Customized Pledges for Voters Including Childcare and Animal Rights

[Asia Economy Reporter Park Jun-yi] Yoon Seok-yeol, the People Power Party’s presidential candidate, has proposed a pledge to reduce income tax burdens for salaried workers by raising the basic personal deduction amount in year-end tax adjustments from 1.5 million won to 2 million won. On the same day, Yoon also unveiled ‘customized living pledges’ targeting various voters, including those concerned with child-rearing and animal rights.

On the 20th, Yoon held a press conference at the central party office in Yeouido, Seoul, where he announced three consecutive pledges: reforming the ‘year-end tax adjustment method’ for salaried workers, introducing a ‘standardized fee system for pet medical treatment,’ and the concept of ‘integrated early childhood education and care (ECEC).’

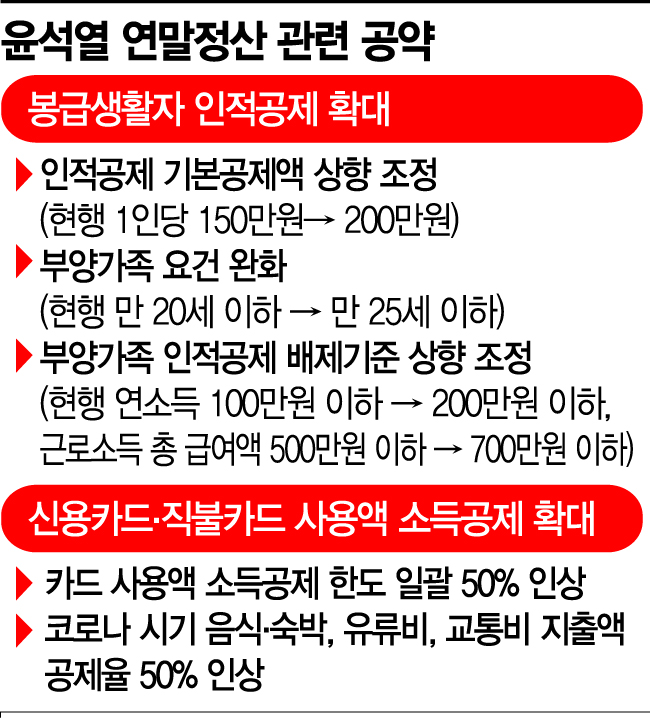

According to the pledge to ease income tax burdens, the basic personal deduction amount per individual will be raised from the current 1.5 million won to 2 million won. This adjustment takes into account that the basic deduction amount has not been increased since 2009 and reflects inflation trends. Reflecting the reality that young people are starting economic activities at increasingly later ages, the eligibility age for dependent family members will be raised from under 20 years old to under 25 years old. The exclusion criteria for dependents with income will also be raised from an annual income of 1 million won or less to 2 million won or less, and the standard for earned income total salary will be relaxed to 7 million won or less. Yoon promised, “A single-income household with one university student child earning an annual salary of 60 million won will receive about 500,000 won more in tax refunds than now,” adding, “We will reduce salaried workers’ income tax burden by more than 3 trillion won annually.”

Income deductions for credit card and debit card usage will also be expanded. During the COVID-19 period, the deduction rates for expenses such as food and lodging, fuel, and transportation will be temporarily doubled to reduce tax burdens by about 45 billion won annually. This aims to compensate for COVID-19 damages and stimulate consumption. Specifically, credit card deduction rates will increase from 15% to 30%, check card and cash receipt rates from 30% to 60%, and traditional markets and public transportation from 40% to 80%. The overall income deduction limit for card usage will also be roughly doubled. Yoon explained that this will reduce tax burdens by about 70 billion won annually. Regarding concerns about fiscal impact, he responded, “It is difficult to increase spending immediately, but there is no big problem with collecting less.”

Yoon Chang-hyun, deputy director of the People Power Party’s policy headquarters who participated in policy planning, explained, “This is an acknowledgment of the damages caused by COVID-19 to salaried workers, often called ‘hard wallets,’ during the COVID-19 phase.” The intention is now to also target the votes of 20 million salaried workers.

On the same day, Yoon introduced child-rearing support measures following the ‘parental salary’ pledge. Through the ‘national responsibility system for childcare and early childhood education for ages 0 to 5,’ he promised to “ensure a fair starting line from infancy after birth.” The plan includes providing free eco-friendly meals three times a day for young children at a monthly cost of 60,000 won (50,000 won for infants) and improving childcare quality by reducing the teacher-to-child ratio in infant classes. Additionally, to establish an integrated service system for daycare centers and kindergartens, a task force for integrated early childhood education and care will be formed to implement ‘gradual integration.’

Yoon also presented a pledge targeting 15 million pet owners. To reduce the burden of pet medical expenses, he proposed introducing a ‘standardized fee system for pet medical treatment’ and establishing systems such as standardizing treatment items and disclosing costs by item. He also promised to create legal and institutional foundations to develop related service industries such as pet supplies, grooming cafes, hotels, and funerals. The pet protection system will be improved through expanding pet protection facilities and strengthening crackdowns on illegal breeders and distributors. Alongside this, sanctions against pet owners who violate safety obligations, such as preventing dog bite accidents, will be strengthened.

On the same day, Yoon attended a ‘Virtual Asset Conference’ held at a hotel in Jung-gu, Seoul, where he repeatedly emphasized protection measures for virtual asset investors and support policies for the industry. He highlighted the establishment of a ‘Digital Industry Promotion Agency (tentative name)’ to serve as a control tower for digital industries such as coins and non-fungible tokens (NFTs), and the transition to a negative regulation system, stating, “We must pool wisdom so that unicorn companies can emerge from virtual asset-related businesses.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.