'Presentation on Recent Analysis of Won Depreciation Causes'

[Asia Economy Reporter Jang Sehee] At the beginning of the new year, the won-dollar exchange rate surpassed 1,200 won, deepening the won's depreciation, which was found to be higher than that of other currencies. The main causes were identified as rising commodity prices, high dependence on China, and capital outflows from Seohak Ants' investments.

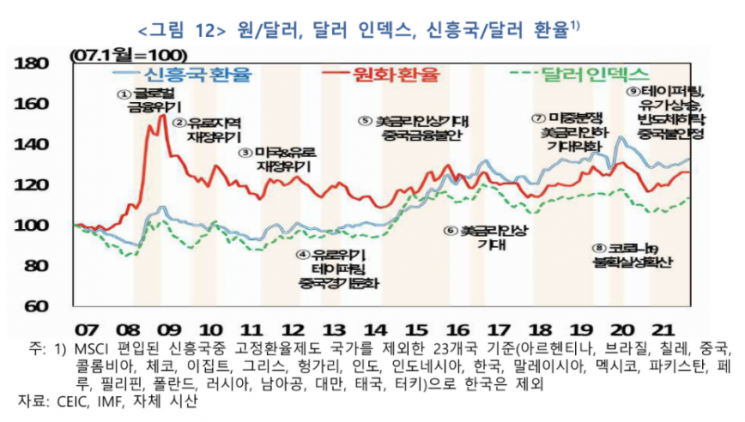

According to the Bank of Korea's report "Analysis of Recent Causes of Won Depreciation" released on the 18th, since last year, the won has depreciated not only against the US dollar but also against the dollar index and major emerging market currencies. The Bank of Korea cited international commodity prices, dependence on the Chinese economy, and portfolio investments as the causes.

Last year, the won-dollar exchange rate increased by 8.2%, higher than the dollar index (6.3%) and emerging market exchange rates against the dollar (2.7%).

Also, compared to past periods when the US tapering expectations and Chinese economic slowdown acted as major factors for dollar strength (December 2012 to July 2013), the won's depreciation expansion (3.6% → 8.2%) was greater than that of the dollar index (2.6% → 6.3%) and emerging market currencies (0.1% → 2.7%).

First, due to the economic characteristic of high dependence on overseas commodities, the Bank of Korea explained that concerns about rising international commodity prices causing deterioration in trade terms and current account deficits, which could deliver a greater shock to the Korean economy, were reflected in the exchange rate.

Moreover, because of the economy's high dependence on China, the possibility of default by Chinese real estate developer Evergrande Group since mid-last year raised concerns about a slowdown in China's real economy, leading to a larger drop in the won's value.

It was evaluated that countries with higher dependence on the Chinese economy experienced relatively greater currency depreciation due to concerns over China's economic slowdown during periods of dollar strength.

Korea's trade dependence on China was 24.6% as of 2020, higher than that of the five Southeast Asian countries (India, Indonesia, Malaysia, Philippines, Thailand, 17.2%) and other MSCI (Morgan Stanley Capital International) emerging markets (13.3%).

Additionally, the reduction in global investors' allocation to Korea led to capital outflows, acting as a factor for won depreciation.

Korea's stock market rose sharply by 54.2% from April to December 2020, but in 2021, as foreign investors increased net selling, Korea's share within global equity funds declined.

Meanwhile, Kim Kyung-geun, head of the International Economy Research Division at the Bank of Korea Economic Research Institute, emphasized, "Since the won exchange rate is influenced by various factors, it is necessary to continuously monitor related external risk trends such as US inflation, international commodity prices, the Chinese economy, capital movements, and changes in domestic corporate earnings according to the semiconductor business cycle, and to strengthen monitoring of global capital flows and the foreign exchange market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.