[Asia Economy Reporter Oh Hyung-gil] It is pointed out that insurance companies should establish value-based management focused on mid- to long-term growth and risk management due to the introduction of the new International Financial Reporting Standard (IFRS17) and the new solvency regime (K-ICS) scheduled for next year.

On the 23rd, Jo Young-hyun, a research fellow at the Korea Insurance Research Institute, stated in the report titled "Environmental Changes to Watch in the Insurance Industry in 2022, Introduction of New Accounting Standards and Enhancement of Insurance Industry Value," "From 2023, when the new insurance accounting standards are implemented, accounting information will reveal the actual performance and risks of insurance companies."

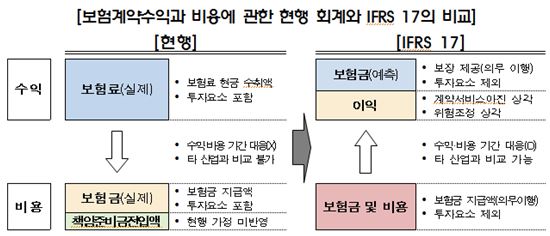

Researcher Jo pointed out, "The current insurance accounting does not properly reflect the economic substance of insurance companies, making it difficult for external stakeholders to understand the actual performance or risks of insurance companies, and there has been an incentive for insurance companies to pursue excessive risks rather than enhancing value based on mid- to long-term performance."

The new insurance accounting provides information reflecting the economic substance of insurance companies by measuring liabilities at fair value and recognizing revenue and expenses on an accrual basis over the entire insurance period.

Researcher Jo explained, "IFRS17 shows the insurance company's expected future profits in the form of the Contractual Service Margin (CSM), allowing stakeholders to concretely grasp the value of the insurance company," and "K-ICS measures various risks compared to the current RBC system, and some risks are evaluated in a more sophisticated manner, thus more accurately assessing the risks held by insurance companies."

He continued, "Since insurance companies create value through risk management, to enhance value, it is necessary to measure performance reflecting actual risks (risk-adjusted performance), plan and execute various strategies company-wide based on this, and transparently disclose these management activities and performance."

He added that insurance companies need to manage risk-adjusted performance separately by product, and products with low risk-adjusted performance should improve the overall process from product design to sales and contract maintenance.

He emphasized, "Financial authorities need to strengthen the disclosure system so that useful information regarding the value of insurance companies can be provided, thereby establishing market discipline and incentivizing the enhancement of the entire industry's value," and "It is necessary to support the efficiency and value enhancement of the insurance industry by organizing systems and infrastructure for business adjustment of insurance companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)