Key Questions Q&A

On the 15th, when the National Tax Service's 'Year-end Tax Settlement Simplification Service' began, employees at the Jongno Tax Office in Seoul were reviewing the year-end tax settlement guidebook. Starting this year, according to the newly revised tax law, data such as postpartum care center expenses, museum and art gallery admission fees, Zero Pay usage amounts, and KOSDAQ venture investment amounts have been added to the data provided by the Year-end Tax Settlement Simplification Service. Photo by Kim Hyun-min kimhyun81@

On the 15th, when the National Tax Service's 'Year-end Tax Settlement Simplification Service' began, employees at the Jongno Tax Office in Seoul were reviewing the year-end tax settlement guidebook. Starting this year, according to the newly revised tax law, data such as postpartum care center expenses, museum and art gallery admission fees, Zero Pay usage amounts, and KOSDAQ venture investment amounts have been added to the data provided by the Year-end Tax Settlement Simplification Service. Photo by Kim Hyun-min kimhyun81@

[Sejong=Asia Economy Reporter Kim Hyunjung] The Hometax Year-end Tax Settlement Simplification Service, which allows users to view the necessary proof documents for income and tax deductions for year-end tax settlement, will open on the 15th. The service is available daily from 6 a.m. to midnight.

Although data can be viewed starting from the 15th, the final confirmed data reflecting any additional submissions or corrections by receipt issuing institutions will be provided from the 20th.

The data available for viewing in the simplification service include national pension insurance premium payments, principal and interest repayments on housing lease loans, amounts spent using credit cards, debit cards, and cash receipts, retirement pension account payments, insurance premium payments for protection-type insurance, medical expenses paid to medical institutions, and education expenses for elementary, middle, high school, and university. Starting this year, electronic donation receipts can also be viewed in the simplified data. Donation organizations can electronically issue donation receipts through Hometax, so donors do not need to submit receipts separately.

For income and tax deduction items not viewable in the simplification service, employees can obtain receipts from the issuing institutions and submit them to their companies.

Simplified data for minor children born after January 1, 2003, can be viewed by parents without the child's consent upon application. However, children born in 2002 who were minors until last year but become adults this year require the child's consent for parents to view their simplified data.

Employees who have applied for the bulk provision service to their company must check and consent to the application details on Hometax by the 19th. The National Tax Service will provide the simplified data of consenting employees to their companies in bulk starting from the 21st. If year-end tax settlement tasks are delegated to a tax agent, the simplified data can be provided to the agent.

Below is a Q&A summary of the main points.

▲ How is year-end tax settlement handled if you changed companies this year or receive salaries from multiple companies?

= If you changed companies, you must combine all earned income from previous workplaces at the workplace where you worked at the end of December for year-end tax settlement. You need to obtain the earned income withholding tax receipt from previous workplaces and submit it to the current workplace withholding agent. Those receiving earned income from two or more employers must combine income from the main workplace and secondary workplaces. By the end of the relevant year, you must designate your main and secondary workplaces and submit a workplace (change) report to the main workplace withholding agent.

▲ How can you receive additional income or tax deductions if some items were not deducted during year-end tax settlement?

= Additional income or tax deductions can be claimed through a ‘final comprehensive income tax return’ or a ‘correction claim.’ For omitted income or tax deductions, the employee can file a final comprehensive income tax return reflecting the omitted deductions with the local tax office by May of the following year.

▲ When and how is year-end tax settlement done if you retired during the year?

= Mid-year retirees perform year-end tax settlement when the company pays the salary for the month of retirement, so they must submit proof documents for income and tax deductions. If proof documents were not submitted at retirement, only earned income deduction, basic deduction for the individual, standard tax credit (130,000 KRW), and earned income tax credit are reflected in the year-end tax settlement. Employees with other income or tax deduction items must file a comprehensive income tax return with the local tax office by the end of May of the following year.

▲ What should a worker with two or more workplaces do if they did not combine earned income for year-end tax settlement and settled separately at each workplace?

= If a person receiving earned income from two or more employers did not combine income for year-end tax settlement and settled separately for each income, they must file a comprehensive income tax return with the local tax office by the end of May of the following year.

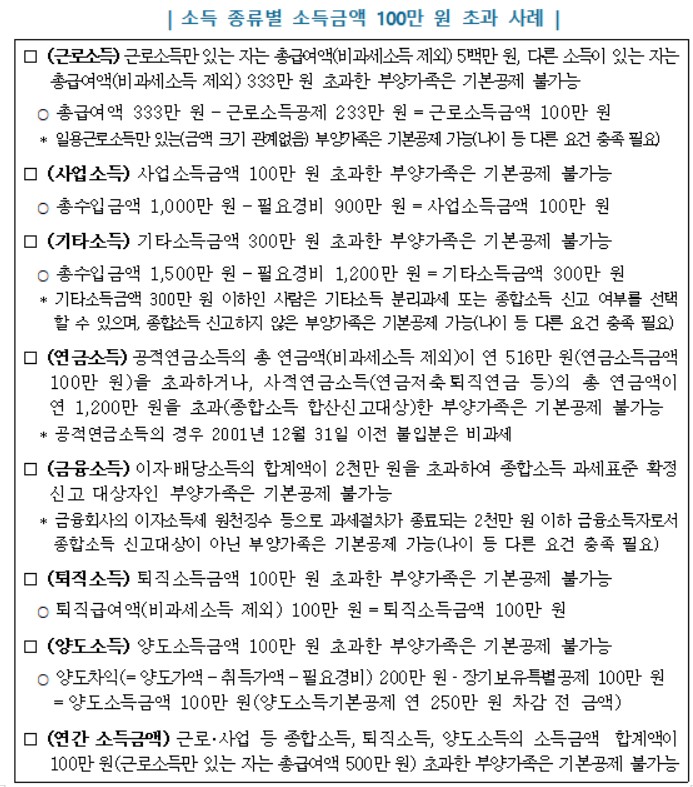

▲ What is the annual income requirement for dependents to qualify for personal deductions?

