Preference Trends for Apartments and Dining Rooms, etc.

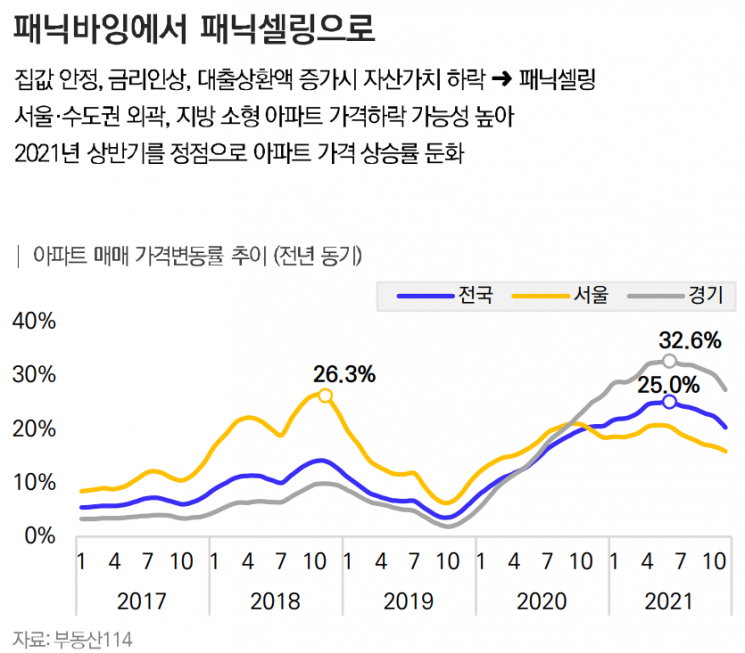

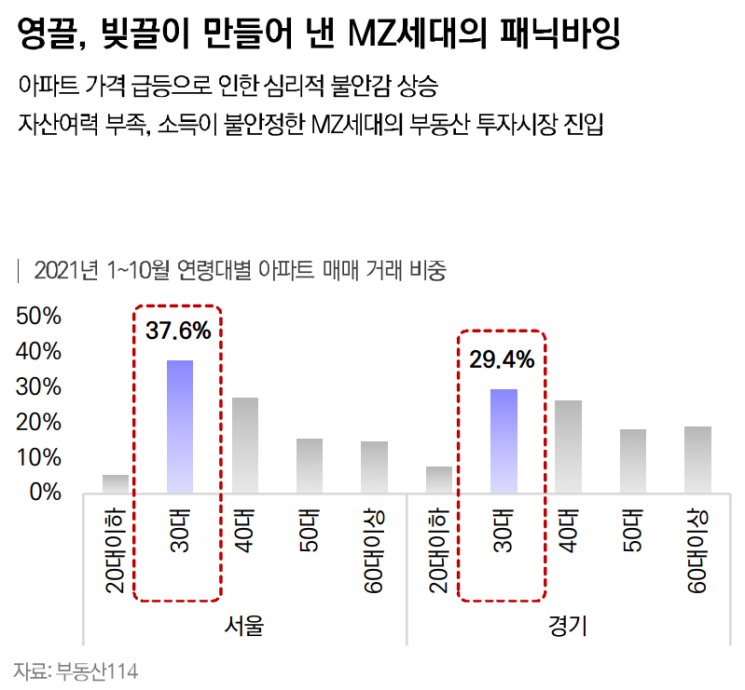

Last year, amid a sharp rise in housing prices, the 2030 generation experienced an intense phenomenon of apartment 'panic buying,' but this year, due to market stagnation and other factors, there is a forecast that 'panic selling' may occur. Additionally, due to a shortage of apartment supply, the popularity of 'Apartel (apartment-style officetel),' an alternative to apartments, is expected to continue.

On the 15th, Heerim Architects, R2 Korea, and Korea Gallup released the '2022 Real Estate Trend Survey' report, which compiled the results of a survey conducted on 1,344 people in the second half of last year.

Eight real estate trends are expected to emerge this year, the first of which is the 'Marginal MZ.' It refers to the MZ generation who invested by leveraging all their resources and borrowing despite low economic power last year, facing a crisis in 2022 due to real estate price stabilization. The report stated, "Apartments owned by the 'Marginal MZ,' who have insufficient assets and income, are mostly small apartments in less competitive areas such as the outskirts of Seoul and the metropolitan area, and provincial regions," adding, "There is a possibility of panic selling following panic buying amid interest rate hikes and apartment price declines."

The second trend is 'Come On City.' It forecasts an increase in demand for small-sized housing close to workplaces, such as urban apartments, officetels, urban lifestyle housing, and one-room units.

