Record-Low Deal Volume

Buying Sentiment Sharply Weakens Due to Total Loan Regulations and Interest Rate Hikes

The number of districts in Seoul where the average apartment sale price exceeds 50 million KRW per 3.3㎡ has more than doubled in one year. As of November last year, only Gangnam-gu, Seocho-gu, and Songpa-gu among the 25 districts in Seoul had average apartment sale prices exceeding 50 million KRW per 3.3㎡, but last month, Yongsan-gu, Seongdong-gu, Mapo-gu, and Gwangjin-gu were added, making a total of seven districts. The photo shows the view of Seoul apartments from 63 Square. Photo by Hyunmin Kim kimhyun81@

The number of districts in Seoul where the average apartment sale price exceeds 50 million KRW per 3.3㎡ has more than doubled in one year. As of November last year, only Gangnam-gu, Seocho-gu, and Songpa-gu among the 25 districts in Seoul had average apartment sale prices exceeding 50 million KRW per 3.3㎡, but last month, Yongsan-gu, Seongdong-gu, Mapo-gu, and Gwangjin-gu were added, making a total of seven districts. The photo shows the view of Seoul apartments from 63 Square. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporters Kim Hyemin and Kim Dongpyo] The housing sales market is experiencing an extreme drought in transactions. Except for urgent sales, transactions have virtually disappeared. This is due to the combined effects of loan regulations, interest rate hikes, and the presidential election, which have strengthened the sentiment of "let's wait and see."

◆ Out of 1,000 real estate properties, only 5 to 6 are traded... The decrease is even greater outside the metropolitan area = According to the Court Registry Information Plaza on the 24th, the turnover rate of collective buildings such as apartments, row houses, and officetels in December last year was 0.56%, marking the lowest point in three years. This means that only 5 to 6 out of 1,000 collective buildings were traded.

This figure has been declining steadily since it peaked at 0.83% in March last year. Compared to a year ago, the turnover rate also dropped significantly from 0.95% (December 2020).

The turnover rate is calculated by dividing the number of real estate properties with completed registrations where the purpose is ownership transfer and the cause is sale, by the total number of real estate properties with valid registrations as of the end of each month. It indicates the level of activity in the real estate sales market; a lower turnover rate means fewer transactions relative to the total number of properties. A turnover rate of 0.56% means that 5.6 out of 1,000 collective buildings were traded.

Even on an annual average basis, last year was a record-breaking transaction cliff. The average turnover rate from January to December 2021 was 0.69%. Since statistics began in 2010, only 2010 (0.65%), 2012 (0.57%), and 2013 (0.65%) had lower annual average turnover rates than last year.

The decrease in turnover rate last year was observed across both the metropolitan area and provinces, but the decline was more pronounced in the provinces. In Seoul, it dropped from 0.67% in December 2020 to 0.42% last year, a decrease of 0.25 percentage points, and in Gyeonggi Province, from 0.94% to 0.55%, a 0.39 percentage point drop. In contrast, Daegu saw a sharp decline from 1.09% to 0.35%, a 0.74 percentage point decrease. Busan also fell significantly from 1.25% to 0.56%, and Gwangju from 1.11% to 0.46%.

◆ Only 1 apartment transaction in Yongsan-gu in January... The transaction market remains 'frozen' in the new year = Apartment transaction volumes continue to freeze rapidly in the new year.

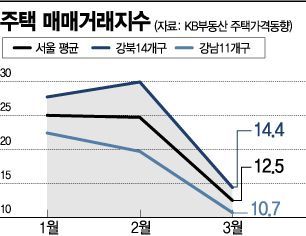

The transaction slump is also confirmed by the housing sales transaction index. According to KB Kookmin Bank Liv Real Estate, the nationwide housing sales transaction index dropped to 3.2 in January this year. This is the lowest since the related statistics began in 2003. The index gauges transaction activity based on surveys of about 4,000 licensed real estate agents nationwide, and no respondents reported "active transactions" this month.

Especially, Seoul's sales transaction index was recorded at 1.5. This is the first time the figure has fallen into the 1-point range since April 2019 (1.5).

Apartment transaction volumes in Seoul have further frozen since the new year. According to the Seoul Real Estate Information Plaza, only 283 transactions have been recorded so far. Considering the reporting period (within one month after the transaction), the prevailing view is that this will not even reach the lowest transaction volume of 1,163 in November 2018.

Among the 25 autonomous districts, 17 have recorded single-digit transaction volumes so far. Yongsan-gu had only one transaction. This was for an 84.77㎡ unit in Gangchon Apartment, Ichon-dong, which was traded at 2.1 billion KRW, down 100 million KRW from 2.2 billion KRW at the end of July last year, marking a price drop within six months.

The Korea Real Estate Agency's sales supply-demand index, which shows the balance between demand and supply, has also been below the baseline every week this year. As of the 17th, Seoul's apartment sales supply-demand index was 91.2, and a figure below 100 means supply exceeds demand.

Recently, amid price stagnation, this transaction cliff phenomenon is being pointed out as forcibly leading to price stability. According to Real Estate R114, as of last week, Gwangjin, Yongsan, and Jongno had no transactions, and their price change rates converged to 0%.

Yoon Jihae, chief researcher at Real Estate R114, said, "Although the recent rise rate has been in the 0% range, this is a phenomenon caused by the disappearance of transactions, so it is difficult to say the market has stabilized. A healthy market direction is to maintain a certain level of transactions with low price volatility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)