= To claim basic deductions for dependents including a spouse during year-end tax settlement, the total annual income amount of the dependent must be 1 million KRW or less (for those with earned income, total salary must be 5 million KRW or less).

▲ Can you claim basic deductions for parents (including parents-in-law) living in rural areas?

= Even if they live separately due to housing circumstances, if you actually support them and other siblings do not claim basic deductions for the parents, and the income requirement (income amount 1 million KRW or less) and age requirement (60 years or older) are met, you can claim the basic deduction.

▲ Can you claim basic deductions for a spouse who married, divorced, or died during the year?

= If married (excluding common-law marriage) during the tax year, the spouse is considered a spouse as of the end of the tax period, so if the spouse’s total annual income is 1 million KRW or less, they qualify for the basic deduction. However, you cannot claim basic deductions for a spouse divorced during the tax year. If the spouse died during the tax period, the basic deduction can be applied, provided the income requirement (annual income amount 1 million KRW or less) is met.

▲ Can you claim basic deductions if a mother you supported died this year?

= If income and age requirements are met, basic deductions can be claimed up to the year of death.

▲ If multiple children apply for personal deductions for parents (including parents-in-law), who can claim the deduction?

= If multiple employees apply as deduction recipients or it is unclear who should claim, the following order is used to determine:

1. The person who can prove actual support (principle)

2. According to the deduction declaration form for the relevant tax period

3. If more than one person can prove actual support:

① The person who claimed the dependent as a personal deduction in the previous tax period

② If no one claimed in the previous tax period, the person with the highest comprehensive income amount in the relevant tax period

▲ If you live separately from your spouse and the spouse owns a house, can you claim the housing subscription savings deduction?

= No. To claim the housing subscription savings deduction, you must meet the head of household requirement for a household that did not own a house during the tax year. Even if spouses live separately, they are considered the same household, and if both are heads of households, only one is recognized as the head of household.

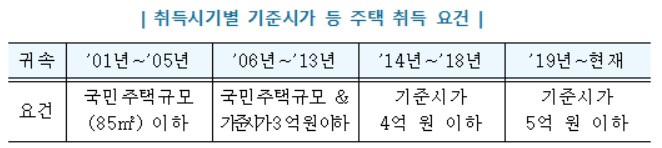

▲ If the standard market price of a house was 500 million KRW or less at acquisition but later rose above 500 million KRW, can you continue to claim the long-term housing mortgage interest deduction?

= The determination is based on the standard market price at the time of acquisition. If the acquisition price was 500 million KRW or less and other conditions are met, you can receive the deduction regardless of any increase in the standard market price after acquisition. This is unrelated to the current market price.

▲ Are there items where you can receive overlapping deductions besides income deductions for credit card payments?

= When medical expenses and academy fees or school uniform purchases for preschool children are paid by credit card, you can receive both medical/education tax credits and credit card income deductions.

▲ If credit card spending increased compared to last year, can you receive additional income deductions for the increased amount?

= If credit card spending in 2021 increased by more than 5% compared to 2020, you can receive income deductions applying 10% of the increased amount and an additional limit of 1 million KRW. However, if credit card spending this year is below the minimum usage amount, no income deduction is available.

▲ If you joined a company in June this year, is the income deduction for increased credit card spending calculated based on spending from June to December?

= No. The income deduction for increased credit card spending is calculated based on the total annual spending in 2020 and 2021, regardless of the length of the employment period.

▲ Can all employees who pay monthly rent receive the monthly rent tax credit?

= Employees who are heads of households without housing as of the end of the tax period (including household members if the head of household does not receive deductions for housing lease loan principal and interest repayments, housing subscription savings, or long-term housing mortgage interest), whose total salary is 70 million KRW or less, and who rent a house of national housing size or less or with a standard market price of 300 million KRW or less (including residential officetels and gosiwons), and whose lease contract address matches the resident registration address, can receive the monthly rent tax credit.

▲ Can you receive the monthly rent tax credit if you have not registered your move-in on the resident registration?

= No. Even if other conditions are met, the monthly rent tax credit cannot be applied for rental housing without resident registration move-in.

▲ How can you claim deductions for data not viewable in the year-end tax settlement simplification service?

= Deduction items not legally required to be submitted only provide data voluntarily submitted by receipt issuing institutions. Some institutions like hospitals may not submit data due to staff shortages or system issues. For deduction proof documents not viewable in the simplification service, you must obtain the documents directly from the issuing institution and submit them to your company.

▲ How to claim deductions if the credit card spending amount differs from the actual payment?

= You can request a reissued credit card usage confirmation from the card company and submit it to your company, or submit evidence verifying the transaction according to tax law to apply the correct deduction rate. For industries handling both income deduction eligible and excluded goods/services, card companies issue credit card usage confirmations separately showing ① total usage amount, ② income deduction eligible amount, and ③ income deduction excluded amount.

▲ What to do if you lose your set password?

= Access Hometax using the company ID or certificate, and select the screen for registering the list of employees applying for bulk provision. There, you can check the originally set password.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.