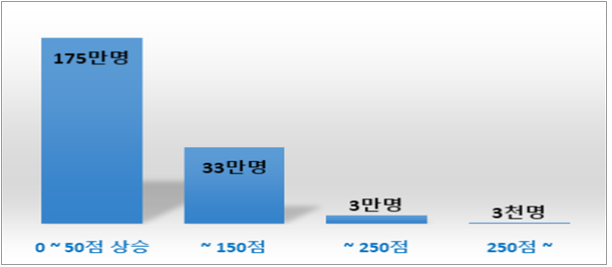

Credit score increase effect according to the 'Credit Forgiveness' policy (based on NICE). Photo by Korea Credit Information Services

Credit score increase effect according to the 'Credit Forgiveness' policy (based on NICE). Photo by Korea Credit Information Services

[Asia Economy Reporter Song Seung-seop] Approximately 2.28 million people benefited from an increase in their credit scores (ratings) due to the financial authorities' and government's 'credit pardon' policy.

According to the Credit Information Center on the 27th, the sharing of delinquency records was restricted for 2,113,000 individuals and 168,000 sole proprietors.

Last August, the Credit Information Center signed a 'business agreement for credit recovery support' to assist vulnerable groups struggling with debt delinquency during the COVID-19 period. From August 2020, even if delinquency occurred for one year, if the delinquent debt was repaid by the end of last year, financial institutions were prevented from viewing the delinquency records.

During this period, the number of individuals and sole proprietors who experienced delinquency was 2,438,000 and 172,000 respectively. 87% of individuals and 98% of sole proprietors received the benefits.

With the restriction on sharing delinquency records, the credit scores of delinquent debtors also increased. Individuals' scores rose by 24 points on average, from 678 to 702. Sole proprietors' credit ratings improved from 7.8 to 7.3. The number of individuals whose credit scores increased by more than 100 points was also counted at 114,000.

Additionally, about 110,000 people met the minimum credit score for card issuance (NICE 680 points). It was also identified that 160,000 people exceeded the average credit score of new bank loan borrowers (NICE 866 points).

A Credit Information Center official emphasized, “The support recipients have expanded opportunities to receive cards normally or convert to low-interest loans through bank refinancing loans,” adding, “This has greatly contributed to improving the practical financial accessibility of vulnerable groups.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.