Ahn Cheol-soo, the presidential candidate of the People’s Party, is experiencing a rapid rise in approval ratings. Recently, Ahn Cheol-soo’s support has surpassed the 10% mark, establishing a three-way race alongside candidates Lee Jae-myung and Yoon Seok-youl. Some polls even show him winning in head-to-head matchups against other candidates. As his approval ratings rise, the so-called ‘Ahn Cheol-soo theme stocks’ have been riding a rollercoaster in the stock market. In response, Asia Economy analyzed AhnLab, known as the leading stock of the Ahn Cheol-soo theme, and WI, which is linked to the theme stocks through an outside director connection.

[Asia Economy Reporter Jang Hyo-won] AhnLab, famous for its computer virus antivirus program ‘V3,’ is gaining attention in the stock market as Ahn Cheol-soo, the People’s Party presidential candidate, sees his approval ratings rise. The stock price has been volatile due to its association with the ‘Ahn Cheol-soo theme,’ but looking beyond the theme to the company’s fundamentals, AhnLab is evaluated as a solid company with steady growth every year.

Sales Increase Over 5 Years, Investment Returns Also ‘Considerable’

Founded in March 1995, AhnLab develops and supplies various security solutions suitable for diverse information network environments, including the antivirus solution flagship product line ‘V3,’ online security services, mobile security solutions, online game security solutions, and network security equipment. It operates an emergency response organization and is the only integrated security company in Korea that provides security-related consulting, solutions, and monitoring services.

The largest shareholder of AhnLab is Ahn Cheol-soo, the People’s Party presidential candidate, holding 1.86 million shares (18.6%). The second-largest shareholder, Donggurami Foundation, which holds 1 million shares (9.99%), is also a foundation established by Ahn Cheol-soo. Ahn contributed his shares in kind to establish the foundation. Combining these two stakes, Ahn’s effective ownership is 28.59%.

Main revenue comes from sales of security solutions that respond to all malware infiltration routes such as desktop, network, and internet. Key products include V3, APM, EMS, TrusGuard, and NaePCJikimi (My PC Protector). This segment accounted for 71.8% of total sales as of the end of the third quarter last year. Following this are security monitoring services (16.0%), information provision (4.5%), consulting (4.2%), and external products (3.5%).

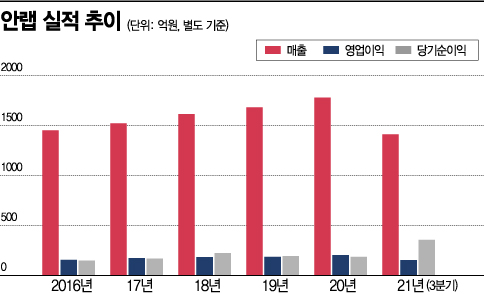

AhnLab’s sales have steadily increased every year. Sales on a separate basis were 132.3 billion KRW in 2015 and rose 30.5% to 172.6 billion KRW by the end of 2020. The compound annual growth rate of sales was 5.5%, showing a stable growth trend. Operating profit during the same period jumped 63% from 12.2 billion KRW to 19.8 billion KRW. Operating profit also steadily increased at an average annual rate of over 10.5%. The operating profit margin has remained in the 10% range.

In the third quarter of last year, cumulative sales reached 137 billion KRW and operating profit 14.9 billion KRW, up 11.1% and 9.7% respectively compared to the same period the previous year. If performance is maintained in the fourth quarter, it is expected to continue a six-year streak of growth.

Notably, AhnLab also earns investment income besides its core business. As of the third quarter last year, AhnLab recorded a net profit of 34.5 billion KRW, exceeding its operating profit. This was thanks to about 20 billion KRW in valuation gains and disposal gains from ‘non-current financial assets.’ Most non-current financial assets are securities, meaning profits came from financial products such as funds invested through securities firms.

In fact, Ahn Cheol-soo revealed that AhnLab invested 20 million KRW in the U.S. metaverse gaming platform company ‘Roblox’ through a venture capital (VC) fund 10 years ago, and the investment has increased more than 1,200 times to date.

Debt-Free Management and 19 Years of Dividends

AhnLab’s financial condition is very sound. It has consistently maintained a debt ratio in the 20% range, and its liabilities are not borrowings but rather lease deposits and advance payments. As of the end of the third quarter last year, 53% (37.4 billion KRW) of AhnLab’s total liabilities of 70.6 billion KRW were advance payments. Advance payments are money received in advance from customers or business partners, recorded as liabilities but eventually converted into sales. Excluding such liabilities, there is no actual borrowing. It is effectively debt-free management.

Based on solid performance, AhnLab has consistently paid dividends for 19 years. As of the end of last year, AhnLab paid 7.8 billion KRW in dividends out of an annual net profit of 18.2 billion KRW. The cash dividend payout ratio is 42.3%. The average dividend yield over the past five years is 1.5%.

The company is also pursuing mergers and acquisitions (M&A) and equity investments to secure new growth engines. In 2020, AhnLab acquired a 60% stake in AI information security startup Jason, and last year it acquired a 60% stake in operational technology (OT) security company Nownworks, incorporating it as a subsidiary.

Shin Ji-hye, senior expert at Korea Enterprise Data, said in a technical analysis report, “AhnLab will organically combine experience and technology through investments related to cloud and OT security to develop differentiated expertise. Demand for advanced security technology continues to arise, so sales growth is expected in the future.”

However, the market opinion is predominantly that predicting the stock price is difficult. The current level is considered overvalued, and the stock price fluctuates sharply depending on Ahn’s approval ratings. As of the 14th, AhnLab’s price-to-book ratio (PBR) was 4.31 times, meaning its market capitalization is more than four times its net asset value. The average PBR for KOSDAQ is around 1 to 2 times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)