[Asia Economy Reporter Ji Yeon-jin] As the financial authorities are expected to reach a conclusion soon regarding the accounting fraud allegations against Celltrion, attention is focused on the upcoming procedures.

According to the financial investment industry on the 16th, the Audit Committee, an accounting expert organization under the Financial Services Commission, discussed from November 9 last year to the 7th of this month whether there were violations of accounting standards based on the Financial Supervisory Service's audit results of the three Celltrion companies (Celltrion, Celltrion Healthcare, Celltrion Pharm) from 2010 to 2020. The Securities and Futures Commission under the Financial Services Commission is reportedly scheduled to place the Celltrion agenda on the table on the 19th. Previously, the Financial Supervisory Service is known to have submitted an opinion to the Securities and Futures Commission that the Celltrion management should be reported to the prosecution.

However, the Financial Supervisory Service clarified regarding such reports, stating, "The Audit Committee procedures related to this matter are currently ongoing, so some parts of the articles are inaccurate, and no decisions have been finalized regarding whether to take action or the content of such actions."

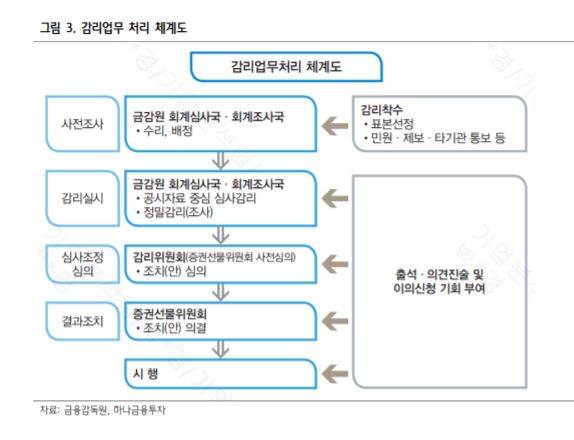

The final measures against Celltrion will be confirmed after the Audit Committee's review, followed by resolutions from the Securities and Futures Commission and the Financial Services Commission. In the case of Samsung Biologics, it took about five months from the Financial Supervisory Service's conclusion to the final resolutions by the Securities and Futures Commission and the Financial Services Commission.

In the market, if Celltrion is ultimately found guilty of accounting violations, the Korea Exchange is expected to begin deliberations on whether to subject it to a substantial review of listing eligibility. Typically, a decision is made within 15 days after the substantial review of listing eligibility.

Lee Junho, a researcher at Hana Financial Investment, explained, "The key factor in deciding whether to subject a company to a listing eligibility review will be the intentionality of the accounting violation. If intentionality is proven, depending on the materiality determined by the scale, notification to the prosecution or indictment is possible. If prosecution notification or indictment proceeds, and the scale of accounting standard violations exceeds 2.5% of equity capital, the company becomes subject to a substantial review of listing eligibility."

As of the third quarter of last year, Celltrion's equity capital was 3.94 trillion KRW (capital stock 137.9 billion KRW), and Celltrion Healthcare's was 2.03 trillion KRW (capital stock 155 billion KRW). The researcher added, "If a reason for substantial review of listing eligibility arises, it corresponds to a trading suspension, and the suspension period lasts until the reason is recognized as resolved. In the case of Samsung Biologics, after being concluded as intentional accounting fraud in the past, trading was suspended for 19 days."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)