55% of Global CEOs and 59% of US CEOs Concerned About Prolonged Inflation

Wholesale Prices Surge Following Consumer Prices, Increasing Need for Price Pass-Through

Inflation Leading to Interest Rate Hikes, Raising Concerns Over Economic Slowdown

[Asia Economy New York=Correspondent Baek Jong-min] A significant number of CEOs worldwide expect inflation to persist until mid-next year. Companies plan to raise prices in response to rising inflation, but they are cautious about central banks' rapid interest rate hikes and the risk of economic contraction.

According to a management outlook report released on the 13th by the U.S. nonprofit economic research organization Conference Board, which surveyed 917 global CEOs, concerns about inflation ranked second among risk factors this year, following COVID-19. In the same survey in 2021, inflation concerns ranked only 22nd.

U.S. companies ranked labor shortages and rising inflation as their first and second biggest concerns, respectively, while European CEOs rated inflation and recession fears as their top two concerns. This contrasts with China, where inflation concerns ranked fourth, and Japan, where inflation concerns ranked 12th.

82% of CEOs reported facing pressure to raise prices. Notably, 93% of CEOs in China, known as the world's factory, expressed concerns about price increases.

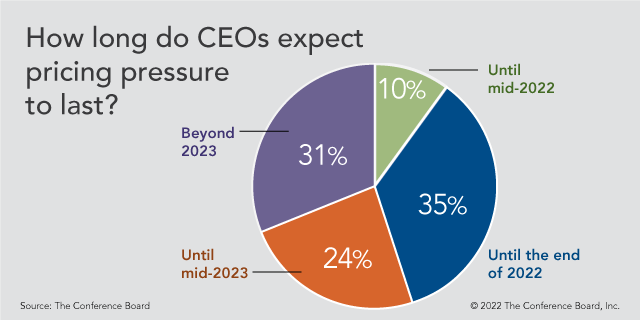

American business leaders, whose consumer price index (CPI) rose by as much as 7% until December last year, are also growing wary of inflation. Overall, 55% of surveyed business leaders expect inflation to remain high until mid-2023 or later, with 59% of U.S. CEOs sharing this view.

CEO concerns are reflected in wholesale prices. The U.S. Department of Labor announced that the producer price index (PPI) for December last year rose by 9.7%, the second-highest record since statistics began in 2010. Although slightly below the market expectation of 9.8%, a near 10% increase poses a burden on companies. The core PPI, excluding food and energy, rose by 8.3%, exceeding the expected 8.0%.

Although the month-over-month increase slowed from 1.0% in November to 0.2%, the still high PPI is likely to be a factor driving companies to raise prices. CNBC noted that a nearly 10% rise in wholesale prices could signal further inflation increases.

The opinions of CEOs responding to the Conference Board survey align with this. CEOs ranked cost-cutting first and price increases second as measures to counter rising inflation. Particularly, U.S. CEOs expressed a strong intention to actively raise prices.

The growing need for wage increases also adds to corporate burdens and acts as a long-term inflationary factor. According to the Conference Board, companies expect a 4% salary increase this year. Although this is lower than the 7% inflation spike, the Conference Board explained that it is the largest raise since 2008.

As inflation control becomes central to monetary policy, Federal Reserve (Fed) officials are increasingly supporting interest rate hikes.

Following Fed Chair Jerome Powell's indication of aggressive rate hikes to curb inflation, on the same day, nominee Vice Chair Lael Brainard appeared before Congress and stated, "Inflation is too high. Our monetary policy focuses on bringing inflation down to 2% while sustaining economic recovery." Brainard emphasized, "This is our most important mission."

Patrick Harker, President of the Philadelphia Fed, also asserted, "A substantial amount of tightening is needed this year."

With continued support for rate hikes from Fed officials, a March rate increase is becoming a foregone conclusion. On this day, the Chicago Mercantile Exchange FedWatch tool estimated an 85.7% chance of a rate hike in March. This probability rose nearly 3 percentage points compared to the previous day. Expectations are also growing for four rate hikes this year.

However, concerns have been raised that rapid and prolonged rate hikes could induce an economic downturn.

Darius Adamczyk, CEO of Honeywell International, expressed to The Wall Street Journal, "If we slam the brakes too hard to stop inflation, a recession could occur."

In the Conference Board survey, the possibility of a recession ranked sixth among threats to corporate management this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.