[Asia Economy Reporter Ji Yeon-jin] Netflix's first-quarter net subscriber additions came in at 2.5 million, far below market expectations, leading to forecasts of a short-term decline in its stock price.

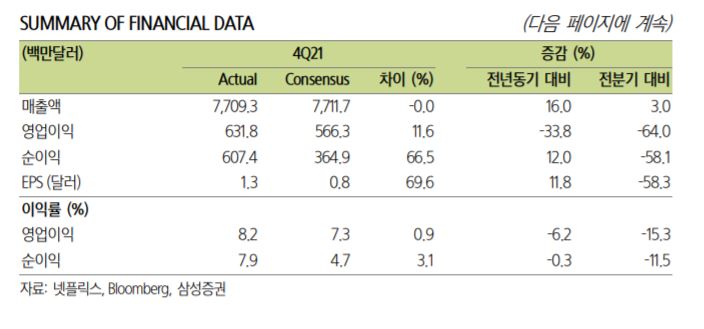

According to Samsung Securities on the 22nd, Netflix's fourth-quarter revenue last year increased by 16% year-on-year to $7.71 billion, and operating profit rose by 33.8% to $630 million. These figures were in line with market expectations.

However, the key indicator determining Netflix's stock price direction?the number of subscribers?fell short of expectations. The net subscriber additions in the fourth quarter of last year were 8.28 million, below the guidance of 8.5 million and the lowered consensus of 8.3 million (Bloomberg). Although the quarter started strong with the record-breaking hit 'Ojingeo Geim' (Squid Game), subscriber growth slowed before the year-end releases of 'Emily in Paris Season 2,' 'The Witcher Season 2,' and 'Don't Look Up.'

The market forecast for Netflix's first-quarter net subscriber additions was 7.25 million. However, Netflix presented a much lower figure of 2.5 million. The delayed global economic recovery and the fact that anticipated titles like 'The Adam Project' and 'Bridgerton Season 2' are scheduled for release at the end of the quarter are cited as reasons for the low subscriber growth forecast.

At the end of last year, Netflix raised subscription fees for the first time in five years since entering the Korean market. Recently, it announced a 10% subscription fee increase in the United States and Canada. This marks the third price hike in three years following increases in 2019 and 2020. Minha Choi, a researcher at Samsung Securities, explained, "Netflix's price increase reflects confidence in its content library and user loyalty, leading the market to believe that subscription cancellations due to the price hike will not be significant. It also shows that competition among OTT providers such as Disney+, HBO Max, and Apple TV+ is intensifying, prompting Netflix to raise subscription fees to increase investment in content production."

Researcher Choi forecasted, "Given the pandemic-related benefits in 2020 and 2021 and the emergence of record-breaking hits highlighting content competitiveness, Netflix has shown excellent performance. Therefore, the somewhat disappointing guidance is likely to cause the stock price to weaken in the short term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)