductor plant over the next three years, from the end of this year through 2025.

The scale of equipment investment is expected to be similar to last year. SK Hynix will also conduct large-scale recruitment within the first quarter. To prepare for future growth engines such as the Yongin semiconductor cluster construction, the launch of the U.S. NAND subsidiary Solidigm, and the full operation of the Icheon M16 fab, the company plans to expand hiring compared to previous years.

However, regarding the Yongin semiconductor cluster construction, which has been delayed by more than a year due to resident persuasion and permit delays, SK Hynix expressed that "there are uncertainties." President Noh said, "We plan to operate the new fab by early 2026. If there is a significant delay in the timing of the first fab in Yongin, we will consider securing another site and are actually considering this."

Meanwhile, SK Hynix also decided on a dividend of 1,540 KRW per share. The total dividend payout amounts to 1.0589 trillion KRW. SK Hynix plans to allocate about 50% of the free cash flow generated over the next three years, from this year through 2024, as shareholder returns. The annual cash dividend formula remains the same, paying a fixed dividend plus 5% of the annual free cash flow as an additional dividend, but the fixed dividend was raised by 20% from 1,000 KRW per share to 1,200 KRW per share. SK Hynix will also consider share buybacks depending on future management conditions to realize shareholder value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)