Last Year's Operating Profit Margin at a Record 13.84%

Operating Profit Surges 1021%

Impact of Soaring Air Cargo Freight Rates

Korean Air achieved its highest-ever profit margin last year despite the impact of COVID-19. Analysts attribute this to the strengthened air cargo transportation strategy to overcome the decline in international passenger demand, which, combined with rising air cargo freight rates, significantly boosted performance.

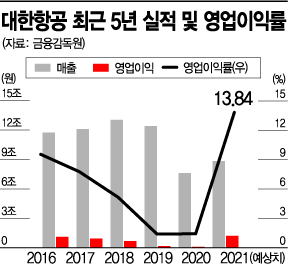

According to financial information firm FnGuide on the 14th, Korean Air's estimated operating profit margin for last year was 13.84%. The operating profit margin represents the proportion of operating profit in total sales and is an indicator of a company's profitability from its business activities.

This is the first time Korean Air has recorded a double-digit annual operating profit margin, surpassing its previous highest of 9.55% achieved in 2016 by 4.29 percentage points. Considering the global airline industry's average operating profit margin is around 4%, due to high fixed operating costs and low operating margins, this is an exceptional figure. Korean Air's estimated consolidated annual sales last year totaled KRW 8.8192 trillion, with operating profit reaching KRW 1.2209 trillion. Sales increased by 15.9% year-on-year, while operating profit surged by an astonishing 1021.1%.

Korean Air's record-high operating profit margin was driven by explosive increases in freight rates due to the rise in air cargo volume following economic recovery after the spread of COVID-19. The TAC Index, an air cargo transportation index published in Hong Kong, reported that last month’s freight rate on the Hong Kong-North America route reached a record high of $12.72 per kilogram.

Since last year, Korean Air has strengthened its air cargo business by deploying not only its existing dedicated freighters but also the country's first converted freighters with seats removed and passenger aircraft equipped with special cargo seat-back equipment. Currently, Korean Air operates a total of 23 freighters including B747F (4 units), B747-8F (7 units), and B777F (12 units), as well as 16 dedicated cargo passenger aircraft including B777 (10 units) and A330 (6 units).

The airline mainly transports IT and automotive parts for global companies to Southeast Asia and carries key manufactured goods such as mobile phone components to South America via the United States to Brazil, increasing profitability. It is also expanding three-country cargo transport. The strategy maximizes route efficiency by extending transport ranges from Incheon to Vietnam, India, and Europe.

Thanks to this, Korean Air generated KRW 4.5141 trillion from its cargo business, accounting for 76.2% of cumulative sales in the third quarter last year. During the same period, operating revenue from the cargo business surged 62.4% year-on-year, playing a substantial role as a cash cow. Additionally, strengthening the cargo business positively contributed to reducing passenger transport-related costs such as labor and facility usage fees.

A financial industry official said, "With global cargo volumes increasing, freight rates are soaring not only for container ships but also for air cargo." He added, "Thanks to Korean Air’s swift response, it is expected to achieve cumulative sales exceeding KRW 10.5 trillion and operating profit in the KRW 1 trillion range again this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.