Past 6 Nuclear Tests Impacted Stock Market

1% Drop Recovered Within About a Week

"However, Current Downtrend Is Concerning... May Amplify When Combined with Other Negative Factors"

[Asia Economy Reporter Minwoo Lee] North Korea hints at resuming nuclear tests... Concerns over synergistic effects with other negative factors rather than standalone impact

North Korea is raising tensions in the market by indicating it will consider resuming nuclear tests and intercontinental ballistic missile (ICBM) launches ahead of the UN Security Council meeting. Although the immediate shock to the market is not expected to be significant, given the sensitivity of the current bearish market to negative news, there are concerns that the impact could expand in conjunction with future interest rate hikes and supply-demand volatility following the LG Energy Solution IPO.

On the 20th, the Korean Central News Agency reported that the Workers' Party Central Committee held the 6th Political Bureau meeting of the 8th term, attended by General Secretary Kim Jong-un, where they discussed countermeasures against the U.S. This suggested the possibility of resuming nuclear tests and ICBM launches, which had been suspended since 2018.

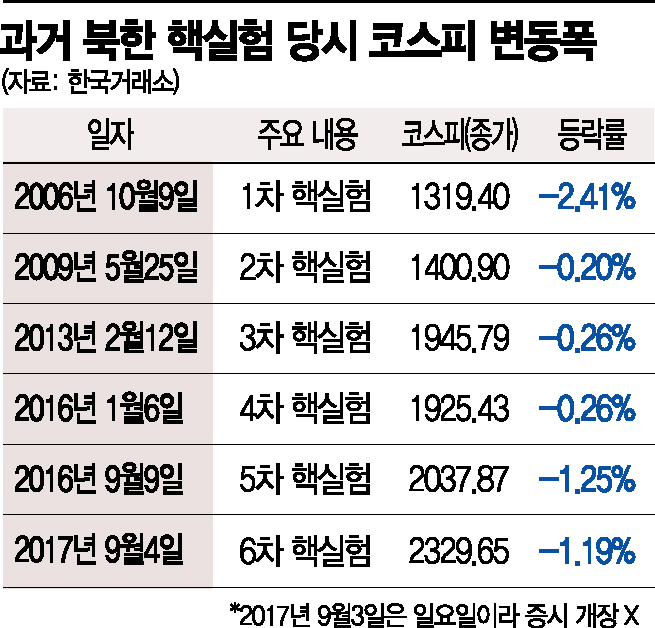

This has raised concerns that the already declining stock market could face additional pressure. Historically, on the day of six previous North Korean nuclear tests, the KOSPI index fell each time. During the first nuclear test on October 9, 2006, the KOSPI plunged 2.41%. However, it rose 0.3% a week later compared to before the test.

The impact was minimal during the 2nd to 4th nuclear tests. The KOSPI dropped only 0.20% on May 25, 2009, during the 2nd test. It fell 0.26% each during the 3rd (February 12, 2013) and 4th (January 6, 2016) tests. This suggests a learning effect that nuclear tests have limited influence on the stock market and real economy. Although the 5th and 6th tests saw declines exceeding 1%, the market mostly recovered to pre-test levels within about a week.

This is why the recent announcement of resuming nuclear tests is also expected to have limited impact. However, since most domestic and international markets are currently in a downtrend, the market's sensitivity to negative news could cause compounded shocks when combined with other variables. This year, the U.S. Federal Reserve's aggressive tightening measures and domestic interest rate hikes have caused the KOSPI to fall about 10.5% from the beginning of the year through the previous day. The U.S. Nasdaq index, a global market leader, has also continued its decline, dropping approximately 11% about two months after reaching its peak on November 22 last year.

Park Kwang-nam, a researcher at Mirae Asset Securities, explained, "Since North Korea's announcement targets the U.S., we need to watch the U.S. response closely and pay attention to North Korea's actual actions. Investment sentiment is currently poor, and the market is sensitive to negative news. Additionally, geopolitical issues in the Middle East and Russia add to the complexity, so if problems arise, it will not have a positive effect on the market." Lee Jae-sun, a researcher at Hana Financial Investment, analyzed, "Considering that the immediate KOSPI drop is not large, the direct impact of the nuclear test itself is limited. However, if concerns over interest rates and supply-demand burdens following the LG Energy Solution IPO overlap, it could stimulate downward pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)