[Asia Economy Reporter Park Jihwan] Hana Financial Investment evaluated on the 23rd that China’s Pyeonjahuang Pharmaceutical is a steadily growing luxury health supplement company, with expectations for improved profitability and an upward trend in stock price.

The flagship product, Pyeonjahuang, is a luxury health supplement in China sold at a high price per 3g tablet. Due to the rarity of the raw materials, the price has been raised 16 times since 2015. The recommended retail price is 590 yuan (approximately 120,000 KRW), but the final consumer price once rose to 3,000 yuan (approximately 560,000 KRW) in June last year.

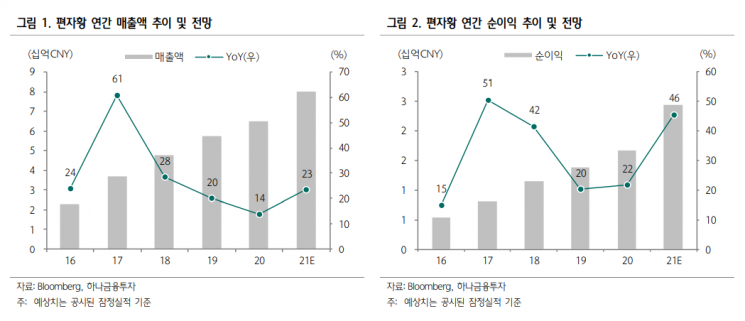

Zhangzhou Pyeonjahuang Pharmaceutical opened online direct stores on platforms such as Tmall and JD.com to stabilize price and supply. In the third quarter of last year, Pyeonjahuang’s net profit was 890 million yuan (approximately 167.2 billion KRW), a 93% increase compared to the same period the previous year. Last year’s operating profit margin and net profit margin are expected to improve by 9.1 percentage points and 6.4 percentage points respectively compared to 2020.

Researcher Baek Seunghye of Hana Financial Investment said, “Although Pyeonjahuang’s stock price experienced three major corrections last year, it generally maintained an upward trend,” adding, “This is judged to be a valuation adjustment due to a short-term rapid price increase rather than a fundamental problem.”

Researcher Baek also said, “Pyeonjahuang holds a unique brand position in the Chinese traditional medicine market and has a stable profit-generating ability of over 20% annually,” and “This year, a favorable stock price trend is expected along with the recovery of the Chinese consumer market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.