Major City Gasoline Prices Rise from January 6-12

Dubai Oil Up $6.9 Since Early Year

WTI Up $7.8...Brent Oil Up $7.1

US Crude Inventories at Lowest Since 2018

OPEC+ Maintains Conservative Production Increase Policy

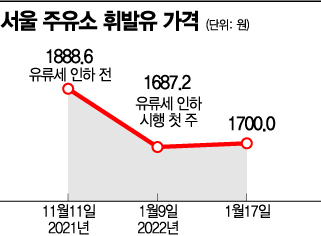

[Asia Economy Reporter Hwang Yoon-joo] After the reduction of the fuel tax, the average selling price of gasoline in the Seoul area, which had been falling, has risen again to the 1700 won range. This is due to the rapid increase in international oil prices, which rose by 7 dollars per barrel within two weeks from the beginning of the new year, offsetting the effect of the fuel tax cut implemented in November last year.

According to the Korea National Oil Corporation's oil price information service Opinet, the price of gasoline in Seoul recorded 1700 won as of 10 a.m. on the 17th. This is the first time in 30 days since December 17 last year (1701.2 won).

Looking at major cities nationwide on a daily basis, gasoline selling prices all rebounded around January 6-12. In the cases of Incheon and Daejeon, prices hit their lowest point at the end of December last year and have been continuously rising.

On a weekly basis, the Seoul area saw prices fall continuously from 1885.3 won before the fuel tax cut (November 12, 2021) but rebounded after 9 weeks to record 1690.7 won. Nationwide weekly trends showed that the decline narrowed from 90.4 won in the first week of the fuel tax cut to 29.1 won → 9.8 won → 13.0 won → 15.8 won → 14.3 won → 9.9 won → 3.8 won → 0.5 won, effectively stabilizing.

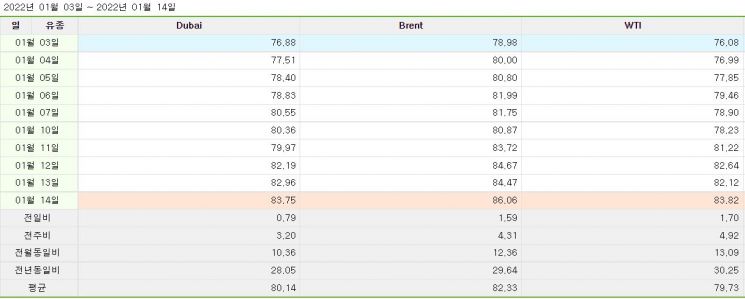

The reason gasoline prices have turned upward again is the rapidly rising international oil prices. Dubai crude oil, which Korea mainly imports, rose from $76.8 on the first trading day of the new year (January 3) to $83.7 on the 14th, an increase of $6.9. During the same period, West Texas Intermediate (WTI) and Brent crude also rose from $76.0 and $78.9 to $83.8 (up $7.8) and $86.0 (up $7.1), respectively.

The background for the rise in international oil prices is attributed to unexpected demand and supply increases that fall short of expectations. First, crude oil inventories in the major consumer, the United States, decreased for seven consecutive weeks (as of January 7). Dow Jones had forecast a decrease of 2.1 million barrels, but inventories dropped by 4.6 million barrels, far exceeding expectations. This is the lowest level since 2018. On the other hand, the Organization of the Petroleum Exporting Countries Plus (OPEC+) has taken a conservative stance on additional production increases, with an average daily increase of 400,000 barrels.

Shim Soo-bin, a researcher at Kiwoom Securities, analyzed, "The escalating tensions between Russia and Ukraine are expected to stimulate upward pressure on oil prices," adding, "This week, crude oil prices are likely to respond more sensitively to related issues such as diplomacy and security."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)