KEF Survey, February BSI Outlook Records 99.7

Manufacturing Slumps to 94.8... Impact of US Logistics Issues and China's Economic Uncertainty

[Asia Economy Reporter Lee Hye-young] As China's economic instability and the global supply chain crisis prolong, companies' economic outlook has worsened for two consecutive months. In particular, the outlook for electronics and telecommunications equipment turned negative for the first time in seven months due to the semiconductor sector's heavy dependence on exports to China.

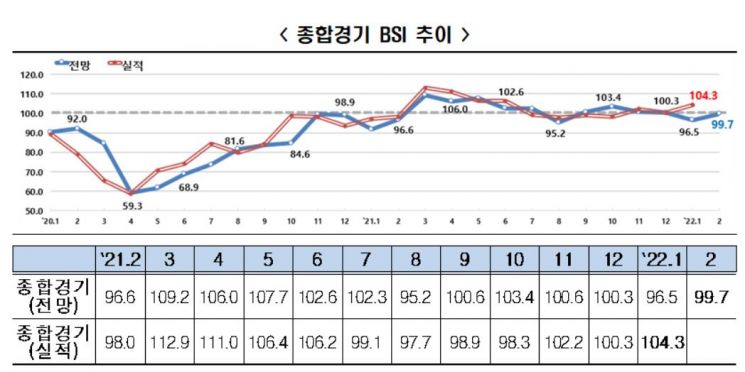

The Federation of Korean Industries (FKI) announced on the 26th that the Business Survey Index (BSI) outlook for February, conducted among the top 600 companies by sales, recorded 99.7.

A BSI above 100 indicates a positive economic outlook compared to the previous month, while below 100 indicates a negative outlook.

Due to ongoing concerns over China's economic slowdown, supply chain disruptions, and soaring international raw material prices, the index has remained below the baseline of 100 for two consecutive months this year. Although the February outlook rose compared to January (96.5), it still failed to surpass 100 amid uncertainties in the global economy.

By industry, economic outlooks diverged between manufacturing and non-manufacturing sectors. The manufacturing BSI for February was 94.8, showing weakness, whereas non-manufacturing recorded 105.7.

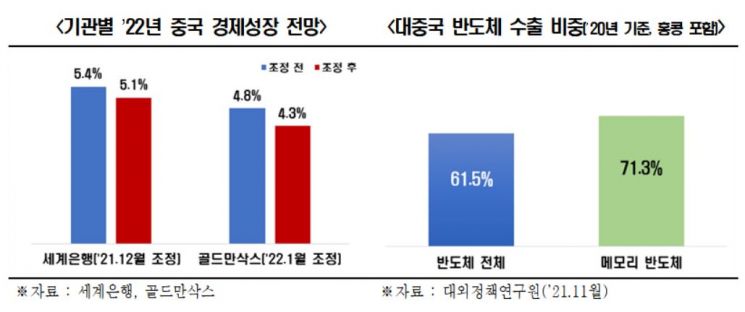

The FKI analyzed that the economic instability in China, a major trading partner, affected the manufacturing sector. Especially, due to the semiconductor industry's export dependence on China exceeding 60%, the outlook for electronics and telecommunications equipment (94.4) fell below the 100 mark for the first time since July last year. The BSI for electronics and telecommunications equipment had exceeded 100 for six consecutive months from August last year (121.7) through January this year but turned negative in this survey.

Earlier, the World Bank downgraded China's economic growth forecast for this year from 5.4% to 5.1%, and Goldman Sachs also lowered its forecast from 4.8% to 4.3%, reflecting market concerns about China's economy.

In the non-manufacturing sector, leisure, accommodation, and dining (85.7) performed poorly due to the spread of Omicron and other factors, but the retail and wholesale industry, including large supermarkets (114.6), significantly exceeded the baseline, raising the overall industry outlook.

The February BSI outlook by sector showed weakness in exports (97.7), financial conditions (94.3), profitability (94.3), and inventory (104.3). An inventory BSI above 100 indicates negative responses (excess inventory). Conversely, domestic demand (100.9), investment (102.3), and employment (102.0) were forecasted positively.

The FKI attributed the poor export outlook (97.7) to supply chain instability in China, Korea's second-largest export market, and logistics difficulties in the United States.

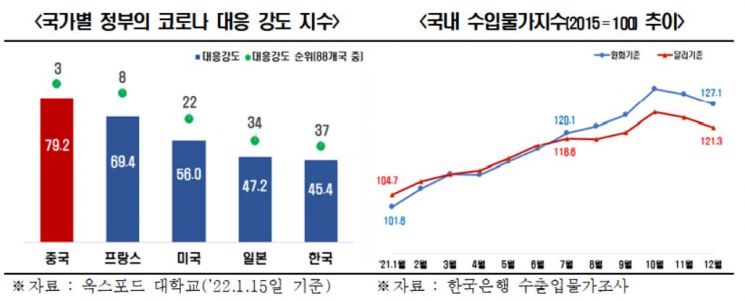

China, ahead of the Beijing Winter Olympics opening, has implemented stringent quarantine measures, causing companies to worry about possible port closures. In the United States, the second-largest export market, logistics issues persist, with sea container costs soaring.

According to the Korea Customs Service, as of December last year, sea freight rates to the U.S. West Coast increased 3.7 times and to the East Coast 3.6 times compared to the same month the previous year, indicating a significant rise in companies' cost burdens.

Regarding the negative outlooks for profitability and financial conditions (both 94.3), the FKI analyzed that companies are concerned about worsening profitability and financing conditions due to soaring raw material import prices and the January base interest rate hike this year.

Choo Kwang-ho, head of the FKI Economic Headquarters, said, "As international raw material prices continue to soar, supply chain disruptions and logistics difficulties are worsening the business environment for companies." He urged, "The government should strengthen support for stabilizing raw material supply, developing overseas resources, and logistics to help companies overcome these challenges."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)