On the First Day, 2.3 Million Applications Received, Overall Competition Ratio Exceeds 20 to 1... Mirae Asset, Hana, KB, Shinhan in Order

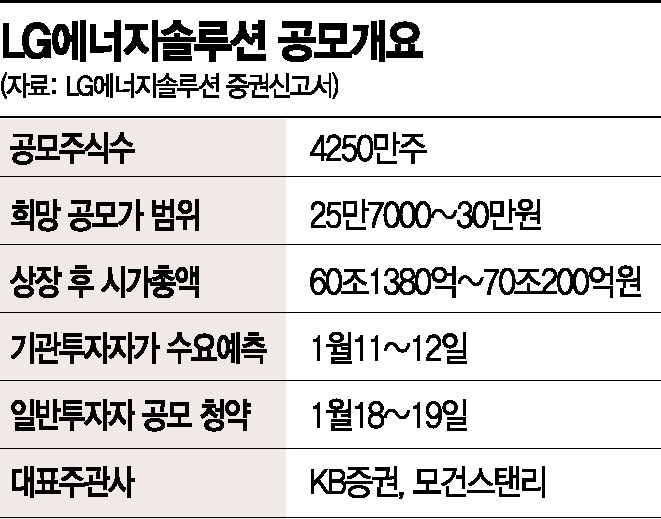

[Asia Economy Reporter Lee Seon-ae] LG Energy Solution has set a new milestone in its initial public offering (IPO). On the first day of the general subscription, the subscription deposit exceeded 32 trillion won, marking an all-time high.

According to the financial investment industry on the 18th, as a result of the general subscription received on the day by KB Securities, the lead underwriter of LG Energy Solution's listing, and seven securities firms including joint underwriters Shinhan Investment Corp. and Daishin Securities, the subscription deposit was tallied at 32.6467 trillion won as of the 4 p.m. closing.

This amount surpasses the subscription deposit of 22.1594 trillion won recorded on the first day of subscription by SKIET (81 trillion won), which currently holds the top spot for subscription deposits.

Considering that subscription deposits usually increase on the last day, LG Energy Solution is highly likely to break the record for the largest subscription deposit for public offering stocks.

On the first day of subscription, KB Securities, the lead underwriter, gathered the largest deposit of 18.4398 trillion won. This was followed by Shinhan Investment Corp. with 5.7978 trillion won, Daishin Securities with 3.0654 trillion won, Mirae Asset Securities with 3.1831 trillion won, Hana Financial Investment with 949.3 billion won, Shinyoung Securities with 380.4 billion won, and Hi Investment & Securities with 290.9 billion won.

The number of accounts participating in the subscription was 2,375,301, surpassing the KakaoBank subscription count (approximately 1.86 million), which had the highest number of subscriptions since duplicate subscriptions were prohibited, all on the first day.

The integrated competition rate based on the number of subscription shares was calculated at 20.48 to 1.

By securities firm, the competition rates were highest at Mirae Asset Securities (95.87 to 1), followed by Hana Financial Investment (28.59 to 1), KB Securities (25.24 to 1), Shinhan Investment Corp. (15.87 to 1), Shinyoung Securities (11.46 to 1), Daishin Securities (9.87 to 1), and Hi Investment & Securities (8.76 to 1).

The expected equal allocation quantity was highest at Hi Investment & Securities (4.44 shares), followed by Daishin Securities (4.16 shares), Shinyoung Securities (3.96 shares), Shinhan Investment Corp. (2.97 shares), Hana Financial Investment (2.19 shares), and KB Securities (1.87 shares).

Due to the small volume and large number of accounts, the expected equal allocation quantity available at Mirae Asset Securities dropped below one share to 0.41 shares.

Since public offering subscriptions usually concentrate on the last day, the strategic observation of competition rates by securities firms is expected to continue until the closing on the 18th. LG Energy Solution will complete subscriptions by the 19th and list on the KOSPI market on the 27th of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)