[Asia Economy Reporter Ji-hwan Park] The Financial Supervisory Service announced on the 18th that the issuance volume of asset-backed securities (ABS) last year was 61.7 trillion won, a 22.0% decrease compared to the same period the previous year.

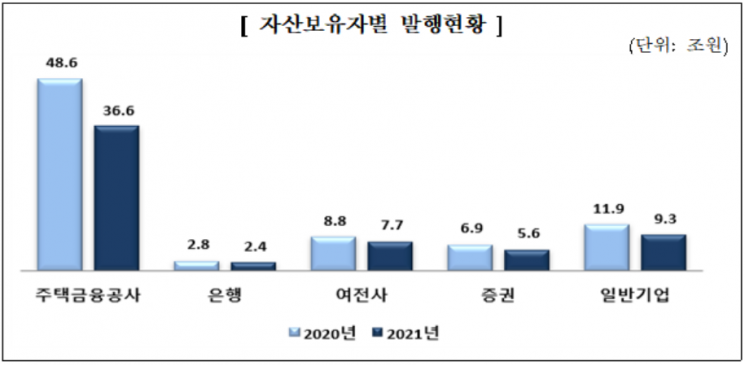

The issuance amount by asset holders also generally decreased. Korea Housing Finance Corporation issued 36.6 trillion won worth of mortgage-backed securities (MBS) last year, down 12 trillion won from the previous year. This was influenced by the effect of the low-income safe conversion loan policy, which refinances existing variable-rate mortgage loans into low-interest fixed-rate mortgage loans, leading to a significant increase in issuance from the second half of 2019 to the first half of last year, followed by a downward trend. MBS are issued based on mortgage bonds as underlying assets and are handled only by the Housing Finance Corporation in Korea.

Financial companies issued ABS worth 15.8 trillion won, down 2.9 trillion won from the previous year, and general corporations issued 9.3 trillion won, down 2.5 trillion won. Banks issued ABS worth 2.4 trillion won based on non-performing loans (NPLs), specialized credit finance companies issued ABS worth 7.7 trillion won based on card receivables and installment finance receivables, and securities companies issued primary collateralized bond obligations (P-CBO) worth 5.6 trillion won based on corporate bonds of low-credit companies. General corporations issued ABS worth 9.3 trillion won based on terminal installment receivables and real estate project financing (PF), among others.

Looking at issuance amounts by underlying assets, ABS issuance based on loan receivables decreased by 12.3 trillion won to 39.7 trillion won last year, and ABS based on accounts receivable decreased by 3.9 trillion won to 16.4 trillion won. P-CBOs based on low-credit corporate bonds decreased by 1.3 trillion won to 5.6 trillion won.

The Financial Supervisory Service explained, "ABS issuance increased in 2020 due to reasons such as low interest rates," and "last year, ABS issuance decreased compared to the previous year due to factors such as rising interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)