Biogen Acquires Entire Epis Stake of '50%-1 Share'

Decides on 3 Trillion Won Rights Offering to Raise Funds

The third plant of Samsung Biologics in Songdo, Incheon, and the new headquarters of Samsung Bioepis (from left in the photo) (Photo by Samsung Biologics, Samsung Bioepis)

The third plant of Samsung Biologics in Songdo, Incheon, and the new headquarters of Samsung Bioepis (from left in the photo) (Photo by Samsung Biologics, Samsung Bioepis)

[Asia Economy Reporter Lee Chun-hee] Samsung Biologics will purchase all shares of Samsung Bioepis held by Biogen.

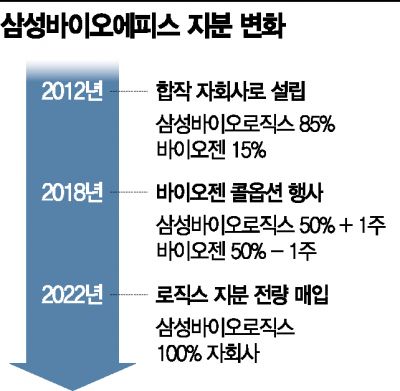

On the 28th, Biologics announced that it will acquire 10,341,852 shares of Bioepis owned by the U.S. company Biogen for $2.3 billion (approximately 2.7656 trillion KRW). This amount corresponds to '50%-1 share' of Bioepis shares. Combined with the '50%+1 share (10,341,853 shares)' that Biologics already holds, Bioepis will become a 100% subsidiary of Biologics.

Bioepis was established in 2012 as a Samsung-centered joint venture with Biologics holding 85% and Biogen holding 15% of the shares. However, in June 2018, Biogen exercised a call option to purchase up to '50%-1 share' of the shares it had held since Bioepis was founded, changing the ownership structure to the current state.

Of the total contract amount of $2.3 billion, excluding the $50 million 'Earn-Out' cost, which will be determined in 2027 based on the fulfillment of certain conditions after the contract signing, the remaining acquisition payment will be paid in installments over two years. The first payment of $1 billion will be made in April, followed by $812.5 million next year, and $437.5 million in 2024. Biologics plans to raise the purchase funds through its own capital and capital increase. On the same day, Biologics decided on a paid-in capital increase worth about 3 trillion KRW (66,165,000 shares) to raise funds for facility investment and acquisition of securities of other companies.

This share acquisition is expected to further accelerate Samsung's expansion in the bio business. This is because Bioepis's continuous development of biosimilars and new pipelines to create synergy with Biologics' contract development and manufacturing organization (CDMO) will be able to speed up. Currently, Bioepis has launched a total of five biosimilar products in the global market, including three autoimmune disease treatments and two anticancer drugs, gaining recognition for their competitiveness. In addition, Bioepis is accelerating pure new drug development beyond biosimilars, such as jointly developing the acute pancreatitis drug candidate 'SB26' with Japan's Takeda Pharmaceutical.

However, Biologics explained that this contract does not mean the end of the cooperative relationship with Biogen. A Biologics official stated, "This contract is due to Biogen's request to sell its shares," and added, "The two companies will continue to maintain a close cooperative relationship."

Biogen's request is interpreted as a result of the recent management crisis it has faced. Biogen gained attention when its ambitious dementia treatment drug 'Aduhelm' (generic name aducanumab) was approved by the U.S. Food and Drug Administration (FDA) in June last year. However, controversy over the actual efficacy of Aduhelm has arisen since then, causing difficulties in market expansion. In the U.S., Medicare coverage is limited only to patients participating in clinical trials, leading to management difficulties due to poor sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.