1st Union Faces KCTU... Stock Prices Plummet and Widespread Disruptions in the Automotive Industry if Strike Occurs

[Asia Economy Reporter Ki-min Lee] For the first time since its founding in 1962, the number of union members in the Korean Metal Workers' Union (KMWU) branch at Hankook Tire has surpassed that of the Korean Rubber Workers' Union under the Federation of Korean Trade Unions (FKTU), which was previously the largest union. With the KMWU, known for its strong stance, taking the forefront, conflicts between labor and management as well as inter-union disputes are expected to intensify. This is likely to negatively impact Hankook Tire's performance and stock price, raising concerns about shareholder losses.

According to Hankook Tire on the 19th, the KMWU branch at Hankook Tire, under the Korean Confederation of Trade Unions (KCTU), demanded wage and collective bargaining negotiations for 2022, stating that their union membership stands at 2,500. If this number is accurate, the FKTU-affiliated Rubber Workers' Union, which had about 4,000 members, has decreased to around 2,100, making it likely to lose its status as the largest union. An industry insider said, "With more union members on the KCTU side, it seems that the KMWU will become the representative union at Hankook Tire," adding, "Considering the KCTU's strong stance, there are concerns about increased strike intensity and labor-management conflicts."

◆Strong Union's Obstruction Risk Inevitably Hurts Performance= Amid ongoing raw material price increases, the emergence of a strong union is highly likely to negatively affect this year's performance. Hankook Tire is already facing a very challenging business environment. Prices for key raw materials such as natural rubber, synthetic rubber, and carbon black feedstock have surged sharply. In the second quarter of last year, when the world was hit hard by COVID-19, prices per ton were $1,107 for natural rubber, $974 for synthetic rubber, and $184 for carbon black feedstock. By the third quarter of last year, these had risen to $1,659, $2,037, and $481 respectively.

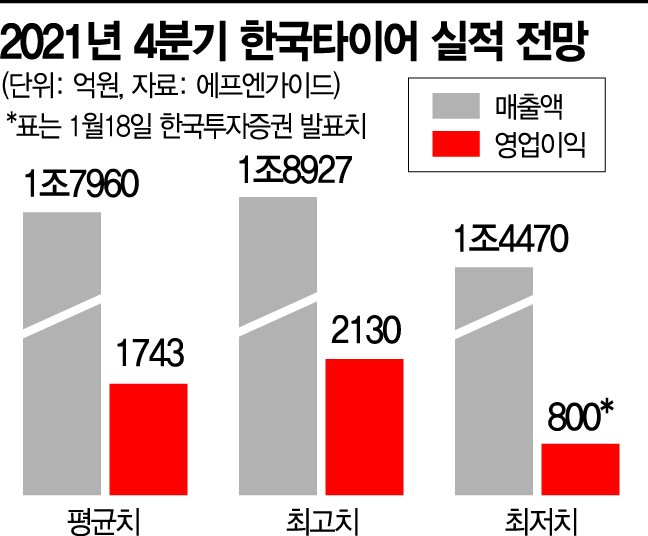

Meanwhile, the KCTU side, dissatisfied with the wage and collective bargaining agreement process last year, has refused to accept the company's proposals and is preparing for a strike. According to financial information provider FnGuide, securities firms forecast that Hankook Tire's operating profit for the fourth quarter of last year will drop 23.35% to 174.3 billion KRW compared to 227.6 billion KRW in the fourth quarter of 2020. The lowest forecasted operating profit for the fourth quarter by securities firms is 80 billion KRW, about one-third of the previous year.

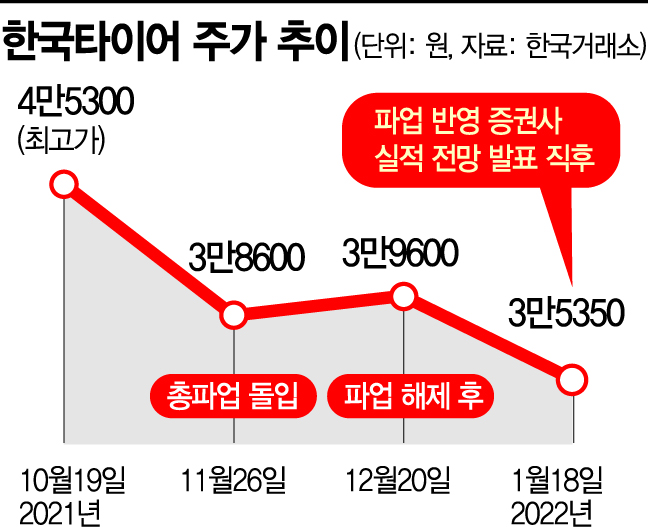

◆Sharp Stock Price Drop Causes Significant Shareholder Losses= If the strong union gains dominance at Hankook Tire, shareholders are also expected to suffer losses. Hankook Tire's stock price hit a peak of 45,300 KRW on October 19 last year but plunged to 38,600 KRW on November 26 when the union launched a general strike. The stock price has shown no signs of recovery even after the strike ended.

Following the release of securities firms' earnings reports reflecting the damage caused by the strike the previous day, the stock price fell further to 35,350 KRW. Korea Investment & Securities reported that the Daejeon and Geumsan plants, which account for about 40% of Hankook Tire's total production, conducted a full strike for 26 days starting November 26 last year. This caused disruptions to about one-third of domestic factory shipments, estimated to have impacted 12% of fourth-quarter sales.

An industry insider commented, "If another strike occurs at Hankook Tire, the business situation will worsen compared to the fourth quarter of last year, causing further damage to shareholders," adding, "Moreover, since Hankook Tire, which accounts for 35% of domestic demand, halted operations during the last strike, it disrupted tire supply to automobile manufacturers, so the strike inevitably affects car companies as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.