Ministry of SMEs and Startups Announces 2021 New Venture Investment Performance

Strong Growth in ICT Services, Distribution, and Bio-Medical Industries

Seoul Accounts for 56.3% of Total Investment... Polarization Deepens

Government to Invest 1 Trillion Won in Mother Fund... Plans to Create 2 Trillion Won Fund

Regional Venture Investment Activation Plan to Be Announced in February

Minister Kwon Chil-seung of the Ministry of SMEs and Startups is giving a briefing on the 2021 new venture investment performance results at the Government Seoul Office Annex in Jongno-gu, Seoul, on the 27th.

Minister Kwon Chil-seung of the Ministry of SMEs and Startups is giving a briefing on the 2021 new venture investment performance results at the Government Seoul Office Annex in Jongno-gu, Seoul, on the 27th.

Last year, venture investment reached 7.7 trillion KRW, achieving the highest record ever. The number of investment deals, the amount invested per deal, and the number of companies receiving investments all set new records. The government plans to contribute 1 trillion KRW to the Korea Fund of Funds this year to create venture funds exceeding 2 trillion KRW.

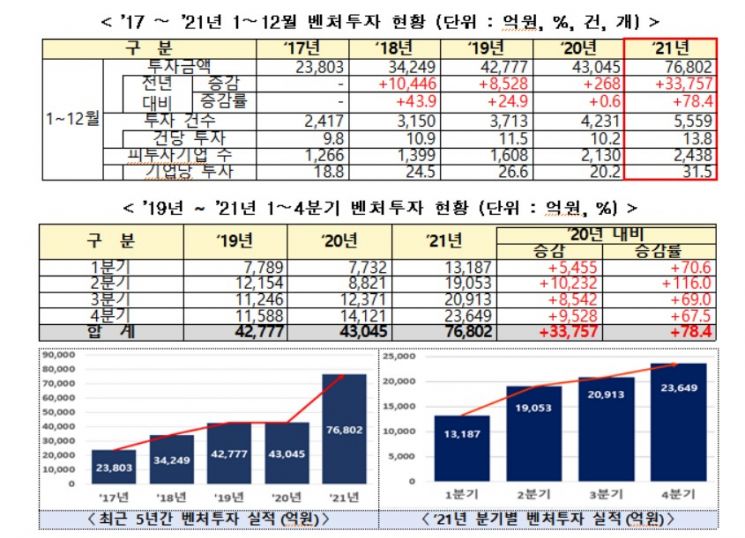

On the morning of the 27th, Kwon Chil-seung, Minister of SMEs and Startups, held a briefing at the Government Seoul Office and announced that venture investment in 2021 reached 7.6802 trillion KRW, marking an all-time high. This figure represents an increase of 3.4 trillion KRW (78.4%) compared to the previous record of 4.3045 trillion KRW in 2020.

The number of investment deals, investment amounts, and the number of invested companies all reached record highs, with 2,438 venture companies receiving an average of 3.15 billion KRW in investment over 2.3 rounds. Notably, the fourth quarter of last year achieved a single-quarter record of 2.4 trillion KRW.

By industry, the Information and Communication Technology (ICT) service sector led the growth in venture investment, recording 2.4283 trillion KRW, a 125.6% increase from the previous year. With the rise of e-commerce during the COVID-19 era, the distribution and service sector also saw investment more than double, reaching 1.4348 trillion KRW. The bio and medical sector ranked second in investment amount for the second consecutive year, with 1.677 trillion KRW.

Comparing this to 2011, when the top three industries for investment were electricity, machinery, and equipment (23.5%), video, performance, and music (16.5%), and ICT manufacturing (13.9%), it is clear that industry investment trends have significantly shifted over the past decade.

Venture investment in non-face-to-face sectors during the COVID-19 period more than doubled from the previous year to 4.0119 trillion KRW, surpassing 4 trillion KRW for the first time. Consequently, the share of investment in non-face-to-face sectors exceeded 50% for the first time.

Among companies that attracted venture investment last year, 157 companies secured large investments of over 10 billion KRW, setting a new record. Additionally, investment in medium-sized companies with 3 to 7 years of operation more than doubled from the previous year to 3.4814 trillion KRW, accounting for 45.3% of the total. Follow-up investments amounted to 5.4646 trillion KRW, representing 71.2% of the total and surpassing 70% for the first time. The Ministry of SMEs and Startups analyzed that "venture capitalists (VCs) are increasing follow-up or scale-up investments as companies they invested in at the startup stage show continuous growth potential."

Among the top 10 companies in terms of investment attraction, four were from the ICT service and distribution/service sectors each, and one was from the bio and medical sector. The company that attracted the most venture investment last year was Dunamu, a cryptocurrency exchange, which received 150.9 billion KRW. The total investment amount from the top 10 VCs last year was 2.323 trillion KRW, accounting for about 30% of the total. The VC with the largest investment was Saehan Startup Investment, which invested 373.8 billion KRW.

Minister Kwon stated, "Since the Moon Jae-in administration, the Korea Fund of Funds has contributed over 1 trillion KRW annually, significantly supporting the venture investment industry," and added, "Various institutional improvements related to venture investment have created synergistic effects."

However, the concentration of venture investment in the Seoul metropolitan area has intensified. Over the past five years, the metropolitan area has maintained a venture investment share of over 70%, with Seoul accounting for about 50%. Last year, Seoul's share rose to 56.3% of the total investment amount. Minister Kwon said, "We plan to announce a concrete plan soon to expand regional investment so that venture investment concentrated in the metropolitan area can serve as a nutrient for revitalizing local economies."

He continued, "To prevent a contraction in venture investment and to continuously spread the second venture boom, the government plans to create venture funds exceeding 2 trillion KRW through a 1 trillion KRW contribution to the Korea Fund of Funds this year." The Ministry of SMEs and Startups announced the first regular contribution project for the Korea Fund of Funds worth 430 billion KRW in December last year and is currently in the selection process. Next month, a second regular contribution project worth 600 billion KRW will be announced to further support the creation of venture funds. Minister Kwon added, "Institutionally, we will also finalize measures such as introducing Silicon Valley-style hybrid financing and multiple voting rights to foster the birth of unicorn companies and expand investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.