The used car market is rapidly growing. The global semiconductor shortage that has continued since the second half of last year has caused delays in new car deliveries, leading to an increase in used car prices and sales volume. According to market research firm Frost & Sullivan, the domestic used car market size grew from 32 trillion won in 2015 to 39 trillion won in 2020. It is projected to reach 50 trillion won by 2025. With Hyundai Motor and Kia preparing to enter this market, which was once dominated by small and medium-sized enterprises, competition is expected to intensify. Asia Economy analyzed the current status and future growth potential of SK Rent-a-Car, which is showing a steep growth trend in the used car business, and K Car, a newly listed company strong in online business.

[Asia Economy Reporter Yoo Hyun-seok] K Car is achieving performance improvements. Amid structural changes in the used car market such as the activation of e-commerce trading, it is fully benefiting from its overwhelming online market share.

K Car started as SK Encar, the used car brand of SK Group. In April 2018, private equity firm Hahn & Company acquired SK Encar’s direct used car business division, and after absorbing Joy Rent-a-Car early last year, it changed its name to K Car. Based on a direct-operated used car (CPO) business model that manages the entire process from purchasing, inspection, management, sales, to after-sales responsibility, it has built an integrated online and offline platform.

The business is divided into the used car business division, which mainly deals with used car sales based on how customers receive products and services, and the rent-a-car business division, which mainly operates short- and long-term car rentals. Furthermore, the used car business division is categorized into retail and auction businesses according to distribution methods and channels.

K Car has advantages such as △the largest inventory of certified used cars in Korea with about 10,000 units △the largest offline network in Korea with over 40 locations nationwide △an online platform available 24 hours a day △pricing and inventory management systems condensed from over 20 years of big data △and differentiated purchasing competitiveness. Among these, the greatest strength is its overwhelming market share in the online market. According to market research firm Frost & Sullivan, K Car’s total used car market share by value was only about 3.42% in 2020, but its online share reached 78.95%. In particular, among major domestic corporate used car dealers conducting e-commerce sales, it accounts for 81% by sales volume.

According to NH Investment & Securities and K Car, the online transaction ratio in the used car market was only 1-2% as of 2020. Issues such as non-standardization, product complexity, and high prices existed. However, K Car targeted the online market by introducing the ‘direct-operated certified used car’ model, which increased trust and customer satisfaction. Based on this, the online channel’s share by sales volume rose sharply from 9.3% in 2016 to 35.0% in 2020, and 47% as of the third quarter of last year.

Joo Young-hoon, a researcher at NH Investment & Securities, said, “Since consumer distrust of the used car market is deep, a highly trustworthy brand image is necessary to sell online. K Car solves this by handling everything from purchasing to inspection and sales through its direct purchase business model.”

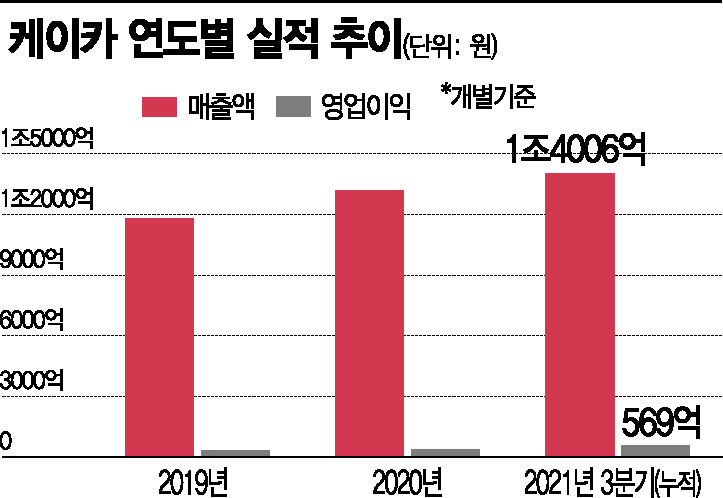

Based on its high online market share, its performance has also shown a growth trend every year. Its revenue and operating profit, which were 742.8 billion won and 10.7 billion won in 2018, respectively, reached 1.1854 trillion won and 29.2 billion won in 2019. In 2020, it recorded 1.3231 trillion won in revenue and 37 billion won in operating profit.

It also showed good performance last year. As of the third quarter cumulative basis last year, it achieved revenue of 1.4006 trillion won and operating profit of 56.9 billion won. Compared to the same period the previous year, revenue increased by 42.05% and operating profit by 88.78%. The biggest reason for the performance improvement is attributed to the growing used car market. Domestic demand for used cars surged due to delays in new car deliveries. Additionally, the increase in the proportion of highly profitable e-commerce sales led to improved performance.

The rise in used car prices also contributed to profitability improvement. According to K Car’s third quarter report last year, the retail price of used cars was 12.7 million won in 2019 but rose to 14.8 million won as of the third quarter cumulative last year. During the same period, auction prices also jumped from 4.12 million won to 4.61 million won.

The outlook is also bright. There is sufficient growth potential based on the high online market share. According to FnGuide, securities firms’ forecasts for K Car’s revenue and operating profit last year were 1.8651 trillion won and 74.1 billion won, respectively. This year, revenue is expected to reach 2.2747 trillion won and operating profit 86.9 billion won, representing increases of 21.96% and 30.72% year-on-year, respectively.

Jeong So-yeon, a researcher at Kyobo Securities, said, “The online used car market is expected to grow rapidly. The online penetration rate of used cars is only 1-2%, which is lower than that of food (21%), a representative low-penetration category. Attention should be paid to the timing when low-penetration categories shift online and the growth potential of category killer platforms.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.