Real Estate R114, Apartment Price Trends in the Seoul Metropolitan Area

[Asia Economy Reporter Kim Hyemin] Since the beginning of the year, tightened financial regulations and interest rate hikes have made obtaining loans more difficult, causing buying sentiment to freeze. The low season due to the upcoming Lunar New Year holiday and the regulatory relaxation pledges of presidential candidates are further shrinking transaction volumes. As uncertainty grows and transaction volumes shrink as a reaction, it is expected that the apartment sale prices in the Seoul metropolitan area will remain stable with limited movement.

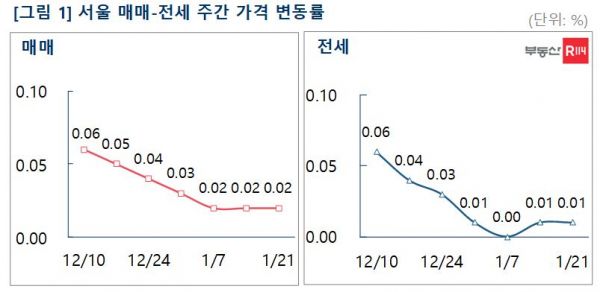

According to Real Estate R114 on the 22nd, the apartment price change rate in Seoul this week rose by 0.02% compared to the previous week. This is the same increase rate for three consecutive weeks. Reconstruction apartments rose by 0.06%, while general apartments increased by 0.01%.

Among the 25 autonomous districts in Seoul, 12 showed increases, 12 remained stable, and only one district, Eunpyeong-gu (-0.01%), declined. By region, the order of increase was ▲Geumcheon (0.1%) ▲Seodaemun (0.07%) ▲Mapo (0.05%) ▲Seocho (0.05%) ▲Dongdaemun (0.04%).

New towns recorded 0% stability for two consecutive weeks. While ▲Jungdong (0.01%) and ▲Dongtan (0.01%) showed slight increases, ▲Pyeongchon (-0.03%), ▲Ilsan (-0.01%), and ▲Bundang (-0.01%) declined.

Gyeonggi and Incheon rose by 0.01% compared to the previous week. The order of increase was ▲Icheon (0.07%) ▲Goyang (0.06%) ▲Gimpo (0.05%), but ▲Seongnam (-0.05%), ▲Yangju (-0.01%), and ▲Guri (-0.01%) fell.

The Seoul jeonse (long-term deposit lease) market rose by 0.01% compared to the previous week. Due to price burdens and seasonal low demand, rising and falling areas are evenly matched. By region, ▲Gangseo (0.1%), ▲Jungnang (0.06%), ▲Yeongdeungpo (0.05%), and ▲Gwangjin (0.04%) increased, while ▲Dongjak (-0.11%), ▲Yangcheon (-0.08%), and ▲Geumcheon (-0.05%) showed significant declines.

New towns and Gyeonggi·Incheon rose by 0.01% and 0.02%, respectively, compared to the previous week.

Yoon Jihae, chief researcher at Real Estate R114, said, "The current government's trend of tightening regulations and the next government's presidential candidates' pledges to ease regulations are mixed, causing confusion among both sellers and buyers." She added, "As both sides postpone the possibility of losses from premature decisions, the market remains in a transaction lull." She further forecasted, "With the spread of COVID-19, the seasonal low demand, and the Lunar New Year holiday just a week away, the stable level of price changes due to a sharp drop in transaction volume is expected to continue for some time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.