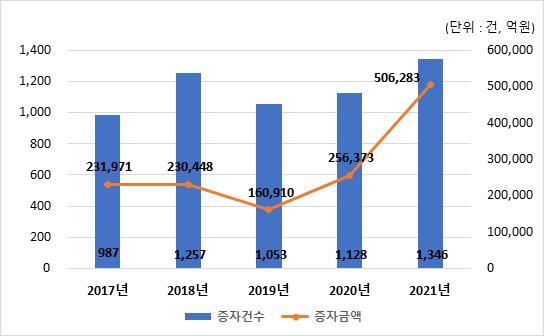

[Asia Economy Reporter Lee Seon-ae] Last year, the total number of paid-in capital increase issuances was 1,346 cases, amounting to 50.6283 trillion KRW. Compared to the previous year (1,128 cases, 25.6373 trillion KRW), the number of cases increased by 19.3%, and the amount increased by 97.5%.

According to the Korea Securities Depository on the 24th, last year in the securities market, paid-in capital increases were issued 125 times, totaling 30.5719 trillion KRW. Compared to the previous year, the number of cases increased by 13.6%, and the amount increased by 130.8%. In the KOSDAQ market, 423 cases were issued, amounting to 9.6814 trillion KRW. Compared to the previous year, the number of cases increased by 8.7%, and the amount increased by 50.5%. In the KONEX market, 58 cases were issued, totaling 401.8 billion KRW. The number of cases decreased by 4.9% compared to the previous year, but the amount increased by 119.1%. In the unlisted (K-OTC, registered and designated for deposit) market, 740 cases were issued, totaling 9.9732 trillion KRW. Compared to the previous year, the number of cases increased by 30.3%, and the amount increased by 72.8%.

Last year, the number of paid-in capital increase cases and amounts by allocation method were ▲public offering method 153 cases, 18.5032 trillion KRW (36.5%) ▲rights offering method 128 cases, 16.3583 trillion KRW (32.3%) ▲third-party allotment method 1,065 cases, 15.7668 trillion KRW (31.1%), in that order.

The company with the largest amount of paid-in capital increase was Korean Air (3.3159 trillion KRW). Krafton (2.8007 trillion KRW), KakaoBank (2.5525 trillion KRW), and KakaoPay (1.5300 trillion KRW) followed. The companies with the largest number of paid-in capital increase shares were Fantagio (256.65 million shares), Samsung Heavy Industries (250 million shares), and Heung-A Shipping (213 million shares), in that order.

Looking at the top companies by the number of paid-in capital increase cases, Curatis, FXGear, and Astron Security (10 cases), MyChef and Shift Information & Communications (8 cases), among others, had many third-party allotment increases by designated deposit corporations.

Last year, the total number of bonus issue issuances was 252 cases, totaling 1.85645 billion shares. Compared to the previous year (165 cases, 971.58 million shares), the number of cases increased by 52.7%, and the number of shares increased by 91.1%. In the securities market, 33 cases were issued, totaling 250.51 million shares. Compared to the previous year, the number of cases increased by 83.3%, and the number of shares increased by 38.8%. In the KOSDAQ market, 108 cases were issued, totaling 1.31027 billion shares. Compared to the previous year, the number of cases increased by 116.0%, and the number of shares increased by 133.1%. In the KONEX market, 4 cases were issued, totaling 15.68 million shares. The number of cases remained the same as the previous year, but the number of shares decreased by 13.9%. In the unlisted market, 107 cases were issued, totaling 279.99 million shares. Compared to the previous year, the number of cases increased by 15.1%, and the number of shares increased by 32.9%.

Among last year's bonus issue resources, capital surplus from stock issuance accounted for 246 cases, representing 97.6% of all target companies. The company with the largest amount of bonus issue was HL Biopharma (2.0208 trillion KRW). Seegene (1.9572 trillion KRW) and Wemade (1.5552 trillion KRW) followed. The company with the largest number of bonus issue shares was Airut (96.23 million shares). Yanolja (82.5 million shares) and Sewon ENC (71.46 million shares) followed.

Looking at the top companies by bonus issue allocation ratio, TakeOne Company (191 times), Valet & Model (19 times), Yanolja, Everspin, and Cheongdam Global (9 times) mainly conducted high multiple bonus issues using capital surplus from stock issuance in registered and designated deposit corporations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)