Bid Rate 48.6% with More Than Half Unsold

DSR Regulations Applied This Year... Expect Stronger Wait-and-See Sentiment

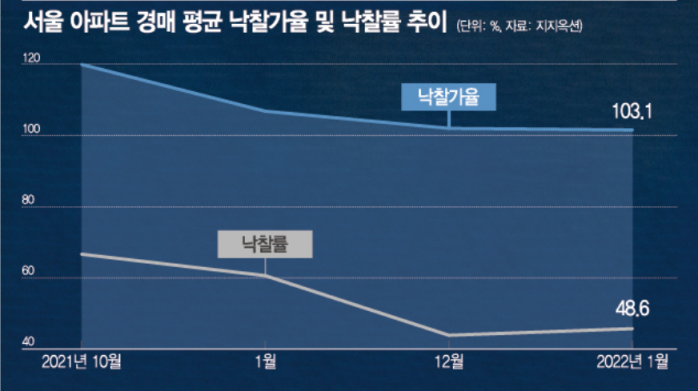

[Asia Economy Reporter Ryu Tae-min] The atmosphere in the court auction market is no longer what it used to be. This appears to be a phenomenon linked to the recent contraction in housing transactions. Auctions serve as a leading indicator of the real estate market. More than half of the apartment listings in Seoul fail to sell, and the winning bid rate has declined for three consecutive months. Since the introduction of the Debt Service Ratio (DSR) regulation earlier this year, this cautious trend is expected to strengthen further.

According to Gigi Auction, a specialized court auction company, the average winning bid rate for apartment auctions in Seoul this month was 103.1%. For example, this means an apartment with an appraised value of 100 million KRW was sold for 103.1 million KRW. This is 16.8 percentage points lower than the record high of 119.9% in October last year. The enthusiasm, which saw the winning bid rate exceed 110% for seven months from the first half of last year and broke records five times, has cooled since the end of last year.

The winning bid rate, which indicates the ratio of successful bids to total listings, also fell below 50%. The apartment winning bid rate in Seoul was 48.6% this month, meaning more than half of the properties failed to find buyers. The winning bid rate rose to 77.8% in August last year but has gradually declined since, reaching 46.9% in December. Gigi Auction explained that the decrease in participants in auctions led to the drop in the winning bid rate.

Polarization of Apartments in the Seoul Metropolitan Area Deepens... Seoul Prefers ‘Smart Single Property’, Gyeonggi Popular for ‘Under 600 Million KRW’

In the auction market, the polarization phenomenon regarding ‘smart single properties’ seems to be intensifying by region. High-priced apartments in Seoul exceeding 1.5 billion KRW are already subject to loan bans, so they are relatively less affected by loan regulation shocks. Investors aiming for low-priced purchases through auctions still appear to participate in bidding. For instance, in the auction of Daerim 153㎡ in Bangi-dong, Songpa-gu, six bidders participated, and the property was sold for 2.31779 billion KRW, which is 487 million KRW higher than the appraised value of 1.83 billion KRW.

On the other hand, in the Gyeonggi area, auctions for mid-to-low priced apartments under 600 million KRW are active. On the 11th, 39 bidders competed in the auction for Daewon Apartment 60㎡ in Wondong, Osan-si, Gyeonggi, and it was sold for 261.33 million KRW, which is 126.33 million KRW (93.6%) higher than the appraised value of 135 million KRW. On the 7th, 45 bidders participated in the auction for Singok Eunhasu 41㎡ in Singok-dong, Uijeongbu-si, and it found a new owner at 539.99 million KRW, which is 224.99 million KRW (71.4%) higher than the appraised value of 315 million KRW.

The winning bid rate for apartments in Gyeonggi this month was 102.8% as of this date, down 7.1 percentage points from the previous month. The winning bid ratio also fell to 54.6% (down 7.3 percentage points from the previous month), marking a decline for two consecutive months since November last year.

The contraction in the Seoul metropolitan area apartment court auction market is interpreted as a result of the government's comprehensive tightening of loan regulations. Lee Joo-hyun, a senior researcher at Gigi Auction, said, “Since loan regulations are equally applied to auction purchases, bidders seem to face increased financial burdens. Especially with interest rate hike forecasts and the upcoming presidential election next year, the cautious sentiment is growing.”

Lee added, “As negative outlooks on the real estate market increase, bidders are submitting conservative prices instead of bidding aggressively like last year. Most bidders appear to be cash-rich individuals targeting ‘smart single properties’ or actual residents aiming to purchase homes in complexes priced under 600 million KRW where loans are relatively easier to obtain.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)