Government Funding Linked to Support SMEs and Small Business Owners Totaling 790.8 Billion KRW

340.8 Billion KRW for SME Policies · 450 Billion KRW for Small Business Management Stabilization

[Asia Economy Yeongnam Reporting Headquarters Reporter Kim Yong-woo] Busan City has decided to release nearly 800 billion KRW in policy funds for small and medium-sized enterprises (SMEs) and small business owners ahead of the Lunar New Year holiday.

On the 23rd, Busan City announced that it will support a total of 790.8 billion KRW, including 340.8 billion KRW in SME policy funds and 450 billion KRW in small business management stabilization funds, to alleviate financial difficulties faced by local SMEs and small business owners.

The SME policy funds include 300 billion KRW in working capital, 40 billion KRW in facility funds for factory purchases, and 800 million KRW in startup special funds. Applications can be made through 14 commercial banks.

Working capital loans have a limit of 400 million KRW per company with interest rate subsidies of 1~1.5%. Facility funds have a limit of 1.5 billion KRW per company with a fixed interest rate of 3.3% and interest subsidies of 0.8~1.1%.

Among the funds, 10 billion KRW will be loaned at a fixed interest rate of 1.9% with a limit of 1.5 billion KRW per loan. Startup special funds can be borrowed up to 100 million KRW at a fixed interest rate of 1.5%.

Additionally, as a preemptive measure to mitigate the impact of the Bank of Korea's base rate hike, the loan maturity of 141.5 billion KRW in working capital loans for 633 SMEs maturing in the first half of this year will be extended by six months, and an additional interest subsidy of 1.0~1.5% will be provided during the extension period.

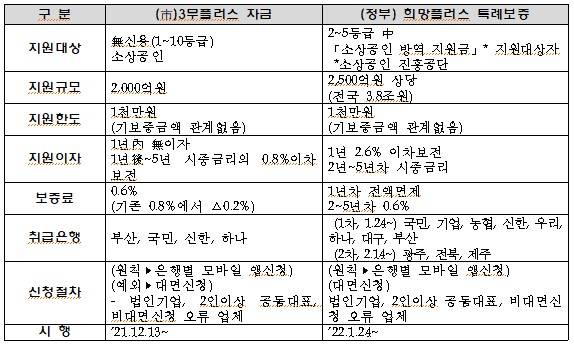

The small business management stabilization funds will be supported in a total amount of 450 billion KRW, linked with government funds, including 250 billion KRW for the ‘Hope Loan Plus Special Guarantee’ and 200 billion KRW for the ‘Small Business 3-No Plus Special Fund’.

The Hope Loan Plus Special Guarantee targets medium- and low-credit borrowers (grades 2~5) among companies that received the government’s ‘Small Business Quarantine Support Fund,’ offering loans up to 10 million KRW with a fixed interest rate of 1% and no guarantee fee (0.8%) for one year after the loan.

After one year, market interest rates will apply, and the guarantee fee will be 0.6%, with a 0.2% reduction.

The ‘Small Business 3-No Plus Special Fund,’ implemented in December last year, will also continue to offer one year of interest-free loans and a guarantee fee of 0.6% without change.

Applications for the Hope Loan Plus Special Guarantee and Small Business 3-No Plus Special Fund are possible regardless of loan limits based on personal credit, provided there are no delinquencies or defaults on other loans. Medium- and low-credit borrowers (grades 2~5) can apply for both funds.

Park Hyung-jun, Mayor of Busan, said, “With the prolonged COVID-19 pandemic worsening the business environment and the recent base rate hike causing liquidity crises, we hope this support will help stabilize management and alleviate financial difficulties ahead of the Lunar New Year holiday.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.