LG Energy Solution General Investor Subscription on 18-19th

Choose After Checking Competition Rates by Securities Firms Following Equal and Proportional Methods

Passive Fund Inflow Expected After Listing... Additional Purchases Also Likely Effective

[Asia Economy Reporter Minwoo Lee] As the historic "big catch" LG Energy Solution's IPO approaches, market interest is intensifying. Since the circulating shares are limited to about 15% of the total stock, the "game of nerves" to buy at the bottom is expected to peak not only during the subscription but also after the listing.

According to the financial investment industry on the 18th, LG Energy Solution will start the public offering subscription for general investors from today until the 19th. The target is 10,625,000 shares, which is 25% of the total public offering volume of 42.5 million shares.

◆ How "historic" is it?= In the previously conducted demand forecast for institutional investors of LG Energy Solution, institutional orders reached the unprecedented "gyeong" unit amount (1,520.3 trillion KRW). The ratio of mandatory lock-up agreements, where shares cannot be sold for a certain period, was also 77.4%. The competition rate recorded an all-time high of 2023 to 1. Accordingly, the subscription deposit for the general public offering is expected to exceed 100 trillion KRW, breaking the previous record. The previous record was 81 trillion KRW by SK IE Technology.

◆ At which securities firms can you subscribe?= Individual investors can subscribe through KB Securities, Shinhan Financial Investment, Daishin Securities, Mirae Asset Securities, Hana Financial Investment, Shinyoung Securities, and Hi Investment & Securities. The lead manager KB Securities has the largest allocation with 4,869,792 shares (45.8%). Joint lead managers Shinhan Financial Investment and Daishin Securities each secured 2,434,896 shares (22.9%). The underwriters Mirae Asset, Hana Financial Investment, Shinyoung Securities, and Hi Investment & Securities were each allocated 221,354 shares (2.1%). Among these, the securities firms where accounts can be opened on the subscription day to participate are KB Securities, Shinhan Financial Investment, Mirae Asset, and Hana Financial Investment.

◆ Equal allocation? Proportional allocation? Which securities firm is advantageous?= Since you cannot subscribe to multiple securities firms simultaneously, choosing the right securities firm is crucial. This is especially important for investors aiming for equal allocation. Equal allocation means that if you deposit the minimum subscription deposit of 1.5 million KRW (calculated based on the public offering price of 300,000 KRW, minimum subscription unit of 10 shares, and deposit rate of 50%), all investors receive the same amount of shares.

Although KB Securities has the largest allocation, it may be disadvantageous for equal allocation due to the large number of subscribers. Mirae Asset, an underwriter, also has many subscribers, so if you subscribe with only the minimum deposit, you might not receive even one share. Since the number of new account openings at securities firms accepting LG Energy Solution public offering subscriptions has recently increased significantly, a "game of nerves" strategy of checking the competition rate until the last day and choosing accordingly is expected to be effective.

However, in the case of proportional allocation, where the larger the deposit, the higher the probability of receiving more shares, securities firms with larger allocations are relatively advantageous. The proportional allocation subscription limit is highest at KB Securities with 162,000 shares, followed by Daishin Securities with 120,000 shares, Shinhan Financial Investment with 81,000 shares, Hi Investment & Securities with 22,000 shares, Mirae Asset and Hana Financial Investment each with 11,000 shares, and Shinyoung Securities with 7,300 shares.

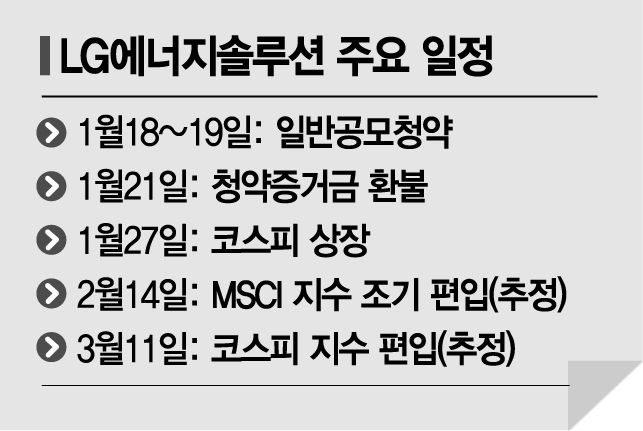

◆ Is there no chance if the subscription fails?= The game of nerves is expected to continue even after the listing on the 27th. Based on the public offering price, LG Energy Solution's market capitalization is 70.2 trillion KRW, but the securities industry views its appropriate corporate value as over 100 trillion KRW. In this case, it will surpass SK Hynix (92.4563 trillion KRW, closing price on the 17th) to become the second-largest market capitalization. Therefore, inclusion in the Morgan Stanley Capital International (MSCI) index and KOSPI 200 is also considered certain. It is anticipated that LG Energy Solution will be included in the MSCI after market close on the 14th of next month and in the KOSPI 200 around March 11. A financial investment industry official advised, "With index inclusion, various passive (index-tracking) funds will flow in, so it is worth considering buying while observing future stock price trends as additional price increases can be expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)