Public Servant Pension Loans Join Open Run

Financial Sector Loan Barriers Seemingly Still High

Over 13,000 People Rushed In on Initial Opening Day, 14th

[Asia Economy Reporter Jin-ho Kim] The government employee pension loan has officially joined the so-called ‘open run’ phenomenon, where the loan limit is exhausted immediately upon release. This surge in demand is attributed to tighter household loan regulations such as the strengthened Debt Service Ratio (DSR) starting this year, driving borrowers to seek ‘circumvention loans’ that are free from these restrictions. The fact that qualified loans, a low-interest policy mortgage product, also sold out immediately after resuming sales indicates that the ‘loan cliff’ crisis, where borrowing money has become difficult, is spreading comprehensively from the beginning of the year.

According to the financial sector on the 22nd, the loan limit for government employee pension loans was completely exhausted on the first day of application in the first quarter of this year. This is analyzed as a result of the rapid surge in loan demand continuing from the fourth quarter of last year.

First, on the 17th, the first quarter limit for ‘general loans and housing fund loans’ was reportedly exhausted in less than 10 minutes. The total amount was about 80 billion KRW. Then, on the 18th, the ‘social policy loans’ targeted at newlyweds and others were also fully exhausted by the morning of the same day. The first quarter limit for ‘social policy loans’ was about 120 billion KRW.

Originally, sales of government employee pension loans for the first quarter of this year began on the 14th. However, as more than 13,000 people rushed in immediately upon opening, the server crashed and sales were temporarily suspended. Sales resumed over two days starting from the 17th, depending on the loan type. One government employee hoping to get a loan said, “Since the second half of last year, government employee pension loans have been so popular that the limit is exhausted within about 10 minutes of opening. To get a loan, thorough preparation beforehand and even multiple attempts are necessary.”

The government employee pension loan is a product secured by the pension that a government employee will receive after retirement. General loans for government employees needing extra funds offer up to 20 million KRW, and loans up to 70 million KRW are available when purchasing or selling a home under 85㎡ in the name of the borrower or spouse. Social policy loans for newlyweds, families with three children, or for children’s marriage have a limit of up to 30 million KRW.

Demand for government employee pension loans has exploded since last year. Especially popular among government employees who need funds for home ownership or investment, this is because these loans are exempt from strong household loan regulations such as the DSR. From this year, loans from banks or secondary financial institutions are subject to borrower-level DSR regulations, significantly reducing loan limits compared to last year.

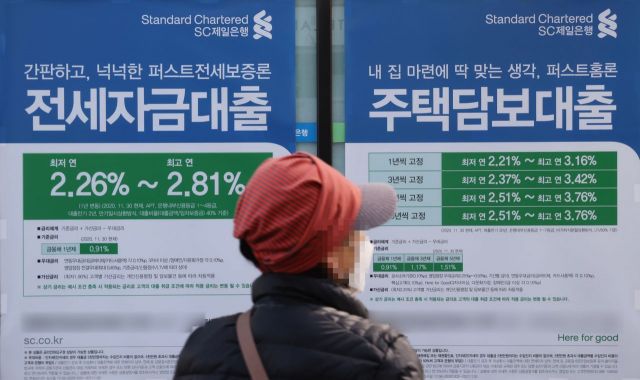

Since the end of last year, rising loan interest rates in the financial sector have drawn more attention to these loans. The interest rate for government employee pension loans is based on the household loan interest rate announced by the Bank of Korea. For the first quarter of this year, the interest rate for general loans and housing fund loans is 3.46%, and for social policy loans, it is 2.46%. Considering that most bank loan interest rates currently range from 4% to 6%, the interest rate advantage is clear.

Meanwhile, the so-called ‘loan cliff’ phenomenon continues to become more evident in various places this year as well. Qualified loans, a low-interest policy mortgage product, sold out their first quarter or one-month limits within a day of release, mainly at major banks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.