Plan to impose 50,000~80,000 KRW per ton... Expected tax revenue of 32.5~52 trillion KRW, exceeding world's highest France

"OECD also analyzes significant carbon costs in Korea... Concerns over competitiveness damage in our manufacturing-heavy industry"

[Sejong=Asia Economy Reporter Kwon Haeyoung] If the carbon tax proposed as a pledge by Lee Jae-myung, the presidential candidate of the Democratic Party of Korea, becomes a reality, the annual tax burden on domestic companies is expected to reach up to five times that of France, which collects the highest carbon tax in the world. Given the high proportion of manufacturing industries in our economic structure, including high carbon-emitting sectors such as steel, petrochemicals, and cement, excessive imposition of carbon tax is raising concerns about damaging industrial competitiveness.

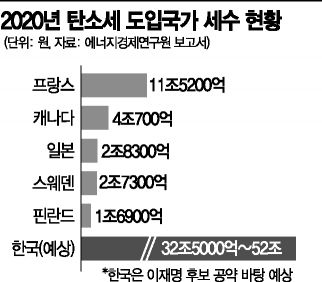

According to the report "Trends in Overseas Carbon Tax Operations and Implications for Carbon Pricing (Professor Lee Dong-gyu, Department of Economics, University of Seoul)" released by the Korea Energy Economics Institute on the 25th, France collected $9.632 billion (approximately 11.52 trillion KRW) in carbon tax in 2020, recording the highest tax revenue among the 28 countries that introduced carbon tax. Next were Canada ($3.407 billion), Japan ($2.365 billion), Sweden ($2.284 billion), and Finland ($1.42 billion).

The actual carbon tax revenue collected by these countries is significantly lower than the expected revenue from the carbon tax that candidate Lee plans to introduce. Lee intends to establish a carbon tax imposing 50,000 to 80,000 KRW per ton, using the revenue as a source for basic income. Based on the 2020 carbon emissions (650 million tons), this would generate a minimum of 32.5 trillion KRW and a maximum of 52 trillion KRW. This amount is about 3 to 5 times the carbon tax revenue of France, which has the largest carbon tax revenue worldwide. Moreover, most countries that have introduced carbon tax, including France, exclude participants in the Emissions Trading System (ETS) from taxation or provide tax rate reductions.

In particular, the carbon tax rate proposed by candidate Lee could severely impact our economy, which heavily depends on manufacturing. According to the OECD, manufacturing accounted for 27.5% of South Korea's Gross Domestic Product (GDP) in 2019. This is higher than the United States (10.9%), the United Kingdom (8.7%), Italy (14.9%), as well as manufacturing powerhouses Germany (19.1%) and Japan (20.7%). The carbon tax rates announced by candidate Lee also exceed those of most countries that have introduced carbon tax. The minimum rate of 50,000 KRW per ton proposed by Lee far surpasses rates in the UK ($25), Spain ($18), the Netherlands ($35), Canada ($32), Japan ($3), Singapore ($4), and Indonesia ($2.1).

The industry is concerned that if the carbon tax is added on top of the current domestic emissions trading market, which is already worth about 1 trillion KRW, the excessive burden could lead to reduced investment, job losses, and inflation, negatively affecting the overall economy. According to an OECD survey, in 2018, 49% of domestic carbon emissions were subject to prices of 60 euros or more per ton. This ranked 10th among 44 countries, indicating a relatively high level. Notably, the increase from 2015 to 2018 was the largest among the 44 countries. The OECD also estimated that the domestic transport sector, which was not subject to the emissions trading system at the time, had 93% of its total carbon emissions taxed at 120 euros or more per ton due to other energy taxes such as environmental costs.

Professor Lee Dong-gyu said, "OECD survey results show that countries with high carbon intensity apply lower effective tax rates to reduce the burden on industries. South Korea has a high contribution of carbon-intensive industries to the national economy and pays a high level of carbon prices relative to GDP through the emissions trading system, so the carbon tax rate should be determined restrictively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)