Financial Services Commission and Citibank Announce Consumer Protection Measures

Extension for 5 Years Until End of 2026 with 7-Year Repayment

Refinancing Loans Available at Other Commercial Banks

[Asia Economy Reporter Kim Jin-ho] Borrowers who took out loans from Citibank Korea can now breathe a sigh of relief. Due to the phased abolition of consumer finance, those holding loans will be able to extend their loan maturities or refinance with other banks for the next five years. This decision by Citibank, which prioritizes financial consumer protection as its core value, is evaluated to have alleviated the anxiety of borrowers facing loan maturities.

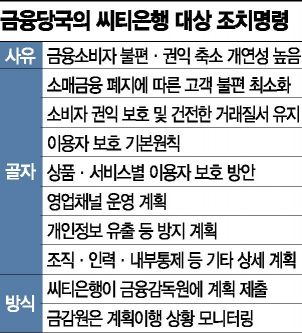

According to the financial sector on the 15th, the Financial Services Commission held a regular meeting on the 12th and announced that it had approved the "User Protection Plan Related to the Phased Abolition of Retail Finance," which centers on these contents.

According to the consumer protection measures, Citibank will continue to provide services unchanged until the contract maturity or termination date for existing contracts with customers. However, all new subscriptions to consumer finance products and services will be completely suspended starting from the 15th of next month.

For loans subject to maturity extension, such as lump-sum repayment loans, Citibank has decided to extend the maturity in the lump-sum repayment method as before for the next five years until the end of 2026 if the customer desires. From 2027, the repayment method will switch to installment repayment, granting a maximum repayment period of up to seven years, and customers will be able to choose the specific installment repayment method (either principal and interest installment repayment or equal principal installment repayment).

There is also discussion about providing a credit loan refinancing program in partnership with commercial banks that reflects important loan conditions such as existing limits and interest rates as much as possible, encouraging borrowers to transfer through this program. However, if the borrower's credit rating declines or debt is excessive, and their debt repayment ability deteriorates according to Citibank's screening criteria, maturity extension may be denied.

In particular, if Citibank's credit loan customers wish to refinance with another financial company due to inconvenience in use, exceptions to household loan regulations will be recognized only if there is no increase in the loan amount. This includes regulations such as the Debt Service Ratio (DSR), which limits the ratio of total household loan principal and interest repayments to annual income, as well as total household loan volume management and credit loan limit regulations.

Accordingly, major commercial banks are expected to launch various campaigns and events to attract Citibank borrowers who are exempt from household loan management regulations. The scale of Citibank's credit loans is estimated to be about 9 trillion KRW. Intense competition is expected to begin in earnest from the second half of this year when the refinancing loan system is established.

Meanwhile, to comply with these consumer protection measures, Citibank has decided to establish and operate its own implementation status management system. It will conduct monthly self-inspections of implementation status and report the results to the board of directors. The financial authorities will also closely monitor the implementation status and guide necessary improvements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.