Proposal from the Banking Sector for Financial Industry Innovation and Expanding Opportunities for National Wealth Growth

[Asia Economy Reporter Park Sun-mi] As the presidential candidates from both ruling and opposition parties flood with populist pledges to ease the financial burden on the public, the banking sector has once again found itself in a precarious position. The banking sector, deeply shaken by being swayed by financial authorities and political circles, has delivered a proposal to the presidential candidates' camps requesting the guarantee of autonomous management.

According to the financial sector on the 24th, the Korea Federation of Banks delivered a document titled "Banking Sector Proposals for Financial Industry Innovation and Expansion of National Asset Growth Opportunities" containing requests from the banking sector to the presidential candidates' camps at the end of last month. The document includes four goals and measures for the development of the financial industry: ▲realizing data-driven future-oriented finance ▲creating asset growth opportunities responding to increased asset management demand among middle-aged and older generations due to aging and the investment boom among the MZ generation (Millennials + Generation Z) ▲revitalizing regional finance ▲establishing a management environment based on innovation, autonomy, and responsibility.

The Korea Federation of Banks explained, "This contains complaints and improvement points frequently discussed within the banking industry, which were delivered to the presidential campaigns," adding, "It has a declarative meaning reflecting the voice of the banking sector." It has been confirmed that no feedback has been received yet regarding the proposal. Among the four goals and measures proposed by the banking sector this time, establishing a management environment based on autonomy and responsibility is a "staple menu" that the banking sector has emphasized every presidential election. This can be interpreted as a direct expression of the banking sector's dissatisfaction with being swayed by political circles.

A banking sector official also lamented about this proposal, saying, "It is already commonly recognized in many areas that financial companies are losing competitiveness due to pressure from the government and political circles," and added, "Although they voice their concerns to political circles whenever issues arise, there is no improvement, and the content is filled with similar points every time."

As concerns over loan defaults by self-employed individuals grew due to the prolonged COVID-19 pandemic, the banking sector had to endure four rounds of COVID-19 maturity extensions and repayment deferrals. Furthermore, shareholder return policies could not be freely implemented. The financial authorities publicly recommended limiting the dividend payout ratio of bank holding companies and banks to within 20% of net income for 2020, stating, "Banks must strengthen their loss absorption capacity in preparation for potential shocks from COVID-19-related defaults," and banks had to accept disadvantages if they did not comply.

Following successive private equity fund scandals such as Lime and Discovery, and the enforcement of the Financial Consumer Protection Act, financial sanctions against banks as financial product sellers have been strengthened, but the services provided by financial authorities to prevent financial accidents are insufficient, leaving banks to bear full responsibility. A banking sector official said, "The proposal presented to the political circles also includes content about strengthening the role of financial authorities," and added, "Banks pay supervisory fees to the Financial Supervisory Service, but they feel that the authorities' services for preventing financial accidents are insufficient."

In particular, since the banking sector achieved record-high profits even during last year's COVID-19 crisis, it is expected that political circles will more strongly demand sacrifices from financial companies this year to ease the public's financial burden. The card industry is already preparing countermeasures against the decrease in merchant fee income, their main business, due to the reduction of merchant card fee rates implemented ahead of the presidential election.

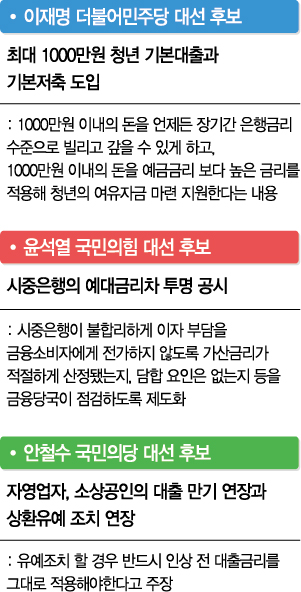

The financial-related pledges of the presidential candidates from the two major parties contain more content about the inevitable sacrifices of financial companies than about the development of the financial industry. For example, Lee Jae-myung, the Democratic Party candidate, proposed the Youth Basic Loan, which allows borrowing and repaying up to 10 million won at bank interest rates anytime for a long period, and the introduction of the Youth Basic Savings with higher interest rates than general deposits to maximize youth asset growth opportunities. Yoon Seok-youl, the People Power Party candidate, also pledged to ease consumer financial burdens by transparently disclosing the interest rate spread between deposits and loans of commercial banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.