[Asia Economy Reporter Park Byung-hee] The Nasdaq index on the New York Stock Exchange entered a correction phase on the 20th (local time). A correction phase refers to a decline of more than 10% from the previous peak.

According to the online economic media MarketWatch, this is the 66th correction phase since the Nasdaq index was first calculated in 1971. Among the previous 65 correction phases, the Nasdaq entered a bear market 24 times. This means the probability of entering a bear market is 37%. A bear market refers to a decline of more than 20% from the previous peak.

However, cases where the Nasdaq index fell to a bear market were concentrated in the early stages, and recently, entering a correction phase has increasingly become an opportunity for buying at a low point.

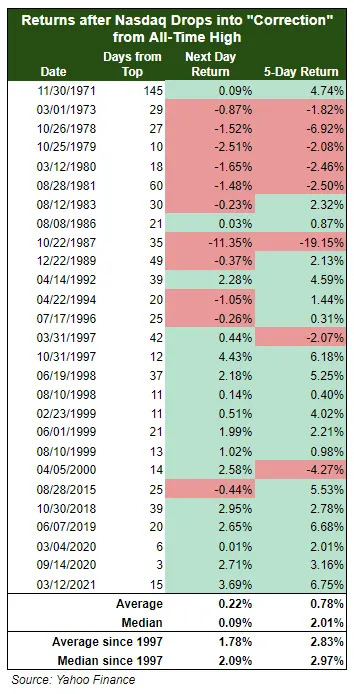

Yahoo Finance reported that since 1997, the Nasdaq index has entered a correction phase 14 times, and the stock price rose by an average of 2.83% over the following five days.

After the dot-com bubble burst in 2000, the Nasdaq index did not surpass the all-time high recorded during the dot-com era until 2015. Yahoo Finance explained that the correction phase could also be defined based on the 52-week high instead of the all-time high, in which case there were 22 correction phases since 1997. Furthermore, even in this case, the average return over five days after entering a correction phase was 2.54%.

However, concerns are growing as the Nasdaq index fell an additional 1.89% on the 21st, the day after entering the correction phase this time. Recently, the Nasdaq index has often rebounded strongly in trading on the day following the entry into a correction phase.

According to Yahoo Finance, based on the all-time high, the Nasdaq index rose the day after entering a correction phase 13 times out of 14 since 1997, while it fell only once. That single decline was only 0.44%. The average return of the Nasdaq index the day after entering a correction phase 14 times was a high 1.78%. Even based on the 52-week high, there were only three cases of continued decline after entering a correction phase 22 times.

With growing doubts about whether entering a correction phase will be an opportunity to buy at a low point, major big-tech companies dominating the top market capitalization rankings will release their earnings this week.

Apple, ranked first in market capitalization, will announce its Q4 earnings after the New York Stock Exchange closes on the 26th. FactSet Research expects a net profit of $31.16 billion and revenue of $118.74 billion, both record highs for a quarter.

Microsoft (MS) will release its earnings on the 25th. FactSet Research expects MS’s quarterly revenue to exceed $50 billion for the first time ever, with a record net profit of $17.41 billion.

Tesla is expected to report $16.99 billion in revenue and a record net profit of $2.33 billion. Tesla will announce its earnings on the 26th. IBM and Intel will also release their quarterly earnings on the 24th and 26th, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)