Nasdaq Down 15.1% from Peak, KOSPI Down 14.5%, Bitcoin Halved

Platinum +9.7%, Palladium +16.9% Surge in One Month Amid Soaring Commodity Prices

[Asia Economy Reporter Park Ji-hwan] Palladium prices, considered one of the 'three major precious metals' alongside gold, continue to soar. As the bullish trend in major raw material prices such as gold is expected to persist, trading volumes of exchange-traded products that allow investment in related commodities are also surging.

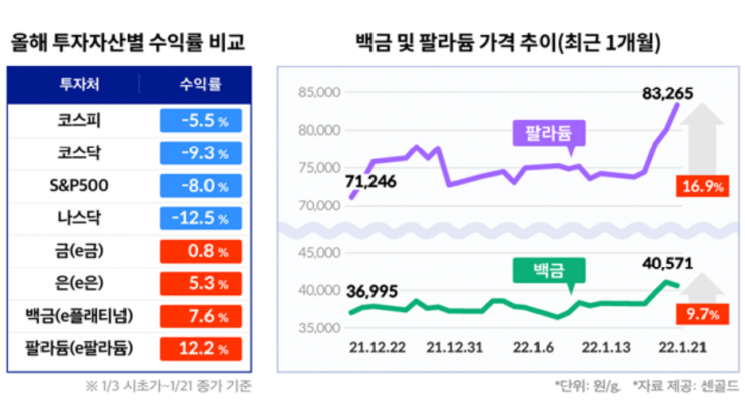

According to Sengold on the 27th, palladium prices have risen more than 12% this year alone, surpassing 80,000 KRW per gram. Sengold is a direct commodity investment service operated by Korea Gold Exchange Digital Asset. Currently, it allows investment in four assets (gold, silver, platinum, palladium). Sengold enables trading in units as small as one ten-thousandth of 10,000 grams. Above all, unlike other investment methods, it has the significant advantage of no tax burden on realized profits. It is also praised for allowing investments by charging various points or gift certificates such as OK Cashback, Hana Financial Group’s integrated points Hana Money, and Happy Money cultural gift certificates as if they were cash.

Kim Jong-in, CEO of Korea Gold Exchange Digital Asset, stated, "Last year, Sengold's transaction amount exceeded 100 billion KRW, increasing about 8.3 times compared to the previous year." He added, "In particular, the transaction amount in December last year increased 43 times compared to the same month the previous year, showing a sharp rise." He said, "As commodities are gaining attention as alternative investment destinations, the number of investors seeking Sengold is steadily increasing."

On the other hand, the stock market has not been able to avoid sluggishness this year. The Nasdaq, centered on technology stocks dominated by big tech companies, has fallen more than 12% this year alone. The S&P 500, known as a global blue-chip index, also dropped 8.0% this year. The domestic stock market also saw losses grow for investors, with the KOSPI down 5.5% and the KOSDAQ down 9.3% this year. Bitcoin, which was expected to surpass 100 million KRW at the end of last year, halved in two months and fell to 40 million KRW.

The overseas market is no different. On the 21st (local time), Netflix closed at $397.5 on the New York Stock Exchange (NYSE), down 21.79% from the previous day. This was due to its earnings announcement after the market closed on the 20th falling short of expectations, acting as bad news for investors. This week, earnings announcements from major companies such as Tesla, Intel, and Apple, as well as the regular meeting of the U.S. Federal Open Market Committee (FOMC), are scheduled, keeping investors on edge.

Experts cite the Federal Reserve's high-intensity tightening stance as the primary reason for the recent stock market sluggishness. In December last year, the Fed announced several interest rate hikes this year as well as quantitative tightening, signaling a strong policy shift to curb inflation. Emerging countries are also raising benchmark interest rates one by one to manage inflation and defend their exchange rates.

While countries worldwide are eager to withdraw liquidity from the market, commodity prices are not easing. With the global spread of eco-friendly policies, new investments by North American shale oil development companies have shrunk, causing international crude oil prices (WTI) to rise 12.5% this year alone. Russia’s suspension of natural gas supply to Europe has further fueled energy price surges. As the automobile market rides the eco-friendly wave, demand for various mineral resources is soaring, pushing related metal prices to new highs. China’s integration of rare earth companies to control the supply and export of rare metals, and Indonesia’s suspension of copper and bauxite exports following coal, are also intensifying the resource war, further driving up commodity prices.

CEO Kim said, "Last year, Sengold focused on quantitative growth by collaborating with various membership points held by customers," adding, "This year, we plan to pursue both quantitative and qualitative growth by diversifying partnerships, including linking with primary financial institutions and MyData services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.