Ahn Cheol-soo, the presidential candidate of the People’s Party, is experiencing a rapid rise in approval ratings. Recently, Ahn Cheol-soo’s support has surpassed the 10% mark, establishing a three-way race alongside candidates Lee Jae-myung and Yoon Seok-youl. Some polls even show him winning in head-to-head matchups against other candidates. As his approval ratings rise, so does the stock market volatility of the so-called ‘Ahn Cheol-soo theme stocks.’ In response, Asia Economy analyzed AhnLab, known as the leading stock in the Ahn Cheol-soo theme, and WI, which is linked to the theme stocks through its outside director.

[Asia Economy Reporter Yoo Hyun-seok] WI, a company specializing in intellectual property (IP) licensing, recorded sluggish performance last year due to COVID-19. The decline in people’s outdoor activities led to decreased sales of goods utilizing IP. However, the company expects performance improvement this year if the impact of COVID-19 eases. Additionally, it plans to strengthen its business using its cash reserves amounting to 25 billion KRW.

WI was established in May 1998 with the purpose of developing and manufacturing semiconductor inspection equipment. It was listed on the KOSDAQ market in 2004 under the name FromSurety. The company changed its name to AT Technology in 2014, then to PMG Pharma Science in 2018, before adopting its current name.

In 2018, WI acquired WithMobile, a mobile accessory specialist company, and shifted its focus to character licensing production and sales using IP. It sells a variety of goods ranging from mobile accessories to small home appliances. In August last year, the appointment of Choi Won-sik, former spokesperson of the People’s Party, as an outside director drew attention, leading to its classification as an Ahn Cheol-soo-related stock.

The stock price, which was 1,135 KRW on December 29 last year, surged as Ahn Cheol-soo’s approval ratings increased. On the 5th of this month, it rose to 1,710 KRW, reaching a market capitalization of 138.3 billion KRW. However, the stock price later declined to the 1,300 KRW range, and market capitalization dropped to around 107 billion KRW. The company’s recent price-to-book ratio (PBR) stands at approximately 2.80. A PBR above 1 indicates that the market capitalization exceeds the book value of net assets.

Character licensing refers to granting permission or rights to third parties to commercialize character IP. WI has signed contracts with companies such as PUBG, Kakao IX, Toinz C, Mercedes-Benz, Big Hit, EBS, SmartStudy, League of Legends Champions Korea (LCK), and Com2uS. In particular, together with its affiliate SSHOWLAB, WI has launched various LCK brand merchandising products including gaming gear, apparel, home & office items, and team goods as the official shop of LCK.

WI’s greatest strength lies in its ability to handle everything from product manufacturing to sales in one go. Unlike other companies, it operates a nationally certified design company-affiliated research institute. It possesses design capabilities that express customer requirements for each product and can implement designs into products. The company holds numerous design rights, trademarks, and utility model rights. It plans, designs, engineers, produces with its own molds, and sells products directly.

After acquiring WithMobile, the company’s main business was completely reorganized into the character business. As of the third quarter last year, 87% of total sales were concentrated in the content business (products). This was followed by others at 6%, semiconductor inspection equipment at 4%, and content business (goods) at 3%.

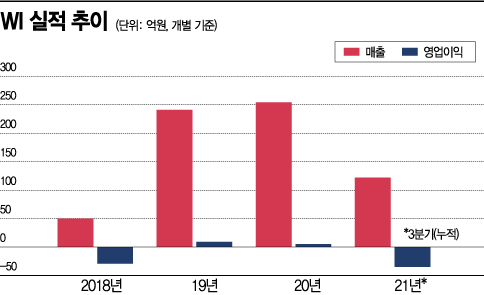

The company recorded a performance turnaround based on its character licensing business. In 2018, it posted sales of 5 billion KRW with an operating loss of 2.9 billion KRW, but in 2019, sales rose to 24.1 billion KRW with an operating profit of 900 million KRW. In 2020, it achieved sales of 25.3 billion KRW and operating profit of 500 million KRW. However, last year’s performance was sluggish. As of the third quarter last year, cumulative sales were 12.2 billion KRW with an operating loss of 3.5 billion KRW. Sales decreased by 34.92% compared to the same period the previous year, and operating profit turned negative.

The shift to a deficit appears to be influenced by increased cost of sales and selling and administrative expenses. The reduction in people’s outdoor activities due to COVID-19 was also a negative factor. As of the third quarter last year, the cost of sales accounted for about 75% of total sales, up 10 percentage points from 64.26% in the same period of 2020. Selling and administrative expenses also increased from 6.2 billion KRW to 6.5 billion KRW during the same period.

A company official said, "The products we handle, such as mobile phone auxiliary batteries and cases, basically require people to be out and about to be activated. Due to COVID-19 and other factors, reduced outdoor activities have negatively impacted our performance."

Although the impact of COVID-19 continues, the company expects performance improvement this year. With the introduction of oral treatments and easing of social distancing, increased outdoor activities could stimulate consumption. The company official explained, "If social distancing due to COVID-19 is relaxed, we expect improvement driven by pent-up demand and other factors."

Meanwhile, WI plans to leverage its abundant cash reserves to pursue new businesses or strengthen existing ones. Last year, it raised 15 billion KRW by issuing the 14th and 15th convertible bonds. Combined with existing cash holdings, the company has secured a total of 25 billion KRW. A company representative emphasized, "The funds we hold will be used to strengthen new or existing businesses. We are reviewing various options, including investing in promising companies or new IP."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)