[Asia Economy Reporter Ji Yeon-jin] #Kim, a wage earner, needed medical care for three months due to illness. Looking for assets that could be liquidated, Kim recalled his Individual Retirement Pension (IRP) and pension savings accounts and is now considering which to withdraw from early.

To get straight to the point, withdrawing early from the pension savings account saves more on taxes.

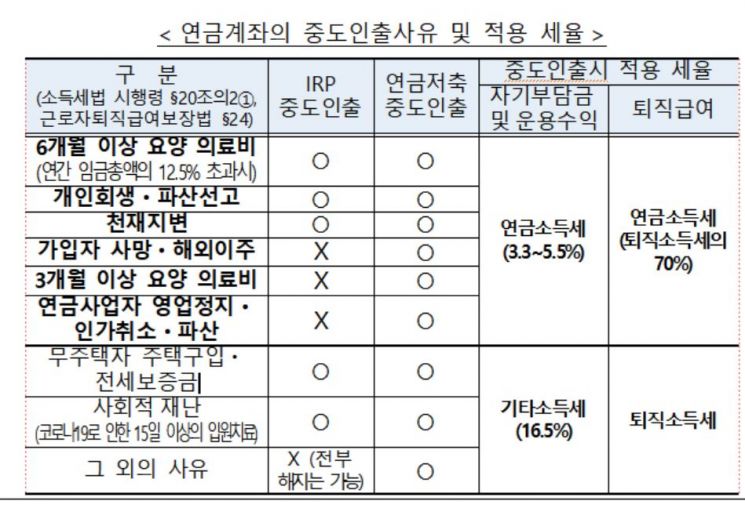

According to the 125th financial tip released by the Financial Supervisory Service on the 24th regarding tax-saving methods when making early withdrawals from IRP and pension savings, IRP allows early withdrawal only under limited circumstances defined by law, whereas pension savings can be withdrawn early without restrictions.

Generally, when withdrawing early from a pension account, other income tax (16.5%) is imposed on the principal amount that received tax deductions and the investment gains, but ‘unavoidable withdrawals’ as defined by the Income Tax Act are subject to a lower pension income tax rate (3.3~5.5%).

However, IRP withdrawal conditions are more strictly limited under the Employee Retirement Benefit Security Act than under tax law. For medical care expenses, early withdrawal is allowed only if the care lasts more than six months and the annual total salary is at least 12.5%. However, if there is no earned income at the time of IRP withdrawal, total salary cannot be calculated, so withdrawal is possible if the six-month care condition is met. Additionally, IRP early withdrawal is allowed for personal rehabilitation or bankruptcy, natural disasters or social disasters (including hospitalization for more than 15 days due to COVID-19), and for funds to purchase or rent a home for those without housing.

Early withdrawal due to natural disasters such as heavy rain, typhoons, floods, earthquakes, or tsunamis is allowed for both pension savings and IRP, with a low pension income tax rate (3.3~5.5%) applied to the withdrawn amount. If the withdrawn amount is retirement benefits, 70% of the retirement income tax is imposed as pension income tax.

In Kim’s case, early withdrawal is not possible due to only three months of medical care, but full surrender is possible. However, full surrender will incur other income tax (16.5%) or retirement income tax.

A Financial Supervisory Service official stated, "If early withdrawal is unavoidable while maintaining the pension, first check whether it qualifies as an ‘unavoidable withdrawal’ under the Income Tax Act, and for IRP, additionally verify the withdrawal reasons stipulated in the Employee Retirement Benefit Security Act," emphasizing that "unlike pension savings which can be withdrawn freely, IRP prohibits early withdrawal except for reasons defined by law, so IRP subscribers need to additionally confirm whether their withdrawal reason falls under those specified in the Employee Retirement Benefit Security Act."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)