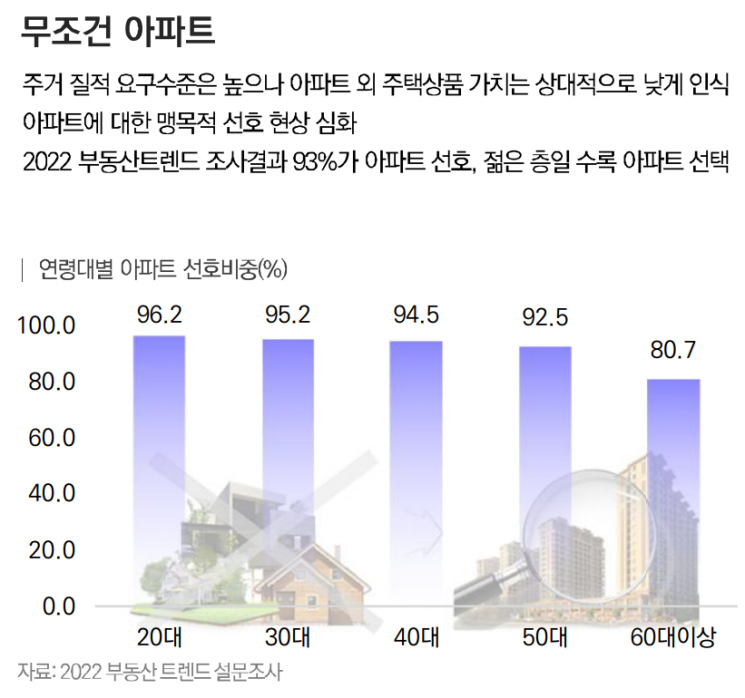

The third trend is 'Muajigyeong' (literally 'ecstasy' or 'being absorbed'). It reflects the tendency to unconditionally prefer apartments despite the functional expansion of housing and consumers' high qualitative demands.

The fourth trend is the 'Popularization of Officetels.' Officetels, once niche products, are expected to become mainstream products. The government is also providing indirect support through measures such as allowing underfloor heating, expanding building area, and permitting purchase rental housing.

The fifth trend is the '10-pyeong Gap.' Due to COVID-19, time spent at home has increased and housing usage has diversified, leading to a higher preference for 40-pyeong-sized homes. However, with the sharp rise in apartment prices, the actual purchase size remains around 30 pyeong, creating a gap of about 10 pyeong.

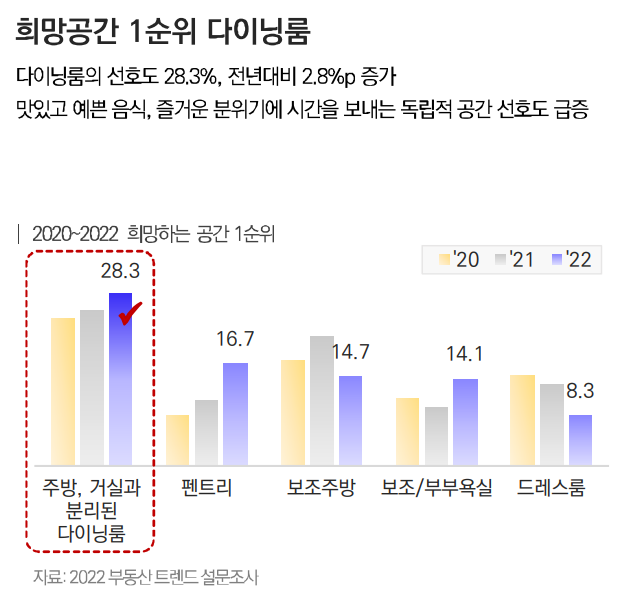

The sixth trend is 'Planet Home (Plate and eat at home).' There is a rapid increase in preference and utilization of dining rooms where kitchens and living rooms are separated, allowing full focus on meals and conversations. With the spread of ready-to-eat meals and home parties becoming a daily routine, Planet Home is expected to become a new trend.

The seventh trend is 'Impact Interior.' This interior trend focuses on individuality rather than fashion, concentrating on one aspect that best expresses oneself. The interior market is expected to be led by online markets producing a wide variety of small-quantity products and accessories, while construction companies will hand over interior discretion to consumers and focus on base interiors that simplify and organize the overall tone.

The eighth trend is 'ESG (Environmental, Social, and Governance), Progress and Reversal.' While social awareness and consensus on ESG are advancing, there may be a tendency to fall short of expectations in concrete implementation.

Meanwhile, this survey was conducted through one-on-one individual interviews with 1,344 household heads and their spouses aged 20 to 69 in Seoul, Gyeonggi, Busan, and Changwon regions over 41 days from September 10 to October 20 last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.