Federation of Korean Industries Surveys Export Outlook for 6 Major Industries

[Asia Economy Reporter Park Sun-mi] This year, exports of automobiles and petroleum products are expected to increase due to rising demand, but steel and shipbuilding are anticipated to face difficulties in exports due to price declines and production disruptions.

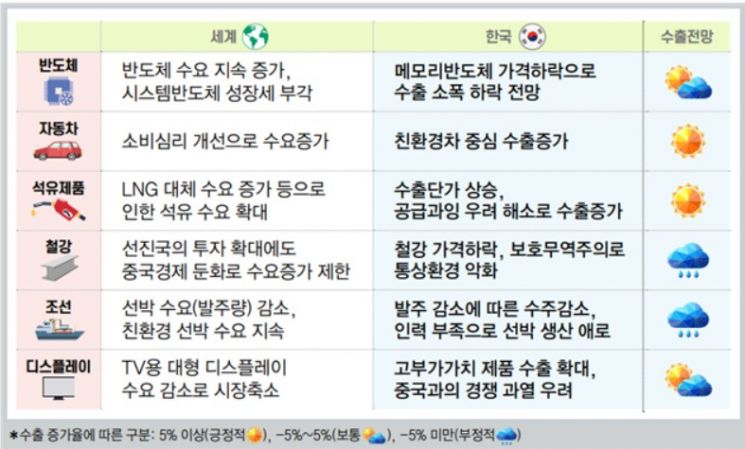

On the 27th, the Federation of Korean Industries (hereafter FKI) released the "2022 Major Industry Export Outlook," which surveyed six key industries including semiconductors, automobiles, petroleum products, steel, shipbuilding, and displays. According to the report, exports of automobiles and petroleum products are expected to be positive, while exports of shipbuilding and steel are projected to be negative.

Automobile exports this year are expected to increase by 6.2% from $46.5 billion last year. With economic recovery improving consumer sentiment and major countries implementing policies to expand the supply of eco-friendly vehicles in response to carbon neutrality, global demand for automobiles is expected to rise. Consequently, demand for Korean eco-friendly vehicles, which have high competitiveness, is also likely to increase, boosting Korea's automobile exports. However, the ongoing shortage of vehicle semiconductors and the rapid growth of Chinese completed vehicle manufacturers are cited as factors limiting the extent of export expansion.

Exports of petroleum products this year are forecasted to increase by 14.7% from $38.2 billion last year. The global economic recovery and the sharp rise in LNG prices are expected to increase demand for petroleum products as substitutes. With international oil prices rising, the export unit price of Korean petroleum products is also expected to increase.

Semiconductor exports this year are expected to decrease by 2.0% from $128 billion last year. Although semiconductor demand is increasing due to the continued non-face-to-face situation caused by the spread of the Omicron variant, the price of memory semiconductors (storage), Korea's main export item, is falling due to oversupply, which may cause semiconductor exports to slow somewhat.

Display exports this year are also projected to decrease by 1.4% from $21.4 billion last year. The demand for large displays is expected to decline as the TV demand that surged after COVID-19 decreases. Despite the shrinking market size, Korean companies are seeking new opportunities by expanding exports of high value-added products such as OLEDs, but with China expanding its OLED market share, display exports may remain at last year's level.

Steel exports this year are forecasted to decrease by 8.5% from $36.4 billion last year. Although advanced countries are expanding infrastructure investments through economic stimulus measures, the demand increase may be limited due to the slump in China's real estate market and economic growth slowdown. There is also a possibility that steel prices, which surged last year due to supply shortages, may decline. The worsening trade environment due to the expansion of protectionism by advanced countries such as the European Union (EU) is also a concerning factor.

Shipbuilding orders this year are estimated to decrease by 19.0% from $42 billion last year. The surge in global ship orders last year makes a decline in ship orders this year inevitable. Moreover, Korea's shipbuilding industry continues to face labor shortages due to factors such as the introduction of the 52-hour workweek, which may cause disruptions in ship production.

Yoo Hwan-ik, head of the FKI Industry Division, said, "Although a global economic recovery is expected this year, risk factors such as delays in global supply chain recovery and protectionism need to be managed," adding, "In particular, shipbuilding needs to enhance production capacity by supplementing labor, and steel requires cooperation with the government to respond to protectionism."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)