Both Office and Commercial Properties Decline Annually

Average Key Money 38 Million KRW... Utilization Rate 54%

The commercial real estate market, hit hard by COVID-19, showed slow recovery with rental price indices declining in the fourth quarter of last year.

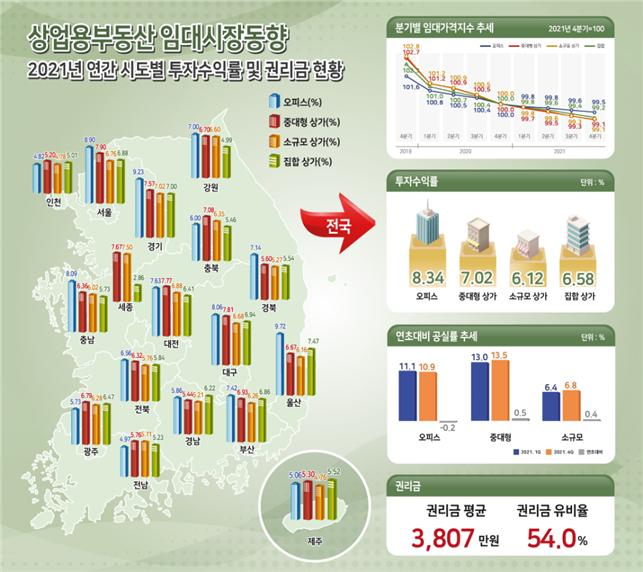

According to the Korea Real Estate Board's survey on the nationwide commercial real estate rental market trends for the fourth quarter, rental price indices and investment yields fell across offices and all types of retail spaces compared to the previous quarter, the board announced on the 26th.

Rental price indices decreased in offices and all retail types compared to the previous quarter, while vacancy rates increased in all retail types except offices.

The rental price index, which reflects market rent fluctuations, fell by 0.12% for offices, and by 0.21%, 0.22%, and 0.21% for medium-to-large, small-scale, and collective retail spaces respectively compared to the previous quarter.

The national average rent was 17,100 KRW/㎡ for offices (average for floors 3 and above), and for retail spaces (based on first floor), 26,900 KRW/㎡ for collective, 25,400 KRW/㎡ for medium-to-large, and 19,000 KRW/㎡ for small-scale retail.

Office investment yield was recorded at 2.11%, medium-to-large retail at 1.83%, small-scale retail at 1.56%, and collective retail at 1.66%.

The income yield, indicating rental profit, was 0.95% for offices, 0.86% for medium-to-large retail, 0.79% for small-scale retail, and 1.02% for collective retail.

The capital yield, reflecting asset value changes, was 1.16% for offices, 0.97% for medium-to-large retail, 0.77% for small-scale retail, and 0.64% for collective retail.

The national average vacancy rate was 10.9% for offices, 13.5% for medium-to-large retail, and 6.8% for small-scale retail.

Regionally, in Seoul, rental price indices declined across all retail types due to a surge in COVID-19 cases and stricter quarantine measures worsening the business environment.

In Sejong City, which experienced oversupply, rental prices were lowered mainly in collective retail spaces to resolve long-term vacancies, leading to declines in rental price indices across all retail types.

On an annual basis, the commercial real estate market remained sluggish.

Office rental price indices fell 0.49% year-on-year due to decreased demand for aging offices and increased rent-free periods, while retail spaces saw declines of 0.79% to 0.94% year-on-year due to reduced sales and increased rental listings.

Notably, Seoul experienced a significant drop in rental price indices for retail spaces directly affected by COVID-19. In Gyeonggi Province, social distancing measures persisted throughout the year, reducing tenant demand especially in multi-use facilities, causing rental price indices to fall across all retail types.

The annual investment yield for commercial real estate in 2021 ranged between 6% and 8%, generally outperforming other investment products such as bonds and fixed deposits.

In 2021, the nationwide premium rate and average premium level for retail spaces both declined compared to the previous year. The premium rate was 54.0%, down 1.4 percentage points from 55.4% the previous year.

The average premium level was 38.07 million KRW, a 6.5% decrease from 40.74 million KRW the